Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

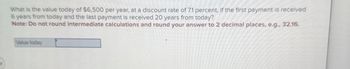

Transcribed Image Text:What is the value today of $6,500 per year, at a discount rate of 7.1 percent, if the first payment is received

6 years from today and the last payment is received 20 years from today?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

Value today

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the value today of $4,300 per year, at a discount rate of 10 percent, if the first payment is received 6 years from today and the last payment is received 20 years from today? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardWhat is the present value of $2,225 per year, at a discount rate of 9 percent, if the first payment is received 8 years from now and the last payment is received 23 years from now? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardWhat is the value today of a money machine that will pay $1,548.00 per year for 17.00 years? Assume the first payment is made 3.00 years from today and the interest rate is 7.00%. Submit Answer format: Currency: Round to: 2 decimal places.arrow_forward

- What is the value today of a money machine that will pay $3,776.00 per year for 19.00 years? Assume the first payment is made one year from today and the interest rate is 10.00%. __________Submit Answer format: Currency: Round to: 2 decimal places.arrow_forwardWhat is the value today of a money machine that will pay $1,321.00 per year for 11.00 years? Assume the first payment is made 9.00 years from today and the interest rate is 15.00%. Answer Format: Currency: Round to: 2 decimal places. Enter Answer Here...arrow_forwardFor each of the following annuities, calculate the future value. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Future Value Annual Payment $ $ $ $ 1,220 4,340 2,940 7,530 Years 10 50 9 35 Interest Rate 5% 6 3 7arrow_forward

- What is the present value of $876.89 if we discount it by 0.09 for one year (remember the equation c/(1+r)^n ) NOTE interest rate is in decimal already, no need to convertarrow_forwardBhadibenarrow_forwardAt 7.3 percent interest, how long does it take to double your money? (Do not round Intermediate calculations and round your enswer to 2 decimal places, e.g., 32.16.) Length of time L years At 73 percent Interest, how long does t lake to quadruple It? (Do not round Intermediate calculations and round your answer to 2 decimel places, o.g., 32.16.) Length of time Years,arrow_forward

- What real annuity (in today’s dollars) will $1 million support if the real interest rate at retirement is 2.3% and the annuity must last for 20 years? Note: Enter your answers in whole dollars, not in millions. Do not round intermediate calculations. Round your answer to 2 decimal places.arrow_forwardIf you put up $51,000 today in exchange for a 6.25 percent, 15-year annuity, what will the annual cash flow be? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardGiven an interest rate of 4.8 percent per year, what is the value at date t = 10 of a perpetual stream of $3,200 payments that begins at date t = 20? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you