Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

not use ai please

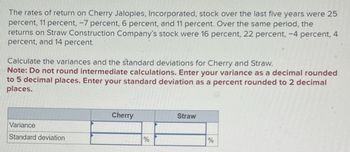

Transcribed Image Text:The rates of return on Cherry Jalopies, Incorporated, stock over the last five years were 25

percent, 11 percent, -7 percent, 6 percent, and 11 percent. Over the same period, the

returns on Straw Construction Company's stock were 16 percent, 22 percent, -4 percent, 4

percent, and 14 percent.

Calculate the variances and the standard deviations for Cherry and Straw.

Note: Do not round intermediate calculations. Enter your variance as a decimal rounded

to 5 decimal places. Enter your standard deviation as a percent rounded to 2 decimal

places.

Variance

Standard deviation

Cherry

%

Straw

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- The rates of return on Cherry Jalopies, Incorporated, stock over the last five years were 18 percent, 11 percent, -2 percent, 7 percent, and 10 percent. Over the same period, the returns on Straw Construction Company's stock were 16 percent, 21 percent, -2 percent, 4 percent, and 13 percent. Calculate the variances and the standard deviations for Cherry and Straw. Note: Do not round intermediate calculations. Enter your variance as a decimal rounded to 5 decimal places. Enter your standard deviation as a percent rounded to 2 decimal places.arrow_forwardThe rates of return on Cherry Jalopies, Inc., stock over the last five years were 17 percent, 11 percent, -1 percent, 7 percent, and 10 percent. Over the same period, the returns on Straw Construction Company's stock were 16 percent, 22 percent, –1 percent, 5 percent, and 12 percent. Calculate the variances and the standard deviations for Cherry and Straw. (Do not round intermediate calculations. Enter your variance as a decimal rounded to 5 decimal places. Enter your standard deviation as a percent rounded to 2 decimal places.) Cherry Straw Variance Standard deviation % %arrow_forwardThe rates of return on Cherry Jalopies, Inc., stock over the last five years were 17 percent, 11 percent, −1 percent, 7 percent, and 10 percent. Over the same period, the returns on Straw Construction Company’s stock were 16 percent, 22 percent, −1 percent, 5 percent, and 12 percent. Calculate the variances and the standard deviations for Cherry and Straw. (Do not round intermediate calculations. Enter your variance as a decimal rounded to 5 decimal places. Enter your standard deviation as a percent rounded to 2 decimal places.)arrow_forward

- The rates of return on Cherry Jalopies, Inc., stock over the last five years were 23 percent, 11 percent, -5 percent, 7 percent, and 10 percent. Over the same period, the returns on Straw Construction Company's stock were 16 percent, 24 percent, -6 percent, 2 percent, and 16 percent. Calculate the variances and the standard deviations for Cherry and Straw. (Do not round intermediate calculations. Enter your variance as a decimal rounded to 5 decimal places. Enter your standard deviation as a percent rounded to 2 decimal places.) X Answer is complete but not entirely correct. Cherry 83.72000 X Straw 117.80000 X Variance Standard deviation 9.15 % 10.85 %arrow_forwardYou've observed the following returns on SkyNet Data Corporation's stock over the past five years: 15 percent, -6 percent, 18 percent, 14 percent, and 10 percent. a. What was the arithmetic average return on the company's stock over this five-year period? (Do not round intermediate calculations and enter your answer as a percent rounded to 1 decimal place, e.g., 32.1.) b-1. What was the variance of the company's returns over this period? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., .16161.) b-2. What was the standard deviation of the company's returns over this period? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Average return b-1. Variance b-2. Standard deviation 10.2 % 72.16000 8.49 %arrow_forwardYou’ve observed the following returns on SkyNet Data Corporation’s stock over the past five years: 11 percent, –10 percent, 19 percent, 18 percent, and 10 percent. a. What was the arithmetic average return on the company's stock over this five-year period? (Do not round intermediate calculations and enter your answer as a percent rounded to 1 decimal place, e.g., 32.1.) b-1. What was the variance of the company's returns over this period? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., .16161.) b-2. What was the standard deviation of the company’s returns over this period? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

- 4arrow_forwardYou’ve observed the following returns on Yasmin Corporation’s stock over the past five years: 15 percent, –6 percent, 18 percent, 14 percent, and 10 percent. a. What was the arithmetic average return on the company's stock over this five-year period? (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place, e.g., 32.1.) Average return % b-1 What was the variance of the company's stock returns over this period? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., 32.16161.) Variance b-2 What was the standard deviation of the company's stock returns over this period? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Standard deviation %arrow_forwardYou've observed the following returns on Pine Computer's stock over the past five years: 15 percent, -15 percent, 17 percent, 27 percent, and 10 percent. a. What was the arithmetic average return on the company's stock over this five-year period? (Do not round intermediate calculations and enter your answer as a percent rounded to 1 decimal place, e.g., 32.1.) b-1. What was the variance of the company's returns over this period? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., .16161.) b-2. What was the standard deviation of the company's returns over this period? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

- The last four years of returns for a stock are as shown here: E a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? Note: Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal format. ..... Data table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Year 1 2 3 4 Return - 4.3% + 27.9% + 12.3% + 3.6%arrow_forwardYou've observed the following returns on Pine Computer's stock over the past five years: 10 percent, -10 percent, 17 percent, 22 percent, and 10 percent. a. What was the arithmetic average return on the company's stock over this five-year period? (Do not round intermediate calculations and enter your answer as a percent rounded to 1 decimal place, e.g., 32.1.) b-1. What was the variance of the company's returns over this period? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., 16161.) b-2. What was the standard deviation of the company's returns over this period? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Average return b-1. Variance b-2. Standard deviation % %arrow_forwardThe last four years of returns for a stock are as shown here: a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? Note: Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal format. Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Year 4 Return +3.51% 1 - 4.17% 2 +27.82% 3 + 11.88% Xarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education