FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

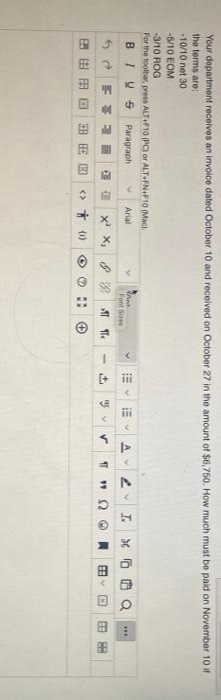

Transcribed Image Text:Your department receives an invoice dated October 10 and received on October 27 in the amount of $6,750. How much must be paid on November 10 it

the terms are:

10/10 net 30

-5/10 EOM

-3/10 ROG

For the toolbar, press ALT+F10 (PC) or ALT-FN+F10 (Mac).

BIYS

Paragraph

Arial

AV

I.

Font Sizes

1 I x x, 8 T

11

田由田国 田田回

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnew Ch 10 Concept Videos i 6 Part 2 of 5 .75 oints eBook Ask Print References Mc Graw Hill Required information Journal entry worksheet 1 On December 31 Wintergreen, Inc., issued $150,000 of 7 percent, 10-year bonds at a price of 93.25. Note: Enter debits before credits. Date Dec. 31 General Journal Cash Discount on bonds payable Bonds payable Record entry Clear entry < Prev. Saved C Debit 139,875 S 678 HCC FIL 9 Credit View general journal of 35 US Narrow_forwardv2.cengagenow.com nvert PDF to Word for fr... -Dashboard Print Item VPN 100% +88 My Home C CengageNOWv2 | Online te.. As of July 31, C. Marion Clinic's general ledger balances, listed in alphabetical order of accounts, are as follows: Accounts Balance Accounts Payable $4,512.00 Accounts Receivable 13,661.00 C. Marion, Capital 43,738.00 C. Marion, Drawing 2,100.00 Cash 23,976.00 Equipment 17,793.00 Laboratory Expense 1,510.00 Prepaid Insurance 2,880.00 Professional Fees 18,368.00 Rent Expense 1,250.00 Salary Expense 2,190.00 Supplies 525.00 Utilities Expense 733.00 Required: Prepare a trial balance as of July 31, 20--. List all the accounts in the proper order as described in the textbook. If no amount is required, leave the entry box blank. C. Marion Clinic Trial Balance Previous Next All work saved. Save and Exit Submit Assignment for Gradingarrow_forwardQuestion #2 in this image.arrow_forward

- 5 5 AutoSave On File 2. K9 O Undo A Home Insert Draw Page Layout Formulas Data 0 X Paste Clipboard 5 B Total credit sales Accounts Receivable.xlsx Saved v . Calibri B IU • XV. fx C 17 Accounts Receivable 18 Allowance for doudtful debts 19 D ✓11 Ready Accessibility: Investigate Font V • Α Α΄ V E V 8- A $ % 98 F == Review View Help G 8 9 Accounts Receivable written off 0 Credit issued to customers for sales returns 1 Recovery of Accounts Receivable, written off 12 as uncollectible in the prior year (not included in the cash collected above) 13 14 15 The following were taken from the Balance Sheet dated Dec 31, 20X4 16 Alignment Search (Alt+C H Sheet1 ex. for income stmt. approach Practice Question Sheet4 22 1 V 620,000 5450 14500 3400 General 96400 9700 J V Number 20 Jeremy Company estimated that bad debts (uncollectible) to be equal to 0.5% of credit sales, net of sales returns 21 22 Calculate the Accounts Receivable and Allowance for doubtful debts accounts balances as at Dec 31, 20X5…arrow_forwardnts & Tests - FINA222 E Sign In in Connect M MHE Reader X + https://player-ui.mheducation.com/#/epub/sn_7cac#epubcfi(%2F6%2F422%5Bdata-uuid-49fada7a8= 15. Determining the Cost of Insurance. Suppose you are 45 and have a $50,000 face E LC amount, 15-year, limited-payment, participating policy (dividends will be used to build up the cash value of the policy). Your annual premium is $1,000. The cash value of the policy is expected to be $12.000 in 15 years. Using time value of money and assuming you could invest your money elsewlhere for a 7 percent annual yield, calculate the net cost of insurance. 30 ond hove n $25 000 facearrow_forwardF myCampus Portal Login - for Stu X B 09 Operational and Legal Consid x E (24,513 unread) - sharmarohit81 b My Questions | bartleby A fleming.desire2learn.com/d21/le/content/130754/viewContent/1518900/View?ou=130754 Table of Contents > Week 9: Operational and legal Considerations > Lecture Notes > 09 Operational and Legal Considerations 09 Operational and Legal Considerations - > Calculating Capacity • How many machines do you need? • You expect your sales to be 3,000,000 granola bars (20g each) • How large is your plant? per month • How many workers do you need? The machine: • How much is the investment? Capacity: 100 kgs per hour • What are the operating costs? Requires 2 people to operate it Takes 8 ft x 40 ft space • Cost per machine $15,000 Energy and maintenance: $5 per hour • Cost of material and packaging: $0.12 per bar I Group Project.xlsx Show all 12:35 AM O Type here to search A O 4) ENG 2020-12-09arrow_forward

- Please answer the whole thingarrow_forwardInstructions to chapter 10 exercises - Word eview View Help Y Tell me what you want to do AaBbCcDc AaBbCcDc AaBbC AABBCCD AaB AaBbCcD 1 Normal 1 No Spac... Heading 1 Heading 2 Title Subtitle Paragraph Styles Exer 10-4 Entries for notes payable Obj. 1 A business issued a 120-day,5% note for $60,000 to a creditor on account. Journalize the entries to record (a) the issuance of the note and (b) the payment of the note at maturity, including interest. Exer 10-6arrow_forwardAutoSave OFF Home Insert Draw Paste Page 47 of 95 Calibri B I U 20 Design V v 16916 words 50 ab X 2 V Layout X Α Α΄ A References Aa ▾ A Αν English (United States) Mailings = Review V V W= Packet Lecture-4 View 12/31 싫 V Accessibility: Investigate Tell me 30,000 V Estimating Uncollectible Accounts An estimate of bad debts is made at the end of the accounting period to match the cost of credit sales (bad debt expense) with the revenue credit sales allowed the company to record during the period. The estimate is incorporated in the company's books through an ADJUSTING ENTRY and the entry increases the allowance for uncollectible accounts and bad debt expense. Saved to my Mac ✓ Percent of Receivables Method (an allowance method) management estimates a percent of ending accounts receivable they expect to be uncollectible the ending balance of the Allowance for Uncollectible Accounts (AUA) is determined based on the estimate (% of uncollectible accounts x ending balance of A/R, "% of A/R").…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education