FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:om X

ssment i

Zakariye - OhioLINK

mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddle

Interest

Amounts

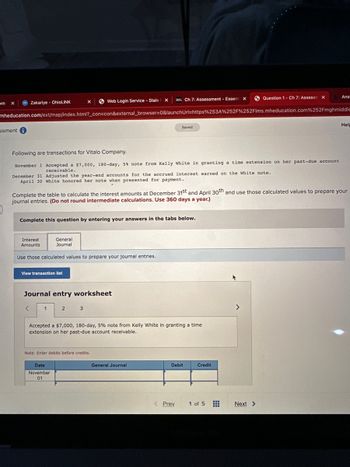

Following are transactions for Vitalo Company.

November 1 Accepted a $7,000, 180-day, 5% note from Kelly White in granting a time extension on her past-due account

receivable.

December 31 Adjusted the year-end accounts for the accrued interest earned on the White note.

April 30 White honored her note when presented for payment.

Complete this question by entering your answers in the tabs below.

View transaction list

<

X

General

Journal

Use those calculated values to prepare your journal entries.

Complete the table to calculate the interest amounts at December 31st and April 30th and use those calculated values to prepare your

journal entries. (Do not round intermediate calculations. Use 360 days a year.)

1

Web Login Service - Stale X

Journal entry worksheet

2

Date

November

01

3

DEL Ch 7: Assessment - Essent X

Note: Enter debits before credits.

Saved

Accepted a $7,000, 180-day, 5% note from Kelly White in granting a time

extension on her past-due account receivable.

General Journal

< Prev

Debit

Credit

Question 1- Ch 7: Assessm X

1 of 5

>

Ans

Next >

Hel

Transcribed Image Text:m x

Zakariye - OhioLINK

=sment i

Web Login Service - Stale

mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddlewa

Interest

Amounts

X

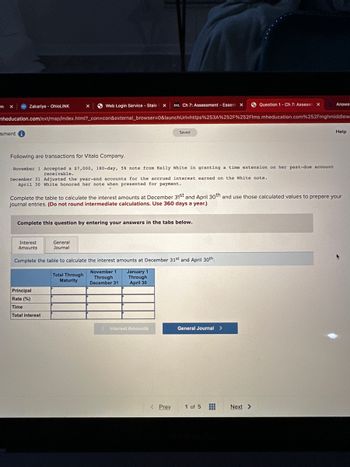

Following are transactions for Vitalo Company.

November 1 Accepted a $7,000, 180-day, 5% note from Kelly White in granting a time extension on her past-due account

receivable.

December 31 Adjusted the year-end accounts for the accrued interest earned on the White note.

April 30 White honored her note when presented for payment.

General

Journal

Principal

Rate (%)

Time

Total interest

Complete this question by entering your answers in the tabs below.

D2L Ch 7: Assessment - Essent X

Total Through

Maturity

Complete the table to calculate the interest amounts at December 31st and April 30th and use those calculated values to prepare your

journal entries. (Do not round intermediate calculations. Use 360 days a year.)

Saved

Complete the table to calculate the interest amounts at December 31st and April 30th

January 1

November 1

Through

December 31

Through

April 30

< Interest Amounts

< Prev

Question 1 - Ch 7: Assessm X

General Journal >

1 of 5

Answer

Next >

Help

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ces Required information [The following information applies to the questions displayed below.] Following are transactions of Danica Company. December 13 Accepted a $20,000, 45-day, 4% note in granting Miranda Lee a time extension on her past-due account receivable. December 31 Prepared an adjusting entry to record the accrued interest on the Lee note. Complete the table to calculate the interest amounts at December 31st and use the calculated value to prepare your journal entries. Note: Do not round your intermediate calculations. Use 360 days a year. Complete this question by entering your answers in the tabs below. Interest Amounts General Journal Complete the table to calculate the interest amounts at December 31st, Interest Recognized December 31 20,000 4% 18/360 Principal Rate (%) Time Total interest Total Through Maturity $ 20,000 $ 4% 45/360 Check my workarrow_forwardAnne Taylor comapany borrowed cash on august 1 of year 1, by signing a $46,620(face amount), one year note payable, due on july 31 of year 2. the accounting period of Anne yalor ends December 31. Assume an effective interest rate of 11%. How much cash should Anne Taylor Company receive from the note on August 1 of Year 1, assuming the note is a noninterest-bearing note?arrow_forwardK On April 1, Hilda made a $2680 deposit to open a savings account paying 3% compounded daily. She then deposited $200 on May 2 and $630 on May 25. Find the balance on June 30 and the interes earned through that date. Click here to view the 3.5% compound interest table. Click here to view the 3.5% compound interest by quarters table View On June 30, what is the balance in the account? S (Round to the nearest cunt as needed.) - X 3.5% Interest Compounded Daily by Quarter Table 1 Interest by Quarter for 3 % Compounded Daily Assuming 90-day Quarters Number of Quarters. Value of (1+i) 1.008667067 1.017409251 1.026227205 1.035121505 3.5% Interest Compounded Daily Table Number R 1 2 3 4 5 6 7 8 9 10 11 12 13 Values of (1+1) for 3% Compounded Daily Valec of Value of 1.000095890 19 35 (1+1) It (1+i) A 1001823491 37 1.003554076 38 1003650307 56 1003746548 57 1000191790 20 1001919556 1.000287699 21 100201 5631 1.000383617 22 1.002111714 1003842797 1000479544 23 1002207807 41 1003939056 59…arrow_forward

- K Cheap Inc. borrowed $95,000 on October 1 by signing a note payable to Scotiabank. The interest expense for each month is $554. The loan agreement requires Cheap Inc. to pay interest on December 31. 1. Make Scotiabank's adjusting entry to accrue interest revenue and interest receivable at October 31, at November 30, and at December 31. Date each entry and include its explanation. 2. Post all three entries to the Interest Receivable account. You need not take the balance of the account at the end of each month. 3. Record the receipt of three months' interest at December 31. 1. Make Scotiabank's adjusting entry to accrue interest revenue and interest receivable at October 31, at November 30, and at December 31. Date each entry and include its explanation. (Record debits first, then credits. Enter explanations on the last line.) Start by making the adjusting entry to accrue monthly interest revenue for October. Date Oct Journal Entry Accounts and Explanation Debit Creditarrow_forwardon Nov 1 alan co. signed a 120 - day, 9% note payable with a face value of 18,000. alan made the appropriate year-end accrual. what is the journal entry as of March 1 to record the payment of the note assuming no reversing entry was madearrow_forwardArvan Patel is a customer of Bank's Hardware Store. For Mr. Patel's latest purchase on January 1, 2018, Bank's Hardware issues a note with a principal amount of $560,000, 13% annual interest rate, and a 24-month maturity date on December 31, 2019. Record the journal entries for Bank’s Hardware Store for the following transactions. If an amount box does not require an entry, leave it blank. A. Note issuance. B. Subsequent interest entry on December 31, 2018. C. Honored note entry at maturity on December 31, 2019.arrow_forward

- Following are transactions of Danica Company. Dec. 13 Accepted a $18,000, 45-day, 10% note in granting Miranda Lee a time extension on her past-due account receivable. 31 Prepared an adjusting entry to record the accrued interest on the Lee note.arrow_forwardJournalize the following entries on the books of the borrower and creditor. Label accordingly. (Assume a 360-day year is used for interest calculations.) June 1 James Co. purchased merchandise on account from O’Leary Co., $90,000, terms n/30. The cost of merchandise sold was $54,000. 30 James Co. issued a 60-day, 5% note for $90,000 on account. Aug. 29 James Co. paid the amount due.arrow_forwardDecember 13 Accepted a $22, 000, 45-day, 4% note in granting Miranda Lee a time extension on her past-due account receivable. December 31 Prepared an adjusting entry to record the accrued interest on the Lee note. January 27 Received Lee's payment for principal and interest on the note dated December 13. March 3 Accepted a $16, 000, 6%, 90-day note in granting a time extension on the past-due account receivable of Tomas Company. March 17 Accepted a $18,000, 30-day, 6% note in granting H. Cheng a time extension on his past-due account receivable. April 16 H. Cheng dishonored his note. May 1 Wrote off the H. Cheng account against the Allowance for Doubtful Accounts. June 1 Received the Tomas payment for principal and interest on the note dated March 3. Complete the table to calculate the interest amounts and use those calculated values to prepare your journal entries. (Do not round Intermediate calculations. Use 360 days a year.) Complete this question by entering your answers in the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education