Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Solve

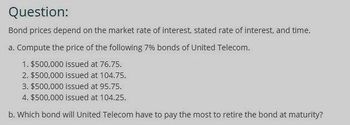

Transcribed Image Text:Question:

Bond prices depend on the market rate of interest, stated rate of interest, and time.

a. Compute the price of the following 7% bonds of United Telecom.

1. $500,000 issued at 76.75.

2. $500,000 issued at 104.75.

3. $500,000 issued at 95.75.

4. $500,000 issued at 104.25.

b. Which bond will United Telecom have to pay the most to retire the bond at maturity?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the total cost of borrowing over the life of the bond? (Round answer to 0 decimal places, e.g. - Total cost of borrowing over the life of the bond $ Save for Later Attempts lipiarrow_forwardBond prices depend on the market rate of interest, stated rate of interest, and time. Read the requirements. Requirement 1. Compute the price of the following 5% bonds of Country Telecom. a. The price of the $500,000 bond issued at 75.75 is Requirements 1. 2. Compute the price of the following 5% bonds of Country Telecom. a. $500,000 issued at 75.75 b. $500,000 issued at 103.50 c. $500,000 issued at 95.75 d. $500,000 issued at 102.50 Which bond will Country Telecom have to pay the most to retire at maturity? Explain your answer. Print Done - Xarrow_forward4. What is the carrying value of the bonds at the end of the second period (third number)? Premium 57,913.01 Carrying value (bonds) 432,913.01 Face Rate Market Rate Semiannual payments a. b. Cash Payment C. d. e. 14% 10% 0 or 1 2 or 3 4 or 5 6 or 7 8 or 9 Interest Expense Today Period #1 26,250.00 Period #2 26,250.00 Carrying value at end of second period (third number) ___________?__ 2. Disc. or Prem. Amort. 21,645.65 21,415.43 Disc. or Prem. 4,604.35 4,834.57 57,913.01 53,308.66 48,474.10 Face Value 375,000.00 375,000.00 375,000.00 Carrying Value 432,913.01 428,308.66 423,474.10arrow_forward

- P.nil Calculate the accrued interest (in $) and the total purchase price (in $) of the bond purchase. (Round your answers to the nearest cent.) Company Coupon Rate Market Price Time Since Last Interest Accrued Interest Commission per bond Bonds Pur. Total Price Company 2 9.7 79.75 23 days ? $9.95 15 ?arrow_forwardProvide correct answer general Accountingarrow_forwardCalculate the value of each bond and discuss whether it sells at par, discount, or premium. (Annual interest rate) O A. Bond Bond Value A B C O B. Bond A B C O C. Bond A B с O D. Bond A B C $1,149.39 Discount $1,000.00 Par $85.60 Premium Bond Value Sells at par/discount/premium Bond Value $1,149.39 Premium $1,000.00 Par $85.60 Discount Sells at par/discount/premium Bond Value Sells at par/discount/premium $1,149.39 Premium $1,000.00 Par $85.60 Premium Sells at par/discount/premium $1,049.39 Premium $1,100.00 Premium $85.60 Discount Bond Par value Coupon interest Years to rate maturity JA B IC $1000 14% $1000 18% $100 10% 120 16 18 Required return 12% 8% 13%arrow_forward

- a. Reset the Data Section to its initial values. The price of this bond is 1,407,831. What would it be if there were only 9 or 8 years to maturity? Use the worksheet to compute the bond issue prices and enter them in the spaces provided. Bond issue price (9 years to maturity) __________________ Bond issue price (8 years to maturity) __________________ b. Compare these prices to the bond-carrying values found in the effective interest amortization schedule you originally printed out in requirement 3. Explain the similarity. c. Click the Chart sheet tab. The chart presented shows the price behavior of this bond based on years to maturity. Explain what effect years to maturity has on bond prices. Check your explanation by trying 8% as the effective rate (cell E10) and clicking the Chart sheet tab again. Also try 9%. When the assignment is complete, close the file without saving it again. Worksheet. Modify the BONDS3 worksheet to accommodate bonds with up to 20-year maturity. Use your new model to determine the issue price and amortization schedules of a 2,000,000, 18-year, 10% bond issued to yield 9%. Preview the printout to make sure that the worksheet will print neatly, and then print the worksheet. Save the completed file as BONDST. Hint: Expand both amortization schedules to 20 years. Expand the scratch pad to 20 years. Modify FORMULA1 in cell F17 to include the new ranges. Chart. Using the BONDS3 file, prepare a line chart that plots annual interest expense over the 10-year life of this bond under both the straight-line and effective interest methods. No Chart Data Table is needed. Put A23 to A32 in the Label format and then select A23 to A32, D23 to D32, and B40 to B49 as a collection. Enter all appropriate titles, legends, formats, and so forth. Enter your name somewhere on the chart. Save the file again as BONDS3. Print the chart.arrow_forwardWhich of these two bonds offers the highest current yield? Which one has the highest yield to maturity? a. A 6.55 percent, 22-year bond quoted at 52.000 b. A 10.25 percent, 27-year bond quoted at 103.625arrow_forwardCalculate the accrued interest (in $) and the total purchase price (in $) of the bond purchase. (Round your answers to the nearest cent.) Market Price Time Since Last Accrued Interest Commission Coupon Rate Bonds Purchased Total Price Company per Bond Interest Company 2 9.8 79.75 23 days $ 6.26 $9.35 15 $ 1149.9arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning