Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Please correct answer and don't use hand rating

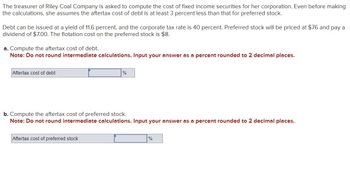

Transcribed Image Text:The treasurer of Riley Coal Company is asked to compute the cost of fixed income securities for her corporation. Even before making

the calculations, she assumes the aftertax cost of debt is at least 3 percent less than that for preferred stock.

Debt can be issued at a yield of 11.6 percent, and the corporate tax rate is 40 percent. Preferred stock will be priced at $76 and pay a

dividend of $7.00. The flotation cost on the preferred stock is $8.

a. Compute the aftertax cost of debt.

Note: Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.

Aftertax cost of debt

%

b. Compute the aftertax cost of preferred stock.

Note: Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.

Aftertax cost of preferred stock

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The treasurer of Riley Coal Co. is asked to compute the cost of fixed income securities for her corporation. Even before making the calculations, she assumes the aftertax cost of debt is at least 3 percent less than that for preferred stock. Debt can be issued at a yield of 11.0 percent, and the corporate tax rate is 20 percent. Preferred stock will be priced at $60 and pay a dividend of $6.40. The flotation cost on the preferred stock is $6. a. Compute the aftertax cost of debt. (Do not round intermediate calculations. Input the answer as a percent rounded to 2 decimal places.) Compute the aftertax cost of preferred stock. (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Based on the facts given above, is the treasurer correct?arrow_forwardThe treasurer of Sutton Security Systems is asked to compute the cost of fixed income securities for her corporation. Even before making the calculations, she assumes the aftertax cost of debt is at least 1 percent less than that for preferred stock. Debt can be issued at a yield of 7.5 percent, and the corporate tax rate is 40 percent. Preferred shares will be priced at $68 and pay a dividend of $3.50. The flotation cost on the preferred stock is $5. (Do not round intermediate calculations. Round the final answers to 2 decimal places.) a. Compute the aftertax cost of debt. Aftertax cost of debt % b. Compute the aftertax cost of preferred stock. Aftertax cost of preferred stock % c. Based on the facts given above, is she correct? multiple choice Yes Noarrow_forwardPlease help me. Thankyou.arrow_forward

- The total market value of the common stock of the Okefenokee Real Estate Company is $11.5 million, and the total value of its debt is $7.3 million. The treasurer estimates that the beta of the stock is currently 1.2 and that the expected risk premium on the market is 9%. The Treasury bill rate is 3%. Assume for simplicity that Okefenokee debt is risk-free and the company does not pay tax. a. What is the required return on Okefenokee stock? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. b. Estimate the company cost of capital. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. c. What is the discount rate for an expansion of the company's present business? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. d. Suppose the company wants to diversify into the manufacture of rose-colored spectacles. The beta of unleveraged…arrow_forwardThe total market value of the common stock of the Okefenokee Real Estate Company is $11.5 million, and the total value of its debt is $7.5 million. The treasurer estimates that the beta of the stock is currently 1.8 and that the expected risk premium on the market is 7%. The Treasury bill rate is 3%. Assume for simplicity that Okefenokee debt is risk-free and the company does not pay tax. Suppose the company wants to diversify into the manufacture of rose-colored spectacles. The beta of unleveraged optical manufacturers is 1.05. Estimate the required return on Okefenokee's new venture. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all working!arrow_forward

- Kolby Corp. is comparing two different capital structures. Plan I would result in 900 shares of stock and $65,700 in debt. Plan II would result in 1,900 shares of stock and $29,200 in debt. The interest rate on the debt is 10 percent. Assume that EBIT will be $8,500. An all-equity plan would result in 2,700 shares of stock outstanding. Ignore taxes. What is the price per share of equity under Plan I? Plan II?arrow_forwardGiven that Local Care, Inc.'s stock is currently selling for $65 a share, calculate the amount of money that Elijah Pearson will make (or lose) on each of the following transactions. Assume that all transactions involve 100 shares of stock, and ignore brokerage commissions. Input all answers as positive values. He short-sells the stock and then repurchases the borrowed shares at $85.Total of $ . He buys the stock and then sells it some time later at $85.Total of $ . He short-sells the stock and then repurchases the borrowed shares at $50.Total of $ .arrow_forwardNikularrow_forward

- Dickson Corporation is comparing two different capital structures. Plan I would result in 36,000 shares of stock and $103,500 in debt. Plan II would result in 30,000 shares of stock and $310,500 in debt. The interest rate on the debt is 4 percent. Assume that EBIT will be $145,000. An all-equity plan would result in 39,000 shares of stock outstanding. Ignore taxes. What is the price per share of equity under Plan I? Plan II? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Plan I Plan IIarrow_forwardSee Attachedarrow_forwardWhat's the answer?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education