EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

not use ai please don't

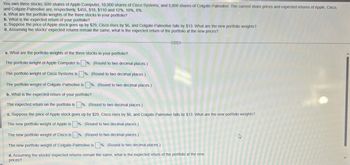

Transcribed Image Text:You own three stocks: 600 shares of Apple Computer, 10,000 shares of Cisco Systems, and 5,000 shares of Colgate-Palmolive. The current share prices and expected returns of Apple, Cisco,

and Colgate-Palmolive are, respectively, $455, $18, $110 and 12%, 10%, 8%.

a. What are the portfolio weights of the three stocks in your portfolio?

b. What is the expected return of your portfolio?

c. Suppose the price of Apple stock goes up by $29, Cisco rises by $6, and Colgate-Palmolive falls by $13. What are the new portfolio weights?

d. Assuming the stocks' expected returns remain the same, what is the expected return of the portfolio at the new prices?

a. What are the portfolio weights of the three stocks in your portfolio?

The portfolio weight of Apple Computer is

%. (Round to two decimal places.)

The portfolio weight of Cisco Systems is %. (Round to two decimal places.)

The portfolio weight of Colgate-Palmolive is %. (Round to two decimal places.)

b. What is the expected return of your portfolio?

The expected return on the portfolio is %. (Round to two decimal places.)

c. Suppose the price of Apple stock goes up by $29, Cisco rises by $6, and Colgate-Palmolive falls by $13. What are the new portfolio weights?

The new portfolio weight of Apple is %. (Round to two decimal places.)

The new portfolio weight of Cisco is %. (Round to two decimal places.)

The new portfolio weight of Colgate-Palmolive is %. (Round to two decimal places.)

d. Assuming the stocks' expected returns remain the same, what is the expected return of the portfolio at the new

prices?

R

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You are a financial investor who actively buys and sells in the securities market. Now you have a portfolio, including four shares: $7,500 of Share A, $4,800 of Share B, $5,700 of Share C, and $2,500 of Share D. Required: Compute the weights of the assets in your portfolio? If your portfolio has provided you with returns of 7.7%, 10.5%, - 8.7% and 14.2% over the past four years, respectively. Calculate the geometric average return of the portfolio for this period? Assume that expected return of the stock A in your portfolio is 13.2%. The risk premium on the stocks of the same industry are 6.8%, beta of this stock is 1.3. Calculate the risk-free rate of return using Capital market pricing model (CAPM). ? You have another portfolio that comprises of two shares only: $500 Tesla shares and $700 Eagle shares. Below is the data of your portfolio: Tesla Eagle Expected return 13% 20% Standard Deviation of return 20% 45% Correlation of coefficient (p) 0.4…arrow_forwardSuppose you have four stocks in your portfolio and the beta of your portfolio is 1.06. You have $3,000 invested in Stock A, $5,000 invested in Stock B, $4,000 invested in Stock C, and $4,000 invested in Stock D. The beta of Stock A is 1.10, the beta of Stock B is 1.97, and the beta of Stock C is 1.98. What is the beta of Stock D?arrow_forwardYou own a portfolio that has $2,800 invested in Stock A and $3,900 invested in Stock B. Assume the expected returns on these stocks are 9 percent and 15 percent, respectively. What is the expected return on the portfolio? (arrow_forward

- 2B) You have $600,000 to invest in the stock market. Suppose you invested one-third of your wealth in stock Q and the rest in stock L. These stocks have the following characteristics: Stock Q has an expected return of 10% and a standard deviation of 7%. Stock L has an expected return of 18% and a standard deviation of 11%. Determine the expected return and standard deviation on a portfolio of stocks Q and L, when the two stocks are uncorrelated and when they are negatively perfectly correlated. Interpret and compare your answers in these two cases.arrow_forwardYou own a portfolio that has $18,000 invested in Stock A and $17,000 invested in Stock B. The expected returns on these stocks are 15.9 percent and 7.1 percent, respectively. What is the expected return on the portfolio? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardStocks A and B have expected returns of 0.119 and 0.133, respectively. You form a portfolio consisting of $5,000 in Stock A and $6,000 in Stock B. What is your portfolio's expected return? Enter your answer as a decimal and show 4 decimal places. Type your answer... Previousarrow_forward

- You own a portfolio that has $7,806 invested in Stock A and $9,747 invested in Stock B. If the expected returns on these stocks are -0.13 and 0.23, respectively, what is the expected return on the portfolio? Enter the answer with 4 decimals (e.g. 0.1234).arrow_forwardYou are investing in a stock that is expected to pay a dividend per share of $3.5 in year 1, $3.7 in year 2, $3.9 in year 3, and $4.0 in year 4. The required rate of return on the stock is 9.5%. Analysts expect earnings per share (EPS) of $13 and a P/E ratio of 36 at the end of year 4. What is the intrinsic value of the stock?arrow_forwardYou own a portfolio that has $2,528 invested in Stock A and $4,124 invested in Stock B. If the expected returns on these stocks are 7 percent and 16 percent, respectively, what is the expected return (in percent) on the portfolio? Answer to two decimals.arrow_forward

- you have invested in two shares, Tinkle.com and Circumbendibus Wheels. Tinkle.com has volatility 38.20%, while Circumbendibus Wheels has volatility 35.90%. The correlation between the two shares' returns is 0.44. You have allocated 50.00% of your money to Tinkle.com. What is the volatility of your portfolio?arrow_forwardYou own a portfolio that has $1,600 invested in Stock A and $2,700 invested in Stock B. Assume the expected returns on these stocks are 11 percent and 17 percent, respectively. What is the expected return on the portfolio? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardPlease answer the question in the image below.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning