Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

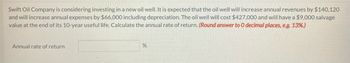

Transcribed Image Text:Swift Oil Company is considering investing in a new oil well. It is expected that the oil well will increase annual revenues by $140,120

and will increase annual expenses by $66,000 including depreciation. The oil well will cost $427,000 and will have a $9,000 salvage

value at the end of its 10-year useful life. Calculate the annual rate of return. (Round answer to 0 decimal places, e.g. 13%.)

Annual rate of return

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Southern Pole is developing a special vehicle for Antarctic exploration. The development requires investments of $100,000 today, $200,000 in 1 year from today and $300,000 in 2 years from today. Net returns for the project are expected to be $96,000 at the end of year over the next 15 years. If the company requires a rate of return of 12% compounded annually-find the NPV of the project. (Chapter 16.2)arrow_forwardDDR Enterprises is analyzing an expansion project. The project's installed cost is $80,000. It is eligible for 100% bonus depreciation. The project has a $12,000 salvage value at the end of its five year expected life. The project will requie an additional $8,000 investment in net working capital. The tax rate is 25%. What is the project's initial investment? If you could show the steps in calcualtion too that would be great!arrow_forwardPharoah Inc. is contemplating a capital project with a cost of $149000. The project will generate net cash flows of $44000 for year 1, $60000 for year 2 and $59000 for year 3. The asset has a salvage value of $10000 and straight-line depreciation will be used. The company's required rate of return is 10%. Year 1 2 3 0 0 0 0 Present Value of 1 at 10% 0.909 0.826 0.751 PV of an Annuity of 1 at 10% 0.909 1.736 2.487 acceptable because it has a positive NPV. unacceptable because it has a zero NPV. unacceptable because it earns a rate less than 10%. acceptable because it has a return of greater than 10%. SUPPOarrow_forward

- Haresh valaarrow_forward* Your answer is incorrect. Sheridan Oil Company is considering investing in a new oil well. It is expected that the oil well will increase annual revenues by $122,625 and will increase annual expenses by $90,000 including depreciation. The oil well will cost $424,000 and will have a $11,000 salvage value at the end of its 10-year useful life. Calculate the annual rate of return. (Round answer to O decimal places, e.g. 13%.) Annual rate of return 20 %arrow_forwardaaarrow_forward

- Riordan Manufacturing is considering an investment in new equipment that will produce equal annual cash flows of $52,000 for 8 years and has a net present value of $94,182. The initial investment is $247,000, the useful life is 8 years, and the equipment's salvage value after 8 years is $26,000. What is the equipment's profitability index? Round your answer to two decimal places. 6.56 1.38 4.75 1.81arrow_forwardSouthern Pole is developing a special vehicle for Antarctic exploration. The development requires investments of $100,000 today, $200,000 in 1 year from today and $300,000 in 2 years from today. Net returns for the project are expected to be $96,000 at the end of year over the next 15 years. If the company requires a rate of return of 12% compounded annually-find the NPV of the project. (Chapter 16.2)arrow_forwardBhaarrow_forward

- XYZ is evaluating a project that would require the purchase of a piece of equipment for $440,000 today. During year 1, the project is expected to have relevant revenue of $786,000, relevant costs of $201,000, and relevant depreciation of $132,000. XYZ would need to borrow $440,000 today to pay for the equipment and would need to make an interest payment of $33,000 to the bank in 1 year. Relevant net income for the project in year 1 is expected to be $337,000. What is the tax rate expected to be in year 1? A rate equal to or greater than 21.96% but less than 26.61% A rate less than 21.96% or a rate greater than 46.34% A rate equal to or greater than 31.02% but less than 38.39% A rate equal to or greater than 38.39% but less than 46.34% A rate equal to or greater than 26.61% but less than 31.02%arrow_forwardBriar Corporation is considering the purchase of a new piece of equipment. The cost savings from the equipment would result in an annual increase in net cash flow of $204,000. The equipment will have an initial cost of $1,204,000 and an 8-year useful life. The salvage value of the equipment is estimated to be $204,000. Briar's cost of capital is 8%. (Future Value of $1. Present Value of $1, Future Value Annuity of $1. Present Value Annuity of $1) Note: Use appropriate factor from the PV tables. Required: a. What is the accounting rate of return? b. What is the payback period? c. What is the net present value? d. What would the net present value be with a 14% cost of capital? e. Based on the NPV calculations, what would be the equipment's internal rate of return? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D What is the accounting rate of return? Required E Note: Do not round intermediate calculations. Round your final…arrow_forwardAccountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education