Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

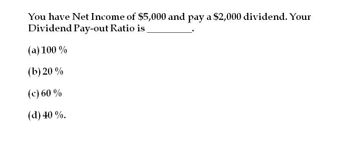

What is the dividend pay out ratio on these financial accounting question?

Transcribed Image Text:You have Net Income of $5,000 and pay a $2,000 dividend. Your

Dividend Pay-out Ratio is

(a) 100%

(b) 20 %

(c) 60 %

(d) 40%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose a firm pays total dividends of $456,000 out of net income of $1.9 million. What would the firm’s payout ratio be? (Round your answer to 2 decimal places.)arrow_forwardAssume you own shares in Walmart and that the company currently earns $6.80 per share and pays annual dividend payments that total $5.55 a share each year. Calculate the dividend payout for Walmart. Note: Enter your answer as a percent rounded to 2 decimal places. Dividend payout %arrow_forwardThis is 1 question that has 2 sub-parts. Please answer both questions. NB!!! Round off both answers to 2 decimal places. ROE= Return on Equityarrow_forward

- Where did you find the dividend declared of $200,000?arrow_forwardHelparrow_forwardCalculate the basic earnings power. (Round your answer to 2 decimal places.) Basic earnings power Calculate the return on assets. (Round your answer to 2 decimal places.) Return on assets % Return on equity % Calculate the return on equity. (Round your answer to 2 decimal places.) % Calculate the dividend payout. (Round your answer to 2 decimal places.)arrow_forward

- Answer all three parts (Round to two decimal places) If you expect the price after the dividend is paid to be $106.88, what total return do you expect to earn over the year? What do you expect to be your dividend yield? What do you expect to be your capital gain rate? (Round to two decimal places)arrow_forwardProvide Answer with calculationarrow_forwardA company has a dividend payout ratio of 40% and a net income of $250,000. What amount is paid out as dividends? a) $100,000 b) $125,000 c) $150,000 d) $175,000arrow_forward

- Assume you are given the following relationships for the Haslam Corporation:Sales/total assets 1.2Return on assets (ROA) 4%Return on equity (ROE) 7%Calculate Haslam’s profit margin and liabilities-to-assets ratio. Suppose half its liabilities are in the form of debt. Calculate the debt-to-assets ratio.arrow_forwardROE Needham Pharmaceuticals has a profit margin of 3.5% and an equity multiplier of 1.5. Its sales are $100 million and it has total assets of $60 million. What is its Return on Equity (ROE)? Round your answer to two decimal places.arrow_forwardAssume the following relationships for the Caulder Corp.: Sales/Total assets 2.2x Return on assets (ROA) 6% Return on equity (ROE) 15% a. Calculate Caulder's profit margin assuming the firm uses only debt and common equity, so total assets equal total invested capital. Round your answer to two decimal places. % b. Calculate Caulder's debt-to-capital ratio assuming the firm uses only debt and common equity, so total assets equal total invested capital. Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning