FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

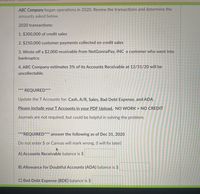

Transcribed Image Text:ABC Company began operations in 2020. Review the transactions and determine the

amounts asked below.

2020 transactions:

1. $300,000 of credit sales

2. $250,000 customer payments collected on credit sales

3. Wrote off a $2,000 receivable from NotGonnaPay, INC a customer who went into

bankruptcy.

4. ABC Company estimates 3% of its Accounts Receivable at 12/31/20 will be

uncollectable.

***

REQUIRED**

Update the TAccounts for: Cash, A/R, Sales, Bad Debt Expense, and ADA.

Please include your T Accounts in your PDF Upload. NO WORK = NO CREDIT

Journals are not required, but could be helpful in solving the problem.

***REQUIRED*** answer the following as of Dec 31, 2020

Do not enter $ or Canvas will mark wrong. (I will fix later)

A) Accounts Receivable balance is $

B) Allowance for Doubtful ACcounts (ADA) balance is $

C) Bad Debt Expense (BDE) balance is $

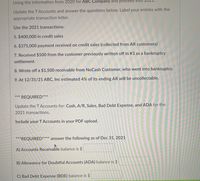

Transcribed Image Text:Using the information from 2020 for ABC Company and procee

Update the TAccounts and answer the questions below. Label your entries with the

appropriate transaction letter.

Use the 2021 transactions:

5. $400,000 in credit sales

6. $375,000 payment received on credit sales (collected from AR customers)

7. Received $500 from the customer previously written off in #3 as a bankruptcy

settlement.

8. Wrote off a $1,500 receivable from NoCash Customer, who went into bankruptcy.

9. At 12/31/21 ABC, Inc estimated 4% of its ending AR will be uncollectable.

*** REQUIRED***

Update the TAccounts for: Cash, A/R, Sales, Bad Debt Expense, and ADA for the

2021 transactions.

Include your TAccounts in your PDF upload.

***REQUIRED**** answer the following as of Dec 31, 2021

A) Accounts Receivable balance is $

B) Allowance for Doubtful Accounts (ADA) balance is $

C) Bad Debt Expense (BDE) balance is $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- SCENARIO #2 12/31/2019: At the end of the first year of operations, Yolandi Company had $900,000 in sales and accounts receivable of $350,000. Yolandi's management has estimated that $9,000 in accounts receivable would be uncollectible (use the aging method). For the end of 2019, after the adjusting entry for bad debts was journalized, what is the balance in the following accounts: Bad debt expense Allowance for doubtful accounts For the end of 2019, what is the company's net realizable value? 12/31/2020: During 2020, S10,000 in accounts receivable were written off. At the end of the second year of operations, Yolandi Company had $1,000,000 in sales and accounts receivable of $400,000. Yolandi's management has estimated that S17,000 in accounts receivable would be uncollectible (use the aging method). Bad debt expense Allowance for doubtful accounts For the end of 2020, what is the company's net realizable value?arrow_forwardNonearrow_forwardFinancial Statements and Closing Entries You can download the following information. Williams Inc. has the following information for calendar year 2020: 2020 Prepaid Insurance 400 Bank Service Charge Expense 30 Allowance for Doubtful Accounts 80 Cost of Goods Sold 5,900 Inventory 550 Rent Expense 20 Common Stock 14,000 Depreciation Expense 800 Sales Revenue 14,925 Income Tax Expense 2,400 Cash 3,700 Bad Debt Expense 75 Accounts Receivable 1,300 Interest Revenue 5 Accumulated Depreciation 3,750 Retained Earnings 15,550 Salaries Expense 1,200 Dividends 50 Building 32,375 Accounts Payable 490 Prepare, in good form, the classified Balance Sheet ONLY through the Current Asset section for Williams Inc. for 2020.arrow_forward

- Notes Payable A business issued a 90-day, 8% note for $52,000 to a creditor for an accounts payable. Illustrate the effects on the accounts and financial statements of recording (a) the issuance of the note and (b) the payment of the note at maturity, including interest. If no account or activity is affected, select "No effect" from the dropdown list and leave the corresponding number entry box blank. Enter account decreases and cash outflows as negative amounts. a. Illustrate the effects on the accounts and financial statements of recording the issuance of the note. Balance Sheet Liabilities Assets Stockholders' Equity Statement of Cash Flows Income Statement b. Illustrate the effects on the accounts and financial statements of recording the payment of the note at maturity, including interest. Assume a 360-day year. If required, round interest expense to the nearest whole number. Balance Sheet Liabilities Assets Stockholders' Equity 4 Statement of Cash Flows Income Statementarrow_forwardPlease do not give solution in image format thankuarrow_forward(8 Problems 1) On January 1, 2021, Cali Consulting has a $110,000 balance in accounts receivable and a $0 balance in the Allowance for Uncollectible Accounts. During 2021, Cali provides $205,000 of service on account. The company collected $190,000 cash from Accounts Receivable. Uncollectible accounts are estimated to be 3% of sales on account. a. What is the amount of uncollectible accounts expense recognized in 2021? b. What is the amount of cash flows from Operating activities that would appear on the 2021 Cash Flow statement? Show the impact (with amounts) of each of the following items on the horizontal C. Oquation. For the asset section, name the specific accounts impacted. i. Record Sales during the year on account of $205,000. ii. Show the impact of $190,000 cash collected during the year. ii. Establish an Allowance for Uncollectible Accounts at year-end. 3. Study guide - Chapter 5 (with solutions).docx O A 69°F P. f5 f12 6J prt sc I14 &arrow_forward

- Current Attempt in Progress * Your answer is incorrect. Crane Inc. has evaluated its process of calculating estimates of uncollectible accounts receivable. In the past, Crane calculated the Bad Debt Expense as a percentage of sales. It recorded Bad Debt Expense at 1% of sales. Due to changes in the economic conditions, Crane will increase that percentage to 3%. The change is made on January 1, 2025. Salles in 2023 were $1630000 and $3130000 in 2024. Sales in 2025 total $4130000. What is the Bad Debt Expense that Crane will record for 2025? $159100 Ⓒ $217800 O $41300 O $123900 e Textbook and Media Save for Later Attempts: 1 of 2 used Submit Answerarrow_forwardDo not use chatgptarrow_forwardDon't give answer in image formatarrow_forward

- Please help mearrow_forwardQuestion 8 Dreadful Behaviour Ltd has credit sales of $400,000 in 2022 and a debit balance of $1,900 in the Allowance for Doubtful Accounts at year end. As of December 31, 2022, $120,000 of accounts receivable remain uncollected. The credit manager of Dangle prepared an aging schedule of accounts abnor receivable and estimates that $4,800 will prove to be uncollectible. On March 3, 2023 the credit manager authorizes a write-off of the $1,000 balance owed by D. Taylor. On April 1, 2023 Mr. Taylor pays his account in full and also pays Dangle $75 interest on his account Required (a) Prepare the adjusting entry to record the estimated uncollectible accounts expense in 2022. (b) Show the statement of financial position presentation of accounts receivable on December 31, 2022. (c) On March 3, 2023 before the write-off, assume the balance of Accounts Receivable account is $160,000 and the balance of Allowance for Doubtful Accounts is a credit of $3,000. Make the appropriate entry to record…arrow_forwardPlease help me. Thankyou.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education