Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General Account Questions Answer nned

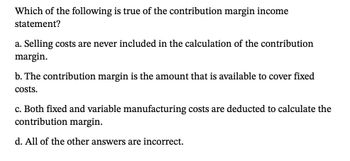

Transcribed Image Text:Which of the following is true of the contribution margin income

statement?

a. Selling costs are never included in the calculation of the contribution

margin.

b. The contribution margin is the amount that is available to cover fixed

costs.

c. Both fixed and variable manufacturing costs are deducted to calculate the

contribution margin.

d. All of the other answers are incorrect.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which of the following statements about determining the breakeven point is FALSE? a) Breakeven revenues equal fixed costs divided by the variable cost per unit. b) Revenues equal fixed costs plus variable costs. c) Operating income is equal to zero. d) Contribution margin minus fixed costs is equal to zero.arrow_forwardWhich of the following is not correct? At break-even A. Fixed costs equals contribution margin B. Profit equals zero C. Sales equal total costs D. Gross profit equals zeroarrow_forwardOnly financial or general accounting expert can accept this Question.arrow_forward

- Which of the following is not a correct definition of the breakeven point? A.the point where total profits equals total fixed expenses B.the point where total profit equals zero C.the point where total contribution margin equals total fixed expenses D.the point where total sales equals total expensesarrow_forwardWhich one of the following is not considered an assumption of cost-volume-profit analysis? a. Costs are linear b. Sales mix of products sold does not change c. Selling price per unit changes with volume d. Costs can be divided into variable and fixed components e. Fixed cost per unit is not constantarrow_forwardWhich one of the following is not considered an assumption of cost-volume-profit analysis? a. Selling price per unit does not change with volume b. Costs can be divided into variable and fixed components C. Fixed cost per unit is not constant d. Sales mix of products sold does not change O e. Costs are nonlineararrow_forward

- Which is not true? At break-even point, A. profit equals zeroB. gross profit equals operating expensesC. contribution margin equals fixed costsD. total revenue equals total costsE. none of the above.arrow_forwardEach incorrect answer cancels out each correcr one. Indicate which of the following statements are true(T) or false (F). Indirect costs are those factors whose increase or decrease is not related to changes in the activity, so that in the short term they must be considered fixed.Cost Accounting studies the resources or productive factors applied to production, so it requires data expressed in physical units (hours, Kilograms, liters etc...) in addition to their monetary value.The fuel consumed by commercial venicles must be assigned as indirect manufacturing cost. This is because it is not possible to do it directly. The warehousing costs refer to the set of activities related to the management of purchases and warehouses, and do not include the acquisition value of this materials.When 50.000 units are produced, the fixed cost is $10 per unit. Therefore, when 100.000 units are produced fixed costs will remain at $10 per unit.The budgeted allocation rate is calculated by dividing the…arrow_forwardWhich of the following statements about CVP analysis is false? O a. Operating income calculations in CVP analysis are based on contribution margin not gross margin. O b. Unit selling price, unit variable costs, and total fixed costs are known and remain constant. O c. Managers use (CVP) analysis to study the behavior of and relationship among the elements such as total revenues, total costs, and income O d. Total revenues and total costs are linear in relation to output units. O e. All of the given answers are true. OUS PAGE FINISH ATTEMPT ... F1 F2 F3 F4 F5 F6 F7 F8 F10 23 % & 2 3 4 7 8. V Q W T A F K 13 C V BYNI M 24 Sarrow_forward

- Which is the true statement? The CVP income statement shows contribution margin instead of gross profit. In a CVP income statement, costs and expenses are classified only by function. In a traditional income statement, costs and expenses are classified as either variable or fixed. The CVP income statement is prepared for both internal and external use.arrow_forwardWhen the contribution margin is not sufficient to cover fixed expenses: Multiple Choice total profit equals total expenses. contribution margin is negative. a loss occurs. variable expenses equal contribution margin.arrow_forwardThis Question is related to financial accounting or general accounting? So only accounting expert should answer this?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning