Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Do fast answer of this accounting questions

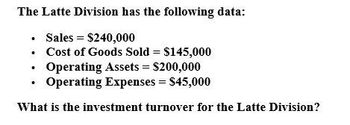

Transcribed Image Text:The Latte Division has the following data:

⚫ Sales = $240,000

•

⚫ Cost of Goods Sold = $145,000

•

Operating Assets = $200,000

Operating Expenses = $45,000

What is the investment turnover for the Latte Division?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The mocha company has sales solution this questionarrow_forwardsolvearrow_forwardThe Bottlebrush Division has income from operations of $90,300, invested assets of $258,000, and sales of $903,000. Use the DuPont formula to compute the return on investment, and show (a) the profit margin, (b) the investment turnover, and (c) the return on investment. Round answers to one decimal place. a. Profit Margin % b. Investment Turnover c. Return on Investment %arrow_forward

- The Marine Division of Pacific Corporation has average invested assets of $110,000,000. Sales revenue of $50,280,000 results in net operating income of $9,972,000. The hurdle rate is 7%. Required a. Calculate the return on investment. b. Calculate the profit margin. c. Calculate the investment turnover. d. Calculate the residual income. Complete this question by entering your answers in the tabs below. Required A Required B Required C Calculate the return on investment. Note: Round percentage to 2 decimals. Return on Investment Required D %arrow_forwardLee enterprises has the following segemnet dataarrow_forwardSelected data from Division A of Green Company are as follows: Sales $ 490,000 Average investment $ 416,500 Operating income $ 83,300 Minimum rate of return 16 % Division A's asset turnover (AT) is (rounded to two decimal places):arrow_forward

- Banderas, Inc. has three investment centers, Red, Brown, and Black. The following data is available for each of these investment centers. BANDERAS, INC. DATA FOR INVESTMENT CENTERS OF COMPANY Red Operating Income $ A $ Brown E $ Sales Revenue B 1,000,000 Black I 1,500,000 Average Investment in Assets 300,000 500,000 J Profit Margin Ratio C 15% 10% Asset Turnover Ratio 4 F K Return on Investment (ROI) 25% G 25% Minimum Required Rate of Return 20% H L Residual Income D 50,000 30,000 REQUIRED: Using the attached answer sheets, compute the missing items A through L for Banderas, Inc. Round all percentages to two decimal places (four decimal places in all), all dollar amounts to the nearest whole dollar, and all other amounts to two decimal places.arrow_forwardWhat is the investment turnover?arrow_forwardAssume the Residential Division of Kipper Faucets had the following results last year: What is the division’s RI? a. $(140,000) b. $104,000 c. $140,000 d. $(104,000)arrow_forward

- Consider the following data from two divisions of a company, P and Q: Divisional P Q Sales $ 2,000,000 $ 1,100,000 Operating Income $ 800,000 $ 660,000 Investment $ 3,200,000 $ 1,760,000 If the minimum rate of return is 9%, what is Division P's residual income (RI)?arrow_forwardA company’s shipping division (an investment center) has sales of $2,420,000, net income of $516,000, and average invested assets of $2,250,000. Compute the division’s profit margin and investment turnover.arrow_forwardSelected data from an investment center of IROL Inc. follow:Sales $8,000,000Net book value of assets, beginning 2,500,000Net book value of assets, ending 2,600,000Net operating income 640,000Minimum rate of return 12%Required1. Calculate return on sales (ROS), asset turnover (AT), and return on investment (ROI).2. Calculate residual income (RI).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub