Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

None

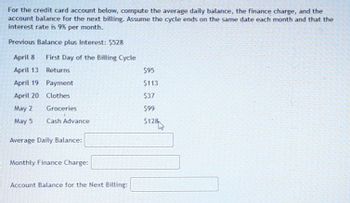

Transcribed Image Text:For the credit card account below, compute the average daily balance, the finance charge, and the

account balance for the next billing. Assume the cycle ends on the same date each month and that the

interest rate is 9% per month.

Previous Balance plus Interest: $528

April 8

First Day of the Billing Cycle

April 13

Returns

$95

April 19

Payment

$113

April 20 Clothes

$37

May 2

Groceries

$99

May 5

Cash Advance

$128

Average Daily Balance:

Monthly Finance Charge:

Account Balance for the Next Billing:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- For the credit card account, assume one month between billing dates (with the appropriate number of days) and interest of 1.1% per month on the average daily balance Find (a) the average daily balance, (b) the monthly finance charge, and (e) the account balance for the next billing Previous Balance: $485.26 January 13 Billing Date January 15 Retums January 20 Clothes January 27 Bus Sickets February 2 Payment February 6 Flowers $105.09 $114.34 $76.83 $130 $64.41 (a) The average daily balance is (Round to the nearest cent as needed.) (b) The finance charge is (Round to the nearest cent as needed) (c) The account balance for the next billing is $ (Round to the nearest cent as needed.)arrow_forwardFor the credit card account, assume one month between billing dates (with the appropriate number of days) and interest of 1.5 % per month on the average daily balance. Find (a) the average daily balance, (b) the monthly finance charge, and (c) the account balance for the next billing. Previous Balance: $449.12 January 10 Billing Date January 12 Returns $102.72 January 21 Clothes $117.41 January 25 Bus tickets $76.64 February 2 Payment $135 February 8 Flowers $56.23 (a) The average daily balance is $arrow_forwardFind the average daily balance for the credit card with the following transactions. Assume one month between billing dates using the proper number of days in the month. Then find the finance charge if interest is 1.5% per month on the average dally balance. Finally, find the new balance. Previous Balance: $556.32 Billing date: July 9 July 15, Return, $114.45 July 17, Purchase, $98.12 July 25, Purchase, $76.12 August 7, Payment, $110 What is the average daily balance? What is the finance charge? What is the new balance?arrow_forward

- For the credit card account, assume one month between billing dates (with the appropriate number of days) and interest of 1.6% per month on the average daily balance. Find (a) the average daily balance, (b) the monthly finance charge, and (c) the account balance for the next billing. Previous Balance: $464.30 January 12 Billing Date January 16 Returns January 21 Clothes January 26 Bus tickets February 4 Payment February 7 Flowers $102.74 $113.66 $69.74 $105 $67.29 (a) The average daily balance is $ (Round to the nearest cent as needed.) (b) The finance charge is $ (Round to the nearest cent as needed.) (c) The account balance for the next billing is $. (Round to the nearest cent as needed.) Enter your answer in each of the answer boxes. fg f10 insert prt sc f5 f6 fg esc & backspace 2 3 7 00 T 5 %24arrow_forwardFor the credit card account, assume one month between billing dates (with the appropriate nmber of days) and interest of 1.5% per month on the average daly balance Find (a) the average dally balance (b) ehe monthly fitance charge and (c) the account balance for the next billing Previoun Balance $754 56 July 8 July 16 July 25 August 5 Concert tickets Bling Date Paynent Lunch $300 $32 30 (a) The average daly balance is (Round to the tearest cent as needed) (b) The france charge is Round ta the nearest cont as neuded) t The account balance for the net biing is (Round to nearet.cent as neaded)arrow_forwardK For the credit card account, assume one month between billing dates (with the appropriate number of days) and interest of 1.4% per month on the average daily balance. Find (a) the average daily balance, (b) the monthly finance charge, and (c) the account balance for the next billing. Previous Balance: $464.26 January 12 Billing Date January 14 Returns January 21 Clothes January 25 Bus tickets February 3 Payment February 8 Flowers $105.64 $122.68 $63.87 $125 $56.36 ...arrow_forward

- A) Find the average daily balance B) Find the monthly finance charge C) Find the account balance fot the next billingarrow_forwardSuppose your MasterCard calculates interest using the average daily balance method, and the monthly interest rate is 1.1%. The itemized billing for the month of August is shown below. Detail Date Amount Unpaid balance August 1 $395 Charge August 9 $1040 Charge August 10 $800 Charge August 18 $1115 Payment received August 25 $710 Last day of billing period August 31 Payment due date September 7 (a) Find the average daily balance. $(b) Find the interest due for this month. $(c) Find the total balance owed on the last day of the billing period. $(d) This credit card requires a $15 minimum payment or 1/24 of the amount due, whichever is higher. What is the minimum monthly payment due for this month? $arrow_forward13. For the credit card account, assume one month between billing dates (with the appropriate number of days) and interest of 1.4% per month on the average daily balance. Find (a) the average daily balance, (b) the monthly finance charge, and (c) the account balance for the next billing. Previous Balance: $449.50 January 13 Billing Date January 15 Returns January 22 Clothes January 27 Bus tickets February 2 Payment February 6 Flowers $105.58 $122.54 $77.74 $120 $65.22 (a) The average daily balance is $ (Round to the nearest cent as needed.). (b) The finance charge is $ (Round to the nearest cent as needed.) (c) The account balance for the next billing is $ (Round to the nearest cent as needed.) C O a IS ry ry av toarrow_forward

- Calculate the average daily balance (in $) for October for a revolving credit account with a previous month's balance of $110 and the following activity. (Round your answer to the nearest cent.) Date Activity Amount October 3 Cash advance $50.00 October 7 Payment $75.00 October 10 Purchase $27.59 October 16 Credit $10.00 October 25 Purchase $121.60 average daily balance = $arrow_forward1. For the credit card account, assume one month between billing dates and interest of 1.6% per month on the daily average balance. Find (a) the average daily balance, (b) the monthly finance charge, and (c) the account balance for the next billing. Previous balance: $562 November 4 Billing date November 15 Payment $400 November 18 Groceries $350 November 20 Train card $190 December 1 Holiday shopping $320arrow_forwardCalculate the average daily balance (in $) for October for a revolving credit account with a previous month's balance of $120 and the following activity. (Round your answer to the nearest cent.) Date Activity Amount October 3 Cash advance $50.00 October 7 Payment $75.00 October 10 Purchase $26.59 October 16 Credit $10.00 October 25 Purchase $122.60arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education