Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

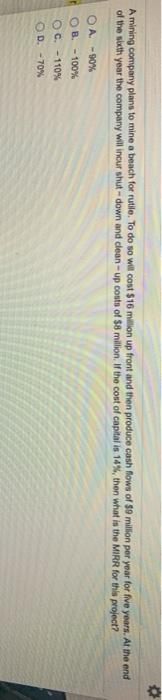

Transcribed Image Text:A mining company plans to mine a beach for rutile. To do so will cost $16 million up front and then produce cash flows of $9 million per year for five years. At the end

of the sixth year the company will incur shut-down and clean-up costs of $8 million. If the cost of capital is 14%, then what is the MIRR for this

project?

OA. -90%

OB. -100%

OC. -110%

OD. -70%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- ilrn/takeAssignment/takeAssignmentMain.do?invoker%-&takeAssignmentSessionLocator3&inprogress%3false ps Cost of Materials Issuances Under the FIFO Method An incomplete subsidiary ledger of materials inventory for May is as follows: a. Complete the materials issuances and balances for the materials subsidiary ledger under FIFO. Received Issued Balance Receiving Materials Unit Report Quantity Requisition Quantity Date Unit Price Amount Quantity Amount Number Number price May 1 250 $5 $1,250 21 180 $7 May 4 102 280 $4 May 10 27 120 May 21 115 170 May 27 b. Determine the materials inventory balance at the end of May. c. Journalize the summary entry to transfer materials to work in process. If an amount box does not require an entry, leave it blank. Previous Nextarrow_forwardEA3. LO 5.3 Given the following information, determine the equivalent units of ending work in process for materials and conversion under the weighted-average method: beginning inventory of 2,500 units is 100% complete with regard to materials and 60% complete with regard to conversion 18,000 units were started during the period • 17,500 units were completed and transferred ending inventory is 100% complete with materials and 65% complete with conversionarrow_forwardFor the given CFD if the MARR (i) =9%, the Net Present Worth, NPW is close to: NPW=2 Benefits i=---% 0₁ -$4,000 1 OD. $4035 E. $-845 $1000 Costs OA. Non of them. OB. $3131 OC.$-4345 2 2000 3 3000 Acost-$2,000 4 5 $12,000 $4000 Yearsarrow_forward

- Use the table to calculate the amount of money that must be invested now at 16% annually, compounded quarterly, to obtain $1,400 in three years. Click the icon to view the $1 present value table. How much money must be invested at 16% annually, compounded quarterly, to obtain S1,400 in three years? 2$ (Round to the nearest cent as needed.)arrow_forwardC. Ksh 1,657,530 D. Ksh 2,499,000 The sales data (in units) of book store has been extracted for the three terms over 3 years as follows; \table[[, Term-, 1 Term-, 2 Term-], [2020, 4500, 3,000, 1,200], [2021, 6,000, 4, 200, 2, 400], [2022, 7, 800, 5, 400, 3, 600]] Required: Using multiplicative index, forecast sales for term - III (to the nearest 100) of the year 2023 given an annual sales forecast of 18,000 A. 3, 100 units B. 3,500 units C. 3,300 units D. 3,400 unitsarrow_forwardPrepare General journal entries for the given questionarrow_forward

- TB MC Qu. 16-158 (Algo) Compute the number of equivalent units... Compute the number of equivalent units with respect to conversion using the weighted-average method. Beginning work in process inventory Units started and completed Units completed and transferred out Ending work in process inventory Units 40,000 140,000 180,000 28,000 Direct Materials Conversion Percent Percent Complete 100% 100% Complete 35% 50%arrow_forwardCurrent Year Current Year Prior Year Prior Year Amount Percent Amount Percent Revenues: Admissions $90,639 fill in the blank % $100,694 fill in the blank% Event-related revenue 136,900 fill in the blank % 146,980 fill in the blank% NASCAR broadcasting revenue 224,227 fill in the blank % 217,469 fill in the blank% Other operating revenue 60,390 fill in the blank % 31,320 fill in the blank% Total revenues $512,156 fill in the blank % $496,463 fill in the blank% Expenses and other: Direct expense of events $(102,786) fill in the blank $(104,303) fill in the blank NASCAR event management fees Other direct expenses (137,727) fill in the blank (133,682) fill in the blank (43,784) fill in the blank (19,541) fill in the blank General and administrative (166,663) fill in the blank (285,166) fill in the blank Total expenses and other Income from continuing operations $(450,960) fill in the blank $(542,692) fill in the blank $61,196 fill in the blank% $(46,229) fill in the blankarrow_forwardPlease help with 4a and 4barrow_forward

- ABFHRL437 Corporation's info is below: (Baruch College Exam) Sales $843,000 VC $168,600 FC $14,350 NOI $660,050 (ID#63561) Q) How much is ABFHRL437's Contribution Margin? A) $ < P.hexarrow_forwardMinar Incorporated reported the following results from last year's operations: $ 5,700,000 3,510,000 2,190,000 1,734,000 Fixed expenses Net operating income $ 456,000 Average operating assets $ 3,000,000 At the beginning of this year, the company has a $900,000 investment opportunity with the following characteristics: Sales Variable expenses Contribution margin Sales Contribution margin ratio Fixed expenses $ 1,530,000 60% of sales $ 810,900 If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:arrow_forwardRequired information [The following information applies to the questions displayed below.] Units of Percent of Blending Process Beginning work in process Product Conversion 164,000 345,000 375,000 134,000 85% Goods started 100 Goods completed Ending work in process 100 40 Compute the total equivalent units of production for conversion using the weighted-average method. Equivalent units of production (EUP) with respect to conversion - weighted average method Units % Conversion EUP Totalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education