Concept explainers

Jacob Inc. is considering a capital expansion project. The initial investment of undertaking this project is $188,500. This expansion project will last for five years. The net operating cash flows from the expansion project at the end of year 1, 2, 3, 4 and 5 are estimated to be $28,500, $38,780, $58,960, $77,680 and $95,380 respectively.

Jacob has a weighted average cost of capital of 18%.

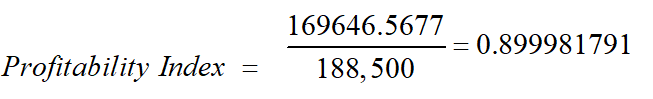

Based on Jacob’s weighted average cost of capital, what is the profitability index (PI)of undertaking this project? That is, what is the profitability index if the weighted average cost of capital is used as the discount rate? Shall Jacob undertake the investment project?

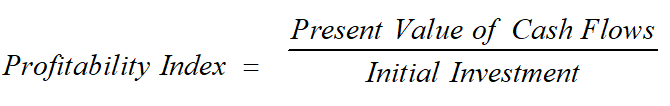

Profitability Index (PI) is calculated by dividing Present value of Cash flows by the initial investment. PI depicts the net present value per dollar of initial investment.

The formula for calculation of Profitability Index is as follows:

Initial Investment = $188500

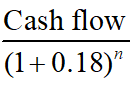

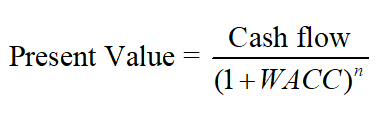

WACC = Weighted Average Cost of capital =18%

n=Year

| Year | Nest Operating cash flow |

Present Value (PV)

|

| 1 | $28,500 | 24152.54237 |

| 2 | $38,780 | 27851.19219 |

| 3 | $58,960 | 35884.87625 |

| 4 | $77,680 | 40066.47982 |

| 5 | $95,380 | 41691.47704 |

| Total | 169646.5677 |

Step by stepSolved in 2 steps with 4 images

- Monterey Company is considering investing in two new vans that are expected to generate combined cash inflows of $30,000 per year. The vans’ combined purchase price is $93,000. The expected life and salvage value of each are four years and $23,000, respectively. Monterey has an average cost of capital of 7 percent. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required Calculate the net present value of the investment opportunity. (Round your intermediate calculations and final answer to 2 decimal places.) Indicate whether the investment opportunity is expected to earn a return that is above or below the cost of capital and whether it should be accepted.arrow_forwardGoodFish Corporation is considering a new project with a four-year useful life. The initial investment on this project is $1,200,000 immediately. The future cash flows associated with this project are $650,000, $650,000, $650,000, and $856,000 in years 1, 2, 3 and 4, respectively. GoodFish has a target debt–equity ratio of 3, a cost of equity of 10 percent, and a pretax cost of debt of 8 percent. The tax rate is 25%. What is the NPV of this project? A. $1,158,843.73 B. $1,077,782.13 C. $905,193.80 D. $1,051,753.51arrow_forwardHathaway, Inc., a resort company, is refurbishing one of its hotels at a cost of $6,820,850. Management expects that this will lead to additional cash flows of $1,584,520 for the next six years. What is the IRR of this project? If the appropriate cost of capital is 12 percent, should Hathway go ahead with this project? (Round answer to 2 decimal places, e.g. 5.25%.)a). The IRR of this project is ___%b). The firm should Reject or Accepted?the project?arrow_forward

- ABC Ltd. is considering an investment which would require the immediate purchase of a capital asset costing €400,000 and working capital of €120,000. Net inflows will be €180,000, €160,000 and €140,000 for year one, year two and year three. Working capital will increase by 20% per year in each of the first two years. All of the working capital will be turned into cash at the end of year three. The company’s cost of capital is 15%. The NPV of the investment (ignoring taxation), to the nearest whole number, is:arrow_forwardHaukea Clothing Inc. is evaluating two capital investment proposals for a retail outlet, each requiring an investment of $200,000 and each with an eight-year life and expected total net cash flows of $320,000. Location 1 is expected to provide equal annual net cash flows of $40,000, and Location 2 is expected to have the following unequal annual net cash flows: Year Amount Year AmountYear 1 $78,000 Year 5 $42,000Year 2 58,000 Year 6 34,000Year 3 38,000 Year 7 24,000Year 4 26,000 Year 8 20,000Determine the cash payback period for both location proposals. Location YearLocation 1 yearsLocation 2 yearsarrow_forwardStrange Manufacturing Co. is purchasing a production facility at a cost of $21 million. The firm expects the project to generate annual cash flows of $7 million annually over the next five years. Its cost of capital is 10%. What is the net present value of this project? O $5,535,507 O $6,535,507 O $6,213,909 O $890,197arrow_forward

- Kelli is considering a project that would last for 3 years and have a cost of capital of 10.98 percent. The relevant level of net working capital for the project is expected to be $9,620.00 immediately (at year 0); $30,700.00 in 1 year; $27,500.00 in 2 years; and $8,520.00 in 3 years. Relevant expected operating cash flows and cash flows from capital spending in years 0, 1, 2, and 3 are presented in the following table. What is the net present value of this project? Operating cash flows Year 0 $0.00 Year 1 Year 2 Year 3 $52,500.00 $52,500.00 $52,500.00 Cash flows from capital spending -$97,700.00 $0.00 $0.00 $7,800.00 O $99,678.69 (plus or minus $10) $84,352.32 (plus or minus $10) O $114,320.23 (plus or minus $10) $24,215.27 (plus or minus $10) None of the above is within $10 of the correct answerarrow_forwardU3 Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows. Project Bono Project Edge Project Clayton Capital investment $176,000 $192,500 $212,000 Annual net income: Year 1 15,400 19,800 29,700 15,400 18,700 25,300 15,400 17,600 23,100 4 15,400 13,200 14,300 15,400 9,900 13,200 Total $77,000 $79,200 $105,600 Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.) Click here to view PV table. (a) Compute the cash payback period for each project. (Round answers to 2 decimal places, e.g. 10.50.) years Project Bono years Project Edge years Project Claytonarrow_forwardCitrus Company is considering a project with estimated annual net cash flows of $28,755 for nine years that is estimated to cost $135,000 Citrus's cost of capital is 11 percent. Required: 1. Determine the net present value of the project. (Future Value of $1, Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1.) 2. Based on NPV, determine whether project is acceptable to Citrus. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the net present value of the project. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) Note: Use appropriate factor(s) from the tables provided. Negative amounts should be indicated by a minus sign. Round your final answer to 2 decimal places. Net Present Value Show less Aarrow_forward

- An investment project requires a net investment of $100,000 and is expected to generate annual net cash inflows of $25,000 for 6 years. The firm's cost of capital is 12%. Determine the profitability index for this project.arrow_forwardOpenSeas, Inc. is evaluating the purchase of a new cruise ship. The ship would cost $497 million, and would operate for 20 years. OpenSeas expects annual cash flows from operating the ship to be $71.1 million (at the end of each year) and its cost of capital is 12.5%. a. Prepare an NPV profile of the purchase. b. Estimate the IRR (to the nearest 1%) from the graph. c. Is the purchase attractive based on these estimates? d. How far off could OpenSeas’ cost of capital be (to the nearest 1%) before your purchase decision would change?arrow_forwardRegarding the proposed investments, XYZ INC. gathers the following data: a cash cost of 13,000, net annual cash flows of 45,000, and a present value factor of 5.40 rounded for cash inflows over a ten-year period. Find out all the relevant details that will be important when choosing an investment. Please let me know whether you think our firm should receive an investment based on the following information:arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education