FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

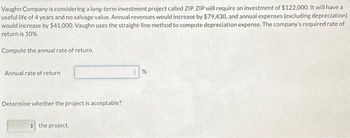

Transcribed Image Text:Vaughn Company is considering a long-term investment project called ZIP ZIP will require an investment of $122,000. It will have a

useful life of 4 years and no salvage value. Annual revenues would increase by $79,430, and annual expenses (excluding depreciation)

would increase by $41,000. Vaughn uses the straight-line method to compute depreciation expense. The company's required rate of

return is 10%.

Compute the annual rate of return.

Annual rate of return

Determine whether the project is acceptable?

the project.

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you explain don't understandarrow_forwardA commercial property has PGI of $5 million, expenses of 40% of EGI and the vacancy is underwritten at 10%. What values would the following parameters suggest for the property. 70% LTV with a rate of 4.5% and 360 month amortization schedule. Given a property value of $45 million, calculate PGIM, EGIM, Cap Rate, Cash on Cash return and DSSCR.arrow_forward2. Now assume the company is considering two methods: automated method and manual system. The estimates for each method are shown below. Automated 400,000 30,000 (per 3 years) 150,000 (per year) 200,000 9 Manual 0 200,000 (per 6 years) 100,000 (per year) 500,000 Infinite First cost, $ Operating cost, $ Revenue, $ Salvage value Life, years The effective interest rate is 3% per quarter. Which alternative should be selected? Use Capitalized Cost Approach.arrow_forward

- Using the previous table, enter the correct factor for three periods at 5%: Periodic payment x Factor = Present value $6,000 x = $16,338 The controller at Ross has determined that the company could save $6,000 per year in engineering costs by purchasing a new machine. The new machine would last 12 years and provide the aforementioned annual monetary benefit throughout its entire life. Assuming the interest rate at which Ross purchases this type of machinery is 9%, what is the maximum amount the company should pay for the machine? $fill in the blank 5aca5ff34fa005f_2 (Hint: This is basically a present value of an ordinary annuity problem as highlighted above.) Assume that the actual cost of the machine is $50,000. Weighing the present value of the benefits against the cost of the machine, should Ross purchase this piece of machinery? Use snippets to answerarrow_forwardCan someone please solve this question using hand calculations only? PLEASE AND THANK YOU!!!arrow_forward5. Compare the following 2 alternatives with a method of your choice. The market rate is 6% and inflation is expected to run at 2.5% per year. Alt A B Construction cost $ Benefits $/yr 450,000 380,000 2,000,000 1,500,000 Salvage 200,000 150,000 Life (yrs) 12 9arrow_forward

- The equivalent annual worth of alternative A over an infinite time period is closest to:a. $-25,000b. $-27,200c. $-31,600d. $-37,100arrow_forwardYou invested $100,000 in a project and received $40,000 at n = 1, $40,000 atn = 2, and $30,000 at n = 3 years. For some reason, you need to terminate theproject at the end of year 3. Your interest rate is 10%; what is the project balanceat the time of termination?(a) gain of $10,000 (b) loss of $8,039(c) loss of $10,700 (d) just breakevenarrow_forwardQ1. A machine costs the company K98,000 and its effective life is estimated to be 12 years. If the scrap realizes K3,000 only, what amount should be retained out of profits at the end of each year to accumulate at compound interest at 5% per annum? Q2. A mortgage of K200,000 is to be repaid over a 25 year period at a fixed interest rate of 4.5 %. Calculate the monthly repayments.arrow_forward

- Consider the mutually exclusive alternatives given in the table below. The MARR is 10% per year. Assuming repeatability, which alternative should thecompany select? (a) Alternative X (b) Alternative Y (c) Alternative Z (d) Do nothing.arrow_forwardA 5-year project is estimated to cost $700,000 and have no residual value. If the straight-line depreciation method is used and estimated total income is $231,000, determine the average rate of return giving effect to depreciation on the investment. Round your percentage answer to one decimal place (for example, a value of .1048 rounds to 10.5%).fill in the blank 1 %arrow_forwardPerform a present worth (PW)-based evaluation of the two alternatives below using a spreadsheet. The after-tax minimum acceptable rate of return (MARR) is 8% per year, Modified Accelerated Cost Recovery System (MACRS) depreciation applies, and Te=40%. The (GI -OE) estimate is made for the first 3 years; it is zero in year 4 when each asset is sold. Alternative First Cost, $ Salvage Value, Year 4, $ GI-OE, $ per Year Recovery Period, Years X -8,000 0 3,500 3 Y -13,000 2,000 5,000 3 The PW for alternative X is determined to be $ The PW for alternative Yis determined to be $ Alternative (Click to select) is selected.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education