FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

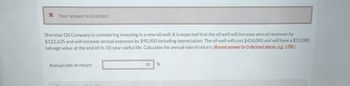

Transcribed Image Text:* Your answer is incorrect.

Sheridan Oil Company is considering investing in a new oil well. It is expected that the oil well will increase annual revenues by

$122,625 and will increase annual expenses by $90,000 including depreciation. The oil well will cost $424,000 and will have a $11,000

salvage value at the end of its 10-year useful life. Calculate the annual rate of return. (Round answer to O decimal places, e.g. 13%.)

Annual rate of return

20

%

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Chaquille's K-House, Inc. made an investment in a project with an initial cost of $11,205,051. This investment was for 8 years and had no residual value. The company expects to receive yearly net cash inflows of $2,611,900. Management is requiring a return of 12% on the investment. (Round your answers to two decimal places when needed and use rounded answers for all future calculations).arrow_forwardHaresh valaarrow_forward* Your answer is incorrect. Sheridan Oil Company is considering investing in a new oil well. It is expected that the oil well will increase annual revenues by $122,625 and will increase annual expenses by $90,000 including depreciation. The oil well will cost $424,000 and will have a $11,000 salvage value at the end of its 10-year useful life. Calculate the annual rate of return. (Round answer to O decimal places, e.g. 13%.) Annual rate of return 20 %arrow_forward

- ...txt Quail Company is considering buying a food truck that will yield net cash inflows of $13,600 per year for seven years. The truck costs $43,000 and has an estimated $6,600 salvage value at the end of the seventh year. (PV of $1, FV of $1. PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Enter negative net present values, if any, as negative values. Round your present value factor to 4 decimals.) What is the net present value of this investment assuming a required 8% return? ! 1 Years 1-7 Totals Net present value A Q D F1 @ 2 W F2 # 3 E 80 F3 Net Cash Flows x PV Factor APR 11 $ 4 R a F4 % 5 * 8 1 l DII F8 U I ( 9 F9 A ) 0 0 S F10 A S D F G H J K L Parrow_forwardHallmark Furniture Company refinishes and reupholsters furniture. Hallmark Furniture uses a job order cost system. When a prospective customer asks for a price quote on a job, the estimated cost data are inserted on an unnumbered job cost sheet. If the offer is accepted, a number is assigned to the job, and the costs incurred are recorded in the usual manner on the job cost sheet. After the job is completed, reasons for the variances between the estimated and actual costs are noted on the sheet. The data are then available to management in evaluating the efficiency of operations and in preparing quotes on future jobs. On February 14, 20Y1, an estimate of $3,318 for reupholstering a chair and couch was given to Millard Schmidt. The estimate was based on the following data: Estimated direct materials: 30 meters at $30 per meter $ 900 Estimated direct labor: 28 hours at $30 per hour 840 Estimated factory overhead (75% of direct labor cost) 630 Total estimated…arrow_forwardThe Karns Oil Company is deciding whether to drill for oil on a tract of land that the company owns. The company estimates the project would cost $4 million today. Karns estimates that, once drilled, the oil will generate positive net cash flows of $2 million a year at the end of each of the next 4 years. Although the company is fairly confident about its cash flow forecast, in 2 years it will have more information about the local geology and about the price of oil. Karns estimates that if it waits 2 years then the project would cost $5 million. Moreover, if it waits 2 years, then there is a 90% chance that the net cash flows would be $2.1 million a year for 4 years and a 10% chance that they would be $1.1 million a year for 4 years. Assume all cash flows are discounted at 8%. If the company chooses to drill today, what is the project's net present value? Do not round intermediate calculations. Enter your answer in millions. For example, an answer of $1.23 million should be entered…arrow_forward

- Question 1) Imagine you are considering buying a gold deposit. It will cost $1 million per year to construct a mine so that gold can be extracted. The construction period lasts 3 years. In the fourth year, production starts. Each year the mine operates it will yield a net return of $500,000 (total revenue minus total cost). What will you pay for the gold deposit if: (a) Interest rates are 10 percent and gold can be extracted for 10 years? (b) Interest rates are 5 percent and gold can be extracted for 6 years?arrow_forwardNovak Company is contemplating an investment costing $168,810. The investment will have a life of 8 years with no salvage value and will produce annual cash flows of $30,500. Click here to view PV tables. What is the approximate internal rate of return associated with this investment? (Use the above table.) (Round answer to O decimal places, e.g. 15%) Internal rate of return. %6arrow_forwardmine. Alma has used the estimates provided by Dan to determine the revenues that could be expected from the mine. She also has projected the expense of opening the mine and the annual operating expenses. If the company opens the mine, it will cost $825 million today, and it will have a cash outflow of $75 million nine years from today in costs associated with closing the mine and reclaiming the area surrounding it. The expected cash flows each year from the mine are shown in the following table. Bullock Mining has a 12 percent required return on all of its gold mines. Year 0 1 2 3 4 5 6 7 8 9 Cash Flow -$825,000,000 160,000,000 185,000,000 215,000,000 245,000,000 210,000,000 205,000,000 190,000,000 160,000,000 75,000,000arrow_forward

- Bunnings Ltd is considering to invest in one of the two following projects to buy a new equipment. Each equipment will last 5 years and have no salvage value at the end. The company’s required rate of return for all investment projects is 8%. The cash flows of the projects are provided below. Equipment 1 Equipment 2 Cost $186000 $195000 Future Cash Flow Year 1 86000 97000 Year 2 93000 84000 Year 3 83000 86000 Year 4 75000 75000 Year 5 55000 63000 Required:a) Identify which option of equipment should the company accept based on Profitability Index? b) Identify which option of equipment should the company accept based on discounted pay back method if the payback criterion is maximum 2 years?arrow_forwardStevie’s Sporting Goods is considering investing $33,000 in a new machine. The machine is expected to last five years and have a salvage value of $8,000. Annual after-tax net cash inflow from the machine is expected to be $7,000. Calculate the accounting rate of return (aka the unadjusted rate of return). (Enter your answer as a percentage rounded to one decimal place, but do NOT include the percentage sign. For example: 5 divided by 35 is 0.142857, which you would enter as “14.3”)arrow_forwardPharoah Oil Company is considering investing in a new oil well. It is expected that the oil well will increase annual revenues by $122,480 and will increase annual expenses by $65,000 including depreciation. The oil well will cost $468,000 and will have a $11,000 salvage value at the end of its 10-year useful life. Calculate the annual rate of return. (Round answer to 0 decimal places, eg. 13%) Annual rate of return %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education