Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

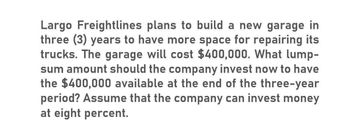

Transcribed Image Text:Largo Freightlines plans to build a new garage in

three (3) years to have more space for repairing its

trucks. The garage will cost $400,000. What lump-

sum amount should the company invest now to have

the $400,000 available at the end of the three-year

period? Assume that the company can invest money

at eight percent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Gardner Denver Company is considering the purchase of a new piece of factory equipment that will cost $420,000 and will generate $95,000 per year for 5 years. Calculate the IRR for this piece of equipment. For further Instructions on internal rate of return in Excel, see Appendix C.arrow_forwardConestoga Plumbing plans to invest in a new pump that is anticipated to provide annual savings for 10 years of $50,000. The pump can be sold at the end of the period for $100,000. What is the present value of the investment in the pump at a 9% interest rate given that savings are realized at year end?arrow_forwardManzer Enterprises is considering two independent investments: A new automated materials handling system that costs 900,000 and will produce net cash inflows of 300,000 at the end of each year for the next four years. A computer-aided manufacturing system that costs 775,000 and will produce labor savings of 400,000 and 500,000 at the end of the first year and second year, respectively. Manzer has a cost of capital of 8 percent. Required: 1. Calculate the IRR for the first investment and determine if it is acceptable or not. 2. Calculate the IRR of the second investment and comment on its acceptability. Use 12 percent as the first guess. 3. What if the cash flows for the first investment are 250,000 instead of 300,000?arrow_forward

- Need helparrow_forwardFraser Company will need a new warehouse in seven years. The warehouse will cost $350,000 to build. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: What lump-sum amount should the company invest now to have the $350,000 available at the end of the seven-year period? Assume that the company can invest money at: (Round your final answer to the nearest whole dollar amount.) Present Value 1. Ten percent 2. Seven percentarrow_forwardGolden Country Homes are to install a street lighting that costs $120,000. Annualmaintenance costs are expected to be $65,000 for the first 20 years and $85,000 foreach year thereafter. The lighting will be needed for an indefinitely long period oftime. With an interest rate of 10% per year, what is the capitalized cost of thisproject?arrow_forward

- Dengerarrow_forwardA newly constructed bridge costs $10,000,000. The same bridge is estimated to need renovation every 10 years at a cost of $1,000,000. Annual repairs and maintenance are estimated to be $100,000 per year.(a) If the interest rate is 5%, determine the capitalized-equivalent cost of the bridge.{b) Suppose that the bridge must be renovated every 15 years, not every10 years. What is the capitalized cost of the bridge if the interest rate is thesame as in (a)?(c) Repeat (a) and (b) with an interest rate of 10%. What can you say about the effect of interest on the results?arrow_forwardThe required investment cost of a new, large shopping center is $52 million. The salvage value of the project is estimated to be $18 rmillon (the value of the land) The projects life is 18 years and the annual operating expenses ar estimated to be $13 million. The MARR for such projects is 22% per year. What must the minimum annual revenue be to make the shopping center a worthwhile venture? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 22% per year To make the shopping center a worthwhile venture, the minimum annual revenue must be S milion per year (Round to three decimal places)arrow_forward

- Foster Incorporated is trying to decide whether to lease or purchase a piece of equipment needed for the next 10 years. The equipment would cost $50,000 to purchase, and maintenance costs would be $5,000 per year. After 10 years, Foster estimates it could sell the equipment for $21,000. If Foster leases the equipment, it would pay $19,000 each year, which would include all maintenance costs. If Foster's cost of capital is 9%, Foster should: (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1) Note: Use the appropriate factors from the PV tables. Multiple Choice lease the equipment, as the net present value of the cost is about $45,000 less. buy the equipment, as the net present value of the cost is about $48,700 less. lease the equipment, as the net present value of the cost is about $48,700 less. buy the equipment, as the net present value of the cost is about $50,000 less.arrow_forwardThe FernRod Motorcycle Company invested $150,000 at 4.5% compounded monthly to be used for the expansion of their manufacturing facilities. How much money will be available for the project in 5 1/2 years? (Round your answer to the nearest dollaarrow_forwardFoster Incorporated is trying to decide whether to lease or purchase a piece of equipment needed for the next 10 years. The equipment would cost $53,000 to purchase, and maintenance costs would be $5,200 per year. After 10 years, Foster estimates it could sell the equipment for $25,000. If Foster leases the equipment, it would pay $15,000 each year, which would include all maintenance costs. If Foster's cost of capital is 12%, Foster should: (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1) Note: Use the appropriate factors from the PV tables. Multiple Choice buy the equipment, as the net present value of the cost is about $53,000 less. lease the equipment, as the net present value of the cost is about $10,400 less. buy the equipment, as the net present value of the cost is about $10,400 less. О lease the equipment, as the net present value of the cost is about $6,700 less.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning