Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

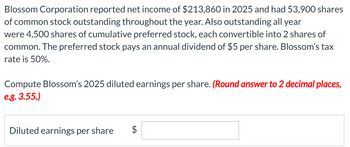

Transcribed Image Text:Blossom Corporation reported net income of $213,860 in 2025 and had 53,900 shares

of common stock outstanding throughout the year. Also outstanding all year

were 4,500 shares of cumulative preferred stock, each convertible into 2 shares of

common. The preferred stock pays an annual dividend of $5 per share. Blossom's tax

rate is 50%.

Compute Blossom's 2025 diluted earnings per share. (Round answer to 2 decimal places,

e.g. 3.55.)

Diluted earnings per share

+A

$

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Given the following year-end information, compute Greenwood Corporations basic and diluted earnings per share. Net income, 15,000 The income tax rate, 30% 4,000 shares of common stock were outstanding the entire year. shares of 10%, 50 par (and issuance price) convertible preferred stock were outstanding the entire year. Dividends of 2,500 were declared on this stock during the year. Each share of preferred stock is convertible into 5 shares of common stock.arrow_forwardOn January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.arrow_forwardLongmont Corporation earned net income of $90,000 this year. The company began the year with 600 shares of common stock and issued 500 more on April 1. They issued $5,000 in preferred dividends for the year. What is the numerator of the EPS calculation for Longmont?arrow_forward

- Errol Corporation earned net income of $200,000 this year. The company began the year with 10,000 shares of common stock and issued 5,000 more on April 1. They issued $7,500 in preferred dividends for the year. What is the numerator of the EPS calculation for Errol?arrow_forwardWindsor Corporation reported net income of $197,880 in 2025 and had 48,200 shares of common stock outstanding throughout the year. Also outstanding all year were 5,000 shares of cumulative preferred stock, each convertible into 2 shares of common. The preferred stock pays an annual dividend of $5 per share. Windsor's tax rate is 40%. Compute Windsor's 2025 diluted earnings per share. (Round answer to 2 decimal places, e.g. 3.55.) Diluted earnings per share $arrow_forwardBonita Corporation earned net income of $443,000 in 2025 and had 110,000 shares of common stock outstanding throughout the year. Also outstanding all year was $700,000 of 5% bonds, which are convertible into 15,000 shares of common. Bonita's tax rate is 30 percent. Compute Bonita's 2025 diluted earnings per share. (Round answer to 2 decimal places, e.g. 3.55.) Diluted earnings per share $arrow_forward

- Sunland Corporation earned net income of $363,460 in 2025 and had 100,000 shares of common stock outstanding throughout the year. Also outstanding all year was $800,000 of 5% bonds, which are convertible into 17,000 shares of common. Sunland's tax rate is 20 percent. Compute Sunland's 2025 diluted earnings per share. (Round answer to 2 decimal places, e.g. 3.55.) Diluted earnings per share $arrow_forwardCulver Corporation reported net income of $282,540 in 2020 and had 45,000 shares of common stock outstanding throughout the year. Also outstanding all year were 5,200 shares of cumulative preferred stock, each convertible into 2 shares of common. The preferred stock pays an annual dividend of $5 per share. Culver's tax rate is 50%. Compute Culver's 2020 diluted earnings per share. (Round answer to 2 decimal places, e.g. 3.55.) Diluted earnings per share $arrow_forwardCulver Corporation reported net income of $282,540 in 2020 and had 45,000 shares of common stock outstanding throughout the year. Also outstanding all year were 5,200 shares of cumulative preferred stock, each convertible into 2 shares of common. The preferred stock pays an annual dividend of $5 per share. Culver’s tax rate is 50%.Compute Culver’s 2020 diluted earnings per share. (Round answer to 2 decimal places, e.g. 3.55.) Diluted earnings per share $arrow_forward

- * Your answer is incorrect. Crane Corporation reported net income of $700,130 in 2023 and had 103,000 common shares outstanding throughout the year. Also outstanding all year were 9,700 cumulative preferred shares, with each being convertible into 3 common shares. The preferred shares pay an annual dividend of $6 per share. Crane's tax rate is 40%. Calculate Crane's 2023 diluted earnings per share. (Round answer to 2 decimal places, e.g. 15.25.) Diluted earnings per share $ 3.43arrow_forwardCrane Corporation had 2020 net income of $1.1 million. During 2020, Crane paid a dividend of $5 per share on 94,000 preferred shares. Crane also had 150,000 common shares outstanding during the year. Calculate Crane's 2020 earnings per share. (Round answer to 2 decimal places, eg. 15.25.) Earnings per share $arrow_forwardAlison Corporation had net income for 2025 of $41,900. Alison Corporation had 18,400 shares of common stock outstanding at the beginning of the year and 19,600 shares of common ck outstanding as of December 31, 2025. During the year, Alison Corporation declared and paid preferred dividends of $2,000. Compute Alison Corporatio earnings per share. (Round earnings per share to the nearest cent, X.XX.) Earnings per sharearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College