FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

You will find the transactions within the spreadsheet. This additional information may be of use, as well.

Additional Info (this mainly relates to adjustments - ie. Thinking)

- Because of the loan, you have to provide the bank with your financial statements at the end of the month - Feb 28, 2021. (we have to make proper FS including adjustments)

- You do a quick count of your inventory and find there are 19 pairs of shoes in inventory.

- On March 2nd, you receive a report from Shopify that states your credit card processing fees for the last month totalled $250. Shopify will remove the amount due from your future sales transactions.

- The March 2nd report also includes notice that your next $400 monthly fee will also simply reduce the amount received from future sales transactions.

- You think that your office furniture etc. will last for about 3 years.

- You do a quick check and find there's still about $370 worth of office and packing supplies left.

- In your wallet you find receipts dating Feb 13 - Feb 28 from Canada Post. They are all for shipping the shoes to customers throughout the month. You must not have had business cheques because the total of the receipts, $1089, was all charged to your personal MasterCard.

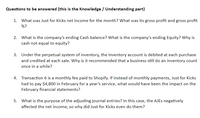

Transcribed Image Text:Questions to be answered (this is the Knowledge / Understanding part)

1. What was Just for Kicks net income for the month? What was its gross profit and gross profit

%?

2. What is the company's ending Cash balance? What is the company's ending Equity? Why is

cash not equal to equity?

3. Under the perpetual system of inventory, the Inventory account is debited at each purchase

and credited at each sale. Why is it recommended that a business still do an inventory count

once in a while?

4. Transaction 6 is a monthly fee paid to Shopify. If instead of monthly payments, Just for Kicks

had to pay $4,800 in February for a year's service, what would have been the impact on the

February financial statements?

5. What is the purpose of the adjusting journal entries? In this case, the AJES negatively

affected the net income, so why did Just for Kicks even do them?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me journalize the following transactions together with the adjustments. Thank you!arrow_forwardAt the end of the month of January, you reconciled your credit card account. All of the transactions reconciled, and you were able to get your reconciliation to balance to $0. You want to go ahead and pay the bill to the credit card company, but the bill does not appear in the list of possible bills you can pay when you select "Pay Bills" from the Create icon. The credit card bill was $850.00. Below is the liability section of your balance sheet. Since you have already reconciled the account, how can you pay the bill?arrow_forwardIn Quickbooks Online 2023, which window would these transactions be recorded in? For example: the receive payment window, sales receipt window, deposit window, invoice window, etc. April 1 Received a six-month insurance policy renewal from General Insurance Co. for $1,200, paid immediately, Check No. 72. April 3 Purchased $500 of office supplies on account from the Office Supply Store, Invoice No. 285, Net 30 Days. Jen expects office supplies to last 3 months April 6 Purchased 25 cans of tennis balls from Sporting Goods, Inc., at $2 per can, paid immediately, Check No. 73. April 6 Provided 2 hours of tennis lessons (owner) at $25 each and 2 hours of tennis court services at $30 each on account to the Davis Family, Invoice No. 1150, Net 30 Days. April 9 Received payment in full from Bayside Youth Group, Check No. 11725. Use the Undeposited Funds account in recording all Receive Payments transactions April 9 Sold 4 tennis rackets for $100 each and 4…arrow_forward

- Show how the following transactions for March 2024 will reflect in the ledger accounts of Mike Traders. i. Purchased trading inventory on cash for R120 000. ii. Bought stationary on credit R7 500. iii. Bought a computer for R19 200 cash.arrow_forwardNeed help with accounting homework question ASAP!arrow_forwardSunshine Sushi, a Japanese restaurant, has the following adjusted trial balance with accounts listed in alphabetical order. For the bank loan, $64,750 is due in 2024. For Notes receivable, $43,750 will be collected in 2024. Account title Accounts payable Accumulated depreciation, equipment Accumulated depreciation, furniture Bank loan Cash Equipment Operating expenses Furniture Merchandise Inventory Natsuki Miyakawa, capital Natsuki Miyakawa, withdrawal Notes receivable Revenue Wages payable Total Debit $108,000 401,625 50,050 195,000 43,250 9,300 97,300 Credit $ 61,550 107,100 73,125 529,000 37,500 74,250 22,000 $904,525 $904,525 Using the template provided, prepare a classified balance sheet for the year-ended December 31, 2023.arrow_forward

- A credit card account had a $299 balance on March 5. A purchase of $184 was made on March 12, and a payment of $10 O was made on March 28. Find the average daily balance if the billing date is April 5. (Round your answer to the nearest cent.)arrow_forwardJounalize all entries required for First Place Running Shoes. ( Record debits first, then credits. Select the Explanation on the last line of the journal entry table.) May 3, 2018: Recorded credit sales of 100,000. Ignore Cost of Goods Sold. Oct 1, 2018: Loaned $18,000 to Tess Philip, an executive with the company, on a one-year 7% note. Dec 31, 2018: Accrued interest revenue on the Phillip note. Oct 1, 2019: Collected the maturity value of the Phillip note. (Prepare a single compound journal entry.)arrow_forwardYour company paid rent of $1,000 for the month with check number 1245. Which journal would the company use to record this?arrow_forward

- Please read the questions carefully the First question is asking for journal entry.arrow_forwardplease answer all of the question thanks !arrow_forwardIn this activity, you are going to record a comprehensive transactions involving merchandising concern. Prepare the journal entries, T-accounts and trial balance of a merchandising concern. Cielo Bonita is engaged in buying and selling of novelty items. The following transactions have transpired for the month of Sept. 2020. Sept. 1 – She invested P100,500 cash and an old office equipment presently valued at P33,200 which she bought 2 years ago for P50,000. Sept. 2- Purchased MDSE from ABC Enterprise for P20,000. Terms: n/30, FOB destination. ABC paid P1,500 for the freight cost. Sept. 3- Sold MDSE for cash amounted to P10,600. Sept. 6- Purchased MDSE from Ali Commercial for P26,500. Terms: 50% down payment, balance 2/10, n/30. Sept. 7 – Sold MDSE to Jay Cesar for P12,500. Terms: 2/10, n/30, FOB Shipping point. Sept. 8 – Purchased from COVID Furniture a display counted for P6,000. Terms : 50% down payment, balance 1/10, n/30.92 Sept. 9 – Sold MDSE to Giles Anthony for P14,000. Terms:…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education