EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Answer

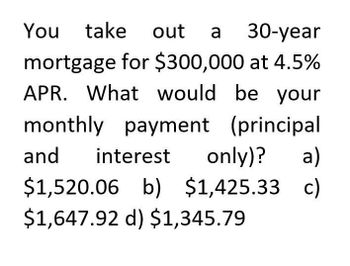

Transcribed Image Text:You take out a 30-year

mortgage for $300,000 at 4.5%

APR. What would be your

monthly payment (principal

and interest only)? a)

$1,520.06

b) $1,425.33 c)

$1,647.92 d) $1,345.79

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Calculating interest and APR of installment loan. Assuming that interest is the only finance charge, how much interest would be paid on a 5,000 installment loan to be repaid in 36 monthly installments of 166.10? What is the APR on this loan?arrow_forwardIf Bergen Air Systems takes out a $100,000 loan, with eight equal principal payments due over the next eight years, how much will be accounted for as a current portion of a noncurrent note payable each year?arrow_forwardSuppose you have $2,300 and plan to purchase a 10-year certificate of deposit (CD) that pays 10.4% interest, compounded annually. How much will you have when the CD matures? a. $2,539.20 O b. $6,896.80 O c. $6,186.12 O d. $6,339.32 e. $5,603.37 Oarrow_forward

- If you borrow $5,300 at $400 interest for one year, what is your annual interest cost for the following payment plan? (Round the final answers to 2 decimal places.) a. Annual payment b. Semiannual payments c. Quarterly payments d. Monthly payments Effective rate % op % %arrow_forwardIf you borrow $5,300 at $900 interest for one year, what is your annual interest cost for the following payment plan? (Round the final answers to 2 decimal places.) Effective rate a. Annual payment % b. Semiannual payments % c. Quarterly payments % d. Monthly payments %arrow_forwardIf you borrow $7,500 at $550 interest for one year, what is your effective interest rate for the following payment plans? (Input your answers as a percent rounded to 2 decimal places.) a. Annual payment b. Semiannual payments c. Quarterly payments d. Monthly payments Effective Rate of Interest % % %arrow_forward

- If you borrow $7,300 at $800 interest for one year, what is your effective interest rate for the following payment plans? Note: Input your answers as a percent rounded to 2 decimal places. a. Annual payment b. Semiannual payments c. Quarterly payments d. Monthly payments Effective Rate of Interest % % % %arrow_forward$5476.6 monthly If you can afford to pay the monthly payment from the above calculation, how much can you borrow? Assume that the term is 20 years and the interest rate is 6.25%.arrow_forwardYour bank offers to lend you $120,000 at an 6.5% annual interest rate to start your new business. The terms require you to amortize the loan with 10 equal end-of- year payments. How much interest would you be paying in Year 2? $16,692.56 O $19,068.53 O $10,428.81 O $18,161.67 O $17,254.82arrow_forward

- If you borrow $1700 and agree to repay the loan in sux equal annual payments at an interest rate of 11%, what will your payment be? what will your oayment be if you make the first payment on the loan immediately instead of at the end of the first year?arrow_forwardYou take out a 10-year installment loan for $220,000 and will make 40 quarterly payments of $9.672.19. Given this information, determine the ratio of the interest that you will pay over the first 4 years (Payments 1-16) to the interest that you will pay over the last 6 years (Payments 17-40). O 1.399 O 1.417 O 1.364 O 1.381 1.436arrow_forwardIf you borrow $4,600 at $850 interest for one year, what is your effective interest rate for the following payment plans? (Input your answers as a percent rounded to 2 decimal places.) X Answer is complete but not entirely correct. a. b. Annual payment Semiannual payments C. Quarterly payments d. Monthly payments Effective Rate of Interest 18.48 % 19.33 X % 19.80 X % 20.13 X %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College