Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Your company is environmentally conscious and is considering two heating options for a new research building. What you know about each option is below, and your company will use an annual interest rate (MARR) of 6% for this decision. Which is the lower cost option for the company?

i Click the icon to view the additional information about the options.

Click the icon to view the interest and annuity table for discrete compounding when the MARR is 3% per year.

Click the icon to view the interest and annuity table for discrete compounding when the MARR is 6% per year.

The PW of the Gas Heating Option is $ - 314,080`. (Round to the nearest dollar.)

The PW of the Geothermal Heating Option is $ - 306,540'. (Round to the nearest dollar.)

The lower cost alternative is the geothermal heating option.

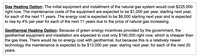

Transcribed Image Text:Gas HeatingOption: The initial equipment and installment of the natural gas system would cost $225,000

right now. The maintenance costs of the equipment are expected to be $1,000 per year, starting next year,

for each of the next 11 years. The energy cost is expected to be $6,000 starting next year and is expected

to rise by 4% per year for each of the next 11 years due to the price of natural gas increasing.

Geothermal Heating Option: Because of green energy incentives provided by the government, the

geothermal equipment and installation are expected to cost only $190,000 right now, which is cheaper than

the gas lines. There would be no energy cost with geothermal, but because this is a relatively newer

technology the maintenance is expected to be $13,000 per year, staring next year, for each of the next 20

years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- United Pigpen (UP) is considering a proposal to manufacture high protein hog feed. The project would make use of an existing warehouse, which is currently rented out to a neighboring firm. The next year’s rental charge on the warehouse is $260,000, and thereafter the rent is expected to grow in line with inflation at 4% a year. In addition to using the warehouse, the proposal envisages an investment in plant and equipment of $3.1 million. This could be depreciated for tax purposes over 10 years. However, UP expects to terminate the project at the end of eight years and to resell the plant and equipment in year 8 for $1,040,000. Finally, the project requires an initial investment in working capital of $910,000. Thereafter, working capital is forecasted to be 10% of sales in each of years 1 through 7. Year 1 sales of hog feed are expected to be $10.9 million, and thereafter sales are forecasted to grow by 5% a year, slightly faster than the inflation rate. Manufacturing costs are…arrow_forwardNew Economy Transport (B) There is no question that the Vital Spark needs an overhaul soon. However, Mr. Handy feels it unwise to proceed without also considering the purchase of a new vessel. Cohn and Doyle Inc., a Wisconsin shipyard, has approached NETCO with a design incorporating a Kort nozzle, extensively automated navigation and power control systems, and much more comfortable accommodations for the crew. Estimated annual operating costs of the new vessel are: Fuel Labor and benefits. Maintenance Other $380,000 330,000 70,000 105,000 $885,000 Page 183 The crew would require additional training to handle the new vessel's more complex and sophisticated equipment. Training would. probably cost $50,000 next year. The estimated operating costs for the new vessel assume that it would be operated in the same way as the Vital Spark. However, the new vessel should be able to handle a larger load on some routes, which could generate additional revenues, net of additional out- of-pocket…arrow_forwardTrader Bubba Industries must choose between solar and an electric-powered forklift truck for moving materials in its factory. Because both forklifts perform the same function, the firm will choose only one. (They are mutually exclusive investments.) The solar truck will cost more but will be less expensive to operate; it will cost $70,000, whereas the electric-powered truck will cost $60,000. The life for both types of truck is estimated to be 8 years, during which time the net cash flows for the solar-powered truck will be $20,000 per year and those for the electric-powered truck will be $12,000 per year. Trader Bubba Industries’ assets are $400 million, financed through bank loans, bonds, preferred stocks, and common stocks. The amounts are as follows: Bank loans: $50 million borrowed at 6% Bonds: $200 million, paying 8% coupon with semi-annual payments, and maturity of 10 years. Trader Bubba sold its $1,000 par-value bonds for $1020 and had to incur $20 flotation cost per bond.…arrow_forward

- Assume that a company is considering purchasing a machine for $50,500 that will have a five-year useful life and no salvage value. The machine will lower operating costs by $17,000 per year. The company's required rate of return is 18%. The profitability index for this investment is closest to: Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. Multiple Choice O 0.95. 1.01. 1.05. 1.11.arrow_forwardJason is interested in finding the breakeven point for a new pump it plans to produce. The price of the pump is $250 and the variable cost ratio is 50% of the price. Jason calculated that the fixed costs will be about $400,000. What is the breakeven point of operations?arrow_forwardDo all plarrow_forward

- Assume that a company is considering purchasing a machine for $50,500 that will have a five-year useful life and no salvage value. The machine will lower operating costs by $17,000 per year. The company's required rate of return is 18%. The profitability index for this investment is closest to: Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. Multiple Choice C O 0.95. 1.01. 1.05. 1.11.arrow_forwardYou are evaluating two different systems: System A costs $45,000, has a three year life and costs $5,000 per year to operate. System B costs $65,000, has a five year life and costs $4,000 per year to operate. If the required rate of return is 8%, which system would you prefer? I Next Slidearrow_forwardAbhaliyaarrow_forward

- For the following two alternatives, if the MARR is 10% per year (a)which one has a shorter payback period (b) which one do you select if you use the PW analysis. (c) is your selection different in (a) and (b)? Why? (d) use Spreadsheet to solve a and b. Alternative A: initial cost = $300,000 Revenue = $60,000 Alternative B: initial costs = $300,000 Revenue starts from n=1 at $10,000 and increases by $15,000 per year The expected life is 10 years for each alternative.arrow_forwardYour latest project involves the development of a death ray. Initial estimates predict that the project has a 50% chance of failure, with a potential loss of $1,000,000. However, you could hire an expert for $450,000. This is likely to reduce the chance of failure to 20% and the potential loss to $300,000. Questions: a) What is the dollar value of the net benefit of hiring the expert? Should you hire the expert? (Show all calculations for credit) b) As the skeptical accountant, do you have any concerns with this analysis? Be specific in order to receive creditarrow_forwardSet up the equation and solve. A contractor estimates that it would take $15,036 to make a home 50% more energy-efficient than a code-built house. She projects that the code-built house wc have annual heating costs of $1711, while the more energy-efficient house would have annual heating costs of $723. How long would it take for the annual savi to pay off the cost of the upgrades? It will take years for the annual savings to pay off the cost of the upgrades. (Simplify your answer. Round up to the nearest year.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education