Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

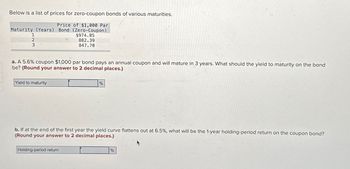

Transcribed Image Text:Below is a list of prices for zero-coupon bonds of various maturities.

Price of $1,000 Par

Maturity (Years) Bond (Zero-Coupon)

1

2

3

$974.85

882.39

847.70

a. A 5.6% coupon $1,000 par bond pays an annual coupon and will mature in 3 years. What should the yield to maturity on the bond

be? (Round your answer to 2 decimal places.)

Yield to maturity

%

b. If at the end of the first year the yield curve flattens out at 6.5%, what will be the 1-year holding-period return on the coupon bond?

(Round your answer to 2 decimal places.)

Holding-period return

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Owearrow_forwardThe following is a list of prices for zero-coupon bonds of various maturities. Maturity (years) Price of Bond 1 $ 953.40 2 903.47 3 852.62 4 787.66 Required: Calculate the yield to maturity for a bond with a maturity of (i) one year; (ii) two years; (iii) three years; (iv) four years. Assume annual coupon payments. Calculate the forward rate for (i) the second year; (ii) the third year; (iii) the fourth year. Assume annual coupon payments.arrow_forwardBased on the following information for a bond, what is the bond's coupon rate? (EXCEL EQUATION IF POSSIBLE) Years to maturity 25 Par value 1000 Interest rate 0.1 current price 1200 Coupon payments are made semiannually. a. .1108 b. .1082 c. .1331 d. .1219arrow_forward

- Vhat is the yield of each of the following bonds, E, if interest (coupon) is paid quarterly? of the following bond if interest (coupon) is paid quarterly? (Round to two decimal places.) Years to Maturity 6 Data Table Coupon Rate 6% 10 d of the following bond if interest (coupon) is (Click on the following icon o in order to copy its contents into a spreadsheet) Yedrsta Maturity 10 20 Yield to Maturity Years to Maturty Per Valud $5,000.00 $5,000.00 $1.000.00 $5,000.00 (Coupon ata 6% 8% Prico S3,740.00 $5,000.00 S800.00 $4.900.00 Coupon Rate 8% 20 5% 7% 30 25 Print Donearrow_forwardVijay shiyalarrow_forwardThe yield to maturity on 1-year zero-coupon bonds is currently 5%; the YTM on 2-year zeros is 6%. The Treasury plans to issue a 2-year maturity coupon bond, paying coupons once per year with a coupon rate of 7.5%. The face value of the bond is $100. Required: a. At what price will the bond sell? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. b. What will the yield to maturity on the bond be? Note: Do not round intermediate calculations. Round your answer to 3 decimal places. c. If the expectations theory of the yield curve is correct, what is the market expectation of the price for which the bond will sell next year? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. d. Recalculate your answer to part (c) if you believe in the liquidity preference theory and you believe that the liquidity premium is 1%. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. a. Price b. Yield to…arrow_forward

- need help with finding the current yield and capital gains yield for bond p and bond d, thank youarrow_forwardProvide Answer with calculation andarrow_forwardA two-year bond with par value $1,000 making annual coupon payments of $98 is priced at $1,000. Required: a. What is the yield to maturity of the bond? (Round your answer to 1 decimal place.) b. What will be the realized compound yield to maturity if the one-year interest rate next year turns out to be (a) 7.8%, (b) 9.8%, (c) 11.8%? (Do not round intermediate calculations. Round your answers to 2 decimal places.)arrow_forward

- What is the price of the bond given the information below. The bond makes semiannual interest payments. (Do not round intermediate calculations, round answer to two decimals, i.e. 32.16) Coupon Rate:8.5% YTM:9.5% Maturity (years):8 Par value: $2,000arrow_forwardSuppose that all bonds have $1,000 of face value. The current prices of zero coupon bonds are as follows: $960 for a one-year bond; $910 for a two-year bond; $850 for a three-year bond. a. What is the price of a three-year bond with 8% annual coupon payment? b. What is the YTM of the two-year zero coupon bond? c. Consider the following two-year bonds: (i) a zero coupon bond as above; (ii) a bond with 6% annual coupon payment. Whose YTM is higher?arrow_forwardConsider the following bond where the coupons are paid annually, Bond Scotiabank Price $1008.50 YTM 9% Years to maturity 8 years What is the coupon rate of this bond? The face value of the bond is $1,000. Enter your answer as a percentage. Do not include the percentage sign in your answer. Enter your response below. Enter your answer rounded to 2 DECIMAL PLACES.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education