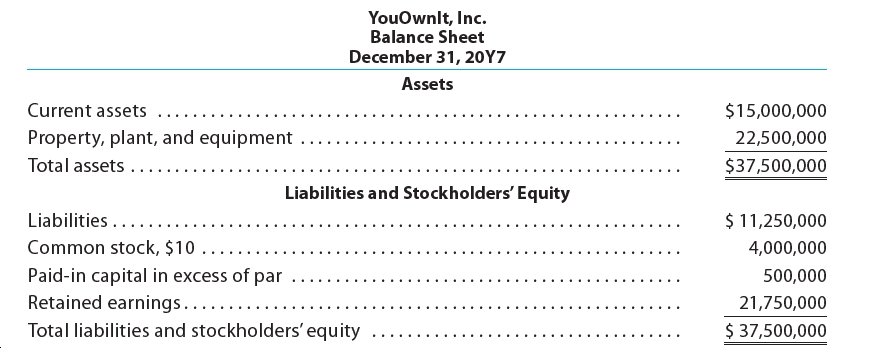

You hold a 25% common stock interest in YouOwnIt, a family-owned construction equipment company. Your sister, who is the manager, has proposed an expansion of plant facilities at an expected cost of $26,000,000. Two alternative plans have been suggested as methods of financing the expansion. Each plan is briefly described as follows:

Plan 1. Issue $26,000,000 of 20-year, 8% notes at face amount

Plan 2. Issue an additional 550,000 shares of $10 par common stock at $20 per share, and $15,000,000 of 20-year, 8% notes at face amount

The

Please see the attachment for details:

Net income has remained relatively constant over the past several years. The expansion program is expected to increase yearly income before bond interest and income tax from $2,667,000 in the previous year to $5,000,000 for this year. Your sister has asked you, as the company treasurer, to prepare an analysis of each financing plan.

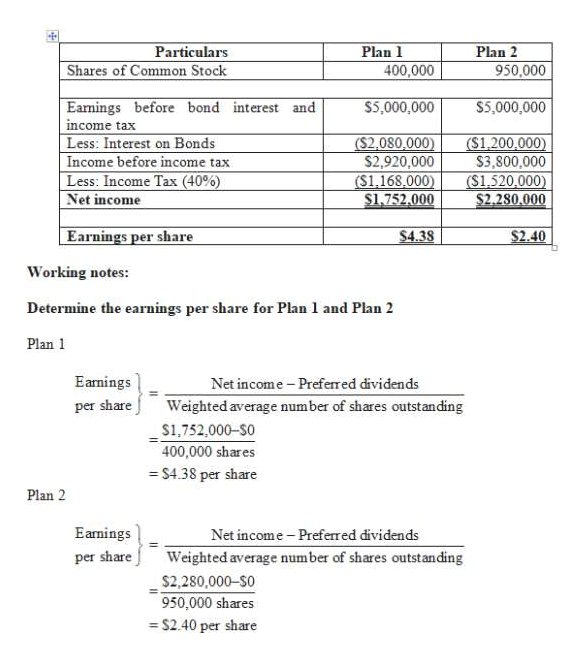

1. Prepare a table indicating the expected earnings per share on the common stock under each plan. Assume an income tax rate of 40%. Round to the nearest cent.

2. a. Discuss the factors that should be considered in evaluating the two plans.

b. Which plan offers greater benefit to the present stockholders? Give reasons for your opinion.

1.

Prepare a table indicating the expected earnings per share on the common stock under each plan.

2.a.

The factors that should be considered in evaluating the two plans are discussed below:

- A corporation has a liability of paying interest on bonds. However, it does not any definite obligation of paying dividends to its common stockholders. Thus, if there is a substantial decrease in the net income, it would be difficult to pay the interest expense. Hence, in such case, the issuance of common stock is better than bonds.

- On issuance of bonds, there is a definite obligation of repaying the principal amount of the bonds in 20 years. Moreover, in case of liquidation, the claims of the bondholders are to be settled before the claims of the common stockholders.

- The existing common stockholders should buy new shares if they intend to have their proportionate authority and the financial interest in the corporation.

Step by stepSolved in 3 steps with 1 images

- Jacob Inc. is considering a capital expansion project. The initial investment of undertaking this project is $188,500. This expansion project will last for five years. The net operating cash flows from the expansion project at the end of year 1, 2, 3, 4 and 5 are estimated to be $28,500, $38,780, $58,960, $77,680 and $95,380 respectively. Jacob has a weighted average cost of capital of 18%. Based on Jacob’s weighted average cost of capital, what is the profitability index (PI)of undertaking this project? That is, what is the profitability index if the weighted average cost of capital is used as the discount rate? Shall Jacob undertake the investment project?arrow_forwardTri-States Gas Producers expects to borrow $800,000 for field engineering improvements. Two methods of debt financing are possible—borrow it all from a bank or issue debenture bonds. The company will pay an effective 8% per year to the bank for 8 years. The principal on the loan will be reduced uniformly over the 8 years, with the remainder of each annual payment going toward interest. The bond issue will be for 800 ten-year bonds of $1000 each that require a 6% per year dividend payment. (a) Which method of financing is cheaper after an effective tax rate of 40% is considered? (b) Which is the cheaper method using a before-tax analysis? Is it the same as the after-tax choice?arrow_forwardInvolves the purchase of a lumber mill operation located in Nova Scotia. You have estimated the initial investment as $1,000,000 and the annual pre-tax cash flow over the next 10 years as $200,000 at which point the operation will be obsolete. If GBEI decides to invest in the lumber mill operation, it will be financed using the same proportions of debt and equity that GWEI currently uses. You have collected information on a publicly-traded lumber products company whose primary line of business is similar to GBEI’s lumber mill operation – this has led you to recommend a discount rate of 11.27% for this investment. Assume straight line depreciation. 1. Calculate the NPV, Payback Period, and Profitability Index of the lumber mill operation.arrow_forward

- Blossom, Inc., a resort management company, is refurbishing one of its hotels at a cost of $5,530,684. Management expects that this will lead to additional cash flows of $1,250,000 for each of the next six years. What is the IRR of this project? If the appropriate cost of capital is 12 percent, should Blossom go ahead with this project? (Round answer to 4 decimal places, e.g. 5.2516%.) The IRR of this project is The firm should reject ✓the project. 9.5 se %arrow_forwardPls show complete steps and all partsarrow_forwardGBC Group is venturing into a commercial investment property, featuring a leasable building area of 100,000 square feet with an existing tenant paying a gross rent of $50 per square foot and estimated operating expenses at 50 % . The lender is proposing a permanent loan with a loan - to - value ratio of 70%, amortized over 15 years at a 5% interest rate (MPF = 0.007881). Considering a vacancy rate of 5% and a cap rate of 5%, what would be the indicated Breakeven Occupancy Ratio (BOR)? Question 10 options: 133 % 115 % 88% 106%arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education