Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

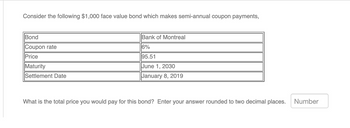

Transcribed Image Text:Consider the following $1,000 face value bond which makes semi-annual coupon payments,

Bond

Coupon rate

Price

Maturity

Settlement Date

Bank of Montreal

16%

95.51

June 1, 2030

January 8, 2019

What is the total price you would pay for this bond? Enter your answer rounded to two decimal places.

Number

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Bhadibenarrow_forwardConsider the following $1,000 face value bond which makes semi- annual coupon payments, Bond Bank of Montreal Coupon rate 3% Price 108.19 Maturity June 1, 2030 Settlement Date January 3, 2019 What is the total price you would pay for this bond? Enter your answer rounded to two decimal places.arrow_forwardYou find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a par value of $1,000 and pay semiannual coupons. Rate ?? 5.424 6.183 Maturity Month/Year May 32 May 35 May 41 Bid 103.4664 104.5004 ?? Asked Change 103.5392 +.3067 104.6461 ?? +.4341 +.5457 Ask Yield 6.079 ?? 4.111 In the above table, find the Treasury bond that matures In May 2035. What is your yield to maturity if you buy this bond? Note: Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Yield to maturity 96arrow_forward

- Today is January 2, 2022, and investors expect the annual nominal risk-free interest rates in 2022 through 2024 to be: Year One-Year Rate (rRF) 2022 2.5 % 2023 2.3 2024 3.3 Assume the bonds have no risks. What is the yield to maturity for Treasury bonds that mature at the end of 2023 (a two-year bond)? Round your answer to one decimal place. % What is the yield to maturity for Treasury bonds that mature at the end of 2024 (a three-year bond)? Round your answer to one decimal place. %arrow_forwardThe following data relate to a corporate bond which pays coupons semi-annually: Settlement date 01 March 2009 Maturity date 31 December 2035 Coupon rate 10% Yield to maturity 8% Face value $1,000 Percentage of face value paid back to the investor on maturity 100% Using the above data, calculate: i. The flat price of the bond ii. Accrued interest iii. Invoice price of the bond Note: Show the assumptions, if any, you made in your calculations.arrow_forwardplease use ball plus calculator functionarrow_forward

- Consider the following bond where the coupons are paid annually, Bond Scotiabank Price $1008.50 YTM 9% Years to maturity 8 years What is the coupon rate of this bond? The face value of the bond is $1,000. Enter your answer as a percentage. Do not include the percentage sign in your answer. Enter your response below. Enter your answer rounded to 2 DECIMAL PLACES.arrow_forwardgive me answerarrow_forwardplease answer urgent!!!arrow_forward

- You find the following corporate bond quotes. To calculate the number of years until maturity, assume that it is currently January 15, 2022. The bonds have a par value of $2,000 and semiannual coupons. Company (Ticker) Xenon, Incorporated (XIC) Kenny Corporation (KCC) Williams Company (WICO) Yield to maturity Coupon 7.20 7.30 ?? % Maturity January 15, 2039 January 15, 2033 January 15, 2035 Last Price Last Yield ?? 6.38 7.20 94.399 ?? 94.915 What is the yield to maturity for the bond issued by Xenon, Incorporated? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Estimated $ Volume (000s) 57,380 48,959 43,820arrow_forwardYou find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a par value of $1,000 and pay semiannual coupons. Rate 22 6.052 6.143 Maturity Month/Year May 32 May 37. May 47 Coupon rate Asked Bid 103.5410 103.6288 104.4900 22 104.6357 22 Change +.3248 +.4245 +.5353 In the above table, find the Treasury bond that matures in May 2032. What is the coupon rate for this bond? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. 2.80% Ask Yield 2.249 77 3.951arrow_forwardFind the total return earned by the bond with the characteristics shown in the table. Face Value $14,000 Annual Interest Rate 6.09% Term to Maturity 4 months What is the total return earned by this bond? $ (Round to the nearest cent as needed.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education