Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

None

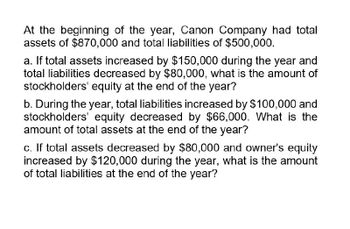

Transcribed Image Text:At the beginning of the year, Canon Company had total

assets of $870,000 and total liabilities of $500,000.

a. If total assets increased by $150,000 during the year and

total liabilities decreased by $80,000, what is the amount of

stockholders' equity at the end of the year?

b. During the year, total liabilities increased by $100,000 and

stockholders' equity decreased by $66,000. What is the

amount of total assets at the end of the year?

c. If total assets decreased by $80,000 and owner's equity

increased by $120,000 during the year, what is the amount

of total liabilities at the end of the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Kretovich Company had a quick ratio of 1.4, a current ratio of 3.0, a days’ sales outstanding of 36.5 days (based on a 365-day year), total current assets of $810,000, and cash and marketable securities of $120,000. What were Kretovich’s annual sales?arrow_forwardJuroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Refer to the information for Juroe Company on the previous page. Also, assume that Juroes total assets at the beginning of last year equaled 17,350,000 and that the tax rate applicable to Juroe is 40%. Required: Note: Round answers to two decimal places. 1. Calculate the average total assets. 2. Calculate the return on assets.arrow_forwardJuroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: Note: Round answers to two decimal places. 1. Calculate the times-interest-earned ratio. 2. Calculate the debt ratio. 3. Calculate the debt-to-equity ratio.arrow_forward

- Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Required: 1. Calculate the average common stockholders equity. 2. Calculate the return on stockholders equity.arrow_forwardAssuming that total assets were $8,037,000 at the beginning of the current fiscal year, determine the following: When required, round to one decimal place. a. Ratio of fixed assets to long-term liabilities b. Ratio of liabilities to stockholders' equity c. Asset turnover d. Return on total assets e. Return on stockholders' equity f. Return on common stockholders' equity % % %arrow_forwardFlitter reported net income of $23,500 for the past year. At the beginning of the year the company had $212,000 in assets and $62,000 in liabilities. By year end, assets had increased to $312,000 and liabilities were $87,000. Calculate its return on assets: Multiple Choice 11.1%. 9.0%. 7.5%. 35.7%. 26.0%.arrow_forward

- The total assets of Blue Co. is funded by both debt and equity with a debt to equity ratio of 100%. If Blue Co. has a retained earnings breakpoint of P1,225,000, the additions to the retained earnings during the year amounts to ?arrow_forwardLast year, Harrington Inc. had sales of $325,000 and a net income of $19,000. Its year-end assets were $250,000. The firms total debt/total assets was 55%. What was the ROE?arrow_forwardAt the beginning of the current fiscal year, the balance sheet for Davis Company showed liabilities of $288,000. During the year, labilmes decreased by $16,200, assets increased by $58,500, and paid-in capital increased from $27,000 to $172,800 Dividends declared and paid during the year were $22,500. At the end of the year, stockholders' equity totaled $386,100 Required: a. Calculate net income (or loss) for the year. Indicate the financial statement effect Complete this question by entering your answers in the tabs below. Required A1 Required A2 Calculate net income (or loss) for the year. Note: Enter decreases with a minus sign to indicate a negative financial statement effect. Beginning $599,000 Changes 58.500 Changes Ending S657,900 Stockholders' Equity Liabilities $ 280,000+ (16,200) RE 284,400 48.600 Not loss 22.500 [Dividends $271,800+ $ 172.800 $ 213,300 ($386,100 total SE) PIC $ 27,000+$ 145.800+arrow_forward

- Six measures of solvency or profitabilityThe following data were taken from the financial statements of GatesInc. for the current fiscal year. Assuming that long-term investments totaled $3,000,000 throughout theyear and that total assets were $7,000,000 at the beginning of the currentfiscal year, determine the following: (A) ratio of fixed assets to long-termliabilities, (B) ratio of liabilities to stockholders' equity, (C) assetturnover, (D) return on total assets, (E) return on stockholders" equity,and (F) return on common stockholders' equity. (Round ratios andpercentages to one decimal place as appropriate.)arrow_forwardAt the beginning of the current fiscal year, the balance sheet for Davis Co. showed liabilities of $640,000. During the year liabilities decreased by $36,000, assets increased by $130,000, and paid-in capital increased from $60,000 to $384,000. Dividends declared and paid during the year were $50,000. At the end of the year, stockholders' equity totaled $858,000. Calculate net income (or loss) for the year.arrow_forwardMaynard enterprises paid $ 1,384 in dividends and $1,067 in interest over the past year.The common stock account increased by $ 1,272 and retainef earnings decreased by $ 379. What was the company net Income?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning