ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

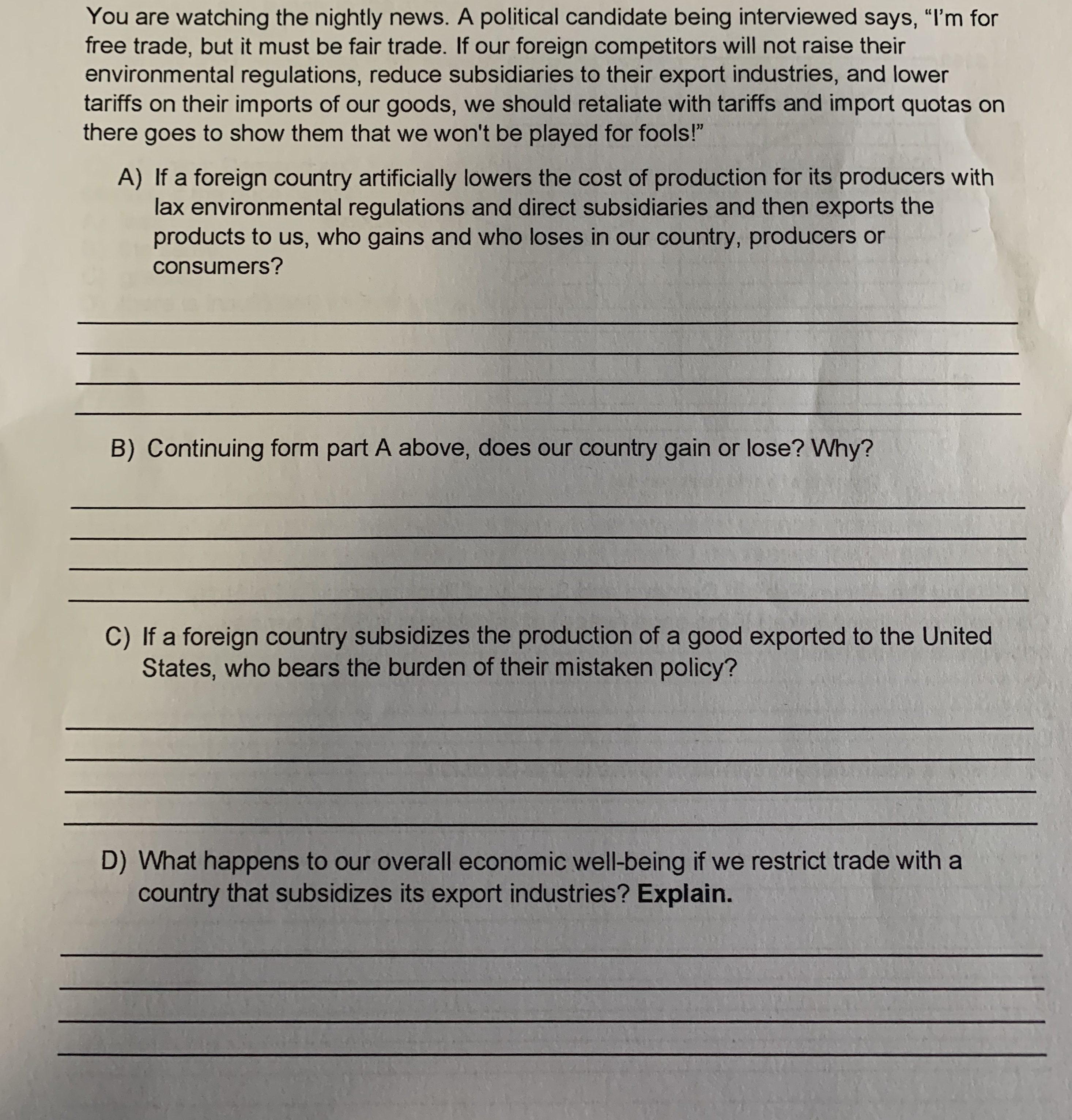

Transcribed Image Text:You are watching the nightly news. A political candidate being interviewed says, "I'm for

free trade, but it must be fair trade. If our foreign competitors will not raise their

environmental regulations, reduce subsidiaries to their export industries, and lower

tariffs on their imports of our goods, we should retaliate with tariffs and import quotas on

there goes to show them that we won't be played for fools!"

A) If a foreign country artificially lowers the cost of production for its producers with

lax environmental regulations and direct subsidiaries and then exports the

products to us, who gains and who loses in our country, producers or

consumers?

B) Continuing form part A above, does our country gain or lose? Why?

C) If a foreign country subsidizes the production of a good exported to the United

States, who bears the burden of their mistaken policy?

D) What happens to our overall economic well-being if we restrict trade with a

country that subsidizes its export industries? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- 40 36 32 28 24 20 16 D 12 8 16 24 32 40 48 56 64 Quantity (millions of shirts per year) The figure shows the market for shirts in the United States, where D is the U.S demand curve and S is the U.S. supply curve. The world price is $20 per shirt. The United States imposes a tariff on imported shirts, $4 per shirt. 18. In the figure above, with the tariff the United States imports shirts per year. million O 24 32 16 Price (dollars per :arrow_forwardThe diagram below shows supply and demand curves for the same good in two countries, A and B. Based on the prices and areas labeled there, Country B P Country A P P3 d P a P D D O The autarky price in Country A is P2. O Country B has a comparative advantage in this good. Moving from autarky to free trade makes suppliers in Country A worse off by the amount a+b. O Moving from autarky to free trade makes demanders in Country B better off by the amount c+d.arrow_forwardIdentify and explain who will make and lose money from this tariff. Identify the people and organizations that will benefit from the tariff. Identify the people and organizations that will suffer because of the tariff. How will the tariff impact your company?arrow_forward

- In an international market, we say that a country will be an (Blank) of a good if it has the (Blank) advantage in producing that good Answer options exporter and comparative exporter and absolute importer and comparative importer and absolutearrow_forwardSuppose that in a day a worker in the United States can produce 10 bushels of corn or 2 shirts. In Russia a worker can produce 9 bushels of corn or 3 shirts in one day. Which of the following would benefit both the United States and Russia if trade occurred? 1 shirt for 6 bushels of corn -----1 shirt for 4 bushels of corn 1 shirt for 1 bushel of corn 1 shirt for 2 bushels of corn Im doing review for a class and I realize that 1 shirt and for bushels are the correct answer I am just confused on what formula would apply to figue this outarrow_forwardDear expert please solve this.arrow_forward

- 3. Import quotas Kazakhstan is a grape producer, as well as an importer of grapes. Suppose the following graph shows Kazakhstan's domestic market for grapes, where SK is the supply curve and DK is the demand curve. The free trade world price of grapes (Pw) is $800 per ton. Suppose Kazakhstan's government restricts imports of grapes to 120,000 tons. The world price of grapes is not affected by the quota. Analyze the effects of the quota on Kazakhstan's welfare. On the following graph, use the purple line (diamond symbol) to draw the Kazakhstan's supply curve including the quota SK+Q. (Hint: Draw this as a straight line even though this curve should be equivalent to the domestic supply curve below the world price.) Then use the grey line (star symbol) to indicate the new price of grapes with a quota of 120,000 grapes. 4000 PRICE (Dollars perton) 3800 3200 2800 2400 2000 1000 1200 800 0 0 St 80 120 160 200 240 200 320 360 QUANTITY (Thousands of tons) Pw SK+Q Price with Quota A Change in…arrow_forwardInternational Trade: End of Chapter Problem In March 2002, then President George W. Bush put a tariff on imported steel as a means of protecting the domestic steel industry. In February, before the tariff went into effect, the United States produced 7.4 million metric tons of crude steel and imported about 2.8 million metric tons of steel products at an average price of $363 per metric ton. Two months later, after the tariff was in effect, U.S. production increased to 7.9 million metric tons. The volume of imported steel fell to about 1.7 million metric tons, but the price of the imported steel rose to about $448 per metric ton. The supply and demand diagram shows this situation (along with an estimated no-trade domestic equilibrium at a price of $625 per metric ton and a quantity of 8.9 million metric tons). For each of the four areas listed, calculate the values of these areas in dollars. How much of the deadweight loss is due to the overproduction of steel by higher-cost U.S. steel…arrow_forwardThe following image shows the market for wheat for the country of Palatino. sº is the domestic supply of wheat, and DD is the domestic demand for wheat. Suppose the world price of wheat is $9 per bushel. Suppose a specific tariff of $6 is imposed on each bushel of wheat imported. The net welfare loss from the tariff is represented by the area Figure 19.4 SO Price($) 25 H 15 A E DD 200 300 600 700 Quantity of Wheat (thousands of bushels) a. B and D b. I and H O c. E O d. F e. A and Carrow_forward

- Consider again this same graph: Price 8 7 6 5 4 3 2 0 1 10 20 30 40 Tariff Domestic demand 80 Domestic supply 70 50 60 World price Quantity Now let's say the economy opens to trade which is initially free. Assume we're dealing with a small economy. Calculate consumer surplus, carefully following all numeric instructions.arrow_forward5 3 2 A B D F 4 C E G I 8 H D S 11 I 7) Use the graph above to answer this question. Initially, Spartania is an autarchy and there is no international trade allowed. Then, the country decides to allow free trade. The world price is $2. Which of the following areas best represents the additional economic surplus created when free trade is permitted? A) G+H B) I C) C+E D) A+B+C E) D+F+E+G+Harrow_forward2. The impact of a tariff Consider a hypothetical example of trade in aluminum between the United States and China. For simplicity, assume that China is the only source of U.S. aluminum imports. The following graph shows the U.S. market for aluminum. Note that in the absence of any trade, the market price for aluminum in the United States is $500 per tonne, and the equilibrium quantity is 250 million tonnes per month. Use the green area (triangle symbol) to show U.S. consumer surplus under free trade with China, and use the purple area (diamond symbol) to show U.S. producer surplus under free trade with China. 1000 Domestic Demand Domestic Supply 900 Consumer Surplus 800 700 Producer Surplus 600 500 400 Free Trade Price 300 200 100 200 250 300 350 400 450 500 50 100 150 QUANTITY OF ALUMINUM (Millions of tonnes per month) PRICE (Dollars per tonne)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education