Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

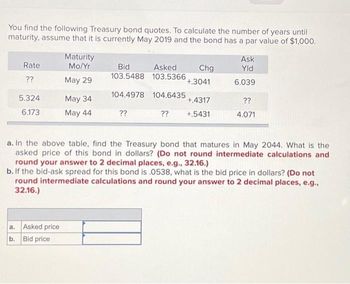

Transcribed Image Text:You find the following Treasury bond quotes. To calculate the number of years until

maturity, assume that it is currently May 2019 and the bond has a par value of $1,000.

Rate

??

5.324

6.173

Maturity

Mo/Yr

May 29

a. Asked price

b. Bid price

May 34

May 44

Bid

Asked

103.5488 103.5366

104.4978

104.6435

??

Chg

+.3041

+.4317

?? +.5431

Ask

Yld

6.039

??

4.071

a. In the above table, find the Treasury bond that matures in May 2044. What is the

asked price of this bond in dollars? (Do not round intermediate calculations and

round your answer to 2 decimal places, e.g., 32.16.)

b. If the bid-ask spread for this bond is .0538, what is the bid price in dollars? (Do not

round intermediate calculations and round your answer to 2 decimal places, e.g.,

32.16.)

Expert Solution

arrow_forward

Step 1: Asked price and bid price

The holder of the bond decides to trade the investment at a specific rate, which is known as the asked price. The opposite party would be willing to trade it for another price, which is known as the bid price. The difference between them is known as the bid ask-spread.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The following is a T-bond quote (par value $1,000) from the WSJ (8/31/2018). Use the information in the quote to answer the question. Maturity Coupon Bid Asked Chg Asked Yield 8/31/2,034 11.68 104:15 104:20 -14 ??? How much is the premium or discount of this bond? (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16). Use a negative sign to represent a discount.)arrow_forwardround to nearest integerarrow_forwardTo calculate the number of years until maturity, assume that it is currently May 2019. All of the bonds have a $1,000 par value and pay semiannual coupons. Maturity Mo/Yr Ask Yld Rate Asked 103.5362 103.8235 Bid Chg +.3204 ?? May 25 2.18 5.850 May 27 103.1840 103.3215 +.4513 ?? 6.125 May 36 ?? ?? +.6821 3.87 a. In the above table, find the Treasury bond that matures in May 2036. What is the asked price of this bond in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. If the bid-ask spread for this bond is .0628, what is the bid price in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Asked price b. Bid pricearrow_forward

- am. 283.arrow_forwardSuppose the following bond quotes for IOU Corporation appear in the financial page of today's newspaper. Assume the bond has a face value of $2,000 and the current date is April 19, 2021. Company (Ticker) IOU (IOU) Coupon 5.5 a. YTM b. Current yield Maturity April 19, 2037 % 5.05 % Last Price Last Yield 108.89 ?? a. What is the yield to maturity of the bond? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the current yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) EST volume (000s) 1,841arrow_forwardvvk.6arrow_forward

- O ook int ences You find the following Treasury bond quotes. To calculate the number of years until maturity, assu of the bonds have a par value of $1,000 and pay semiannual coupons. Rate ?? 6.052 6.143 Maturity Month/Year May 33 May 36 May 42 Yield to maturity Asked Bid 103.4560 103.5288 104.4900 104.6357 ?? Change Ask Yield +.3248 5.00 % +.4245 +.5353 In the above table, find the Treasury bond that matures in May 2036. What is your yield to matur Note: Do not round intermediate calculations and enter your answer as a percent rounded to 5.919 ?? 3.951arrow_forwardYou find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a par value of $1,000 and pay semiannual coupons. Asked Rate ??question mark 5.524 6.193 Maturity Month/Year May 34 May 37 May 43 Bid 103.4690 104.5030 ??question mark 103.5418 104.6487 ??question mark Change Ask Yield +.3093 6.119 +.4365 ?? +.5483 4.151 In the above table, find the Treasury bond that matures in May 2037. What is your yield to maturity if you buy this bond?arrow_forwardThere are two zero-coupon bonds below: Coupon Term to rate maturity 0% 1 year 10% 2 years Bond A B FV $100 $100 Price $95.24 $107.42 Consider a 2-year coupon bond C with FV = $100, coupon rate=25%, and price = $ 138. Is Bond C underpriced/overpriced relative to Bonds A and B? What is the potential arbitrage trading strategy? O a. Overpriced; Long 3/22 unit of A; Long 25/22 unit of B; Short 1 unit of C O b. Underpriced; Long 3/22 unit of A; Long 25/22 unit of B; Short 1 unit of C O c. Overpriced; Long 3 unit of A; Long 25 unit of B; Short 1 unit of C O d. Underpriced; Long 3 unit of A; Long 25 unit of B; Short 1 unit of Carrow_forward

- 7arrow_forwardYou find the following corporate bond quotes. To calculate the number of years until maturity, assume that it is currently January 15, 2022. The bonds have a par value of $2,000 and semiannual coupons. Company (Ticker) Xenon, Incorporated (XIC) Kenny Corporation (KCC) Williams Company (WICO) Coupon 6.300 7.210 ?? a. Price b. Current yield Maturity January 15, 2043 January 15, 2037 January 15, 2039 % Last Price Last Yield 94.291 ?? 6.20 ?? 94.825 7.02 Estimated $ Volume (000s) 57,371 a. What price would you expect to pay for the Kenny Corporation bond? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. What is the bond's current yield? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. 48,950 43,811arrow_forwardS Suppose the following bond quotes for IOU Corporation appear in the financial page of today's newspaper. Assume the bond has a face value of $2,000 and the current date is April 19, 2021. Assume semiannual coupon payments. Company (Ticker) IOU (IOU) Coupon 5.7 Maturity April 19, 2043 Last Price 108.96 Last Yield ?? EST volume (000s) 1,827 a. What is the yield to maturity of the bond? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the current yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. YTM b. Current yield % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education