FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

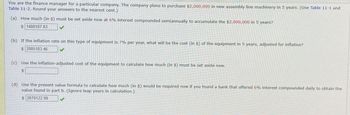

Transcribed Image Text:You are the finance manager for a particular company. The company plans to purchase $2,000,000 in new assembly line machinery in 5 years. (Use Table 11-1 and

Table 11-2. Round your answers to the nearest cent.)

(a) How much (in $) must be set aside now at 6% interest compounded semiannually to accumulate the $2,000,000 in 5 years?

$ 1488187.83

(b) If the inflation rate on this type of equipment is 7% per year, what will be the cost (in $) of the equipment in 5 years, adjusted for inflation?

$ 2805103.46

(c) Use the inflation-adjusted cost of the equipment to calculate how much (in $) must be set aside now.

$

(d) Use the present value formula to calculate how much (in $) would be required now if you found a bank that offered 6% interest compounded daily to obtain the

value found in part b. (Ignore leap years in calculation.)

$ 2078122.99

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cline Corporation deposits $75,000 every quarter in a savings account (beginning at the end of the current quarter) for the next six years so that it can purchase a new piece of machinery at the end of six years. The interest rate is 4%. How much money will Cline Corporation have at the end of six years? (Use spreadsheet software or a financial calculator to calculate your answer. Do not round any intermediary calculations, and round your final answer to the nearest dollar.) Group of answer choices $2,043,240 $2,023,010 $2,931,195 $1,126,935arrow_forwardA young executive is going to purchase a vacation property for investment purposes. She needs to borrow $103,000.00 for 27 years at a 4.1% annual interest rate, with interest compounded monthly, and will make monthly payments of $526.17. (Round all answers to 2 decimal places.) Create an amortization table to answer the following: a) What is the unpaid balance after 11 months? $ 100410.01 b) Over the 11 months in part (a), how much total interest did she pay? Sarrow_forwardPool-N-Patio World needs to borrow $50,000 to increase its inventory for the upcoming summer season. The owner is confident that he will sell most, if not all, of the new inventory during the summer, so he wishes to borrow the money for only four months. His bank has offered him a simple interest amortized loan at 73% interest. (Round your answers to the nearest 4 cent.) (a) Find the size of the monthly bank payment. Interest Portion Total Payment Balance Due (b) Prepare an amortization schedule for all four months of the loan. Principal Portion A A A Payment Number 0 1 2 3 4 A $ A LA +A $ A A A A A $ +A $ +Aarrow_forward

- A company has had record profits and decided to use some of the profits to pay for manufacturing improvements. If the company can invest $1,600,000.00 in an a annuity will that will make payments at the beginning of every six months for 4 years. If the annuity pays 5.6%, compounded semi-annual. What is the size of payments that the company can expect?The payment amount will be $. (Round to 2 decimal places.)arrow_forwardApple has purchased land for $500,000 for their new factory. They make a down payment of $100,000, and the remainder is financed at (15) percent compounded semi-annually with semi-annual payments over 4 years. Develop an Excel® table to illustrate the payment amounts and schedule for the loan, assuming payback follows a) Plan 1: Pay the accumulated interest at the end of each interest period and repay the principal at the end of the loan period. b) Plan 2: Make equal principal payments, plus interest on the unpaid balance at the end of the period. c) Plan 3: Make equal end-of-period payments. d) Plan 4: Make a single payment of principal and interest at the end of the loan period. e) A different plan: Pay off the principal in such a way that it is X, 1.5X, 2X, 2.5X... till the end of the last payment period. In addition, pay the accumulated interest at the end of each interest period.arrow_forwardA company vehicle is being purchased for $55,000 and the business will put $5,000 down.If the company takes out a 5-year loan at 4%, what will the monthly principal and interestpayment be? Create an amortization schedule. All calculated in excel?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education