ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

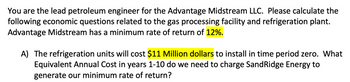

Transcribed Image Text:You are the lead petroleum engineer for the Advantage Midstream LLC. Please calculate the

following economic questions related to the gas processing facility and refrigeration plant.

Advantage Midstream has a minimum rate of return of 12%.

A) The refrigeration units will cost $11 Million dollars to install in time period zero. What

Equivalent Annual Cost in years 1-10 do we need to charge Sand Ridge Energy to

generate our minimum rate of return?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- What is the equivalent annual cost in years 1 through 8.00 of a contract that has a first cost of $78,000 in year 0 and annual costs of $16,000 in years 3 through 8.00? Use an interest rate of 12.00% per year. (Round the final answer to three decimal places.)arrow_forwardProblem 03.041 Shifted Gradients Nippon Steel's expenses for heating and cooling a large manufacturing facility are expected to increase according to an arithmetic gradient beginning in year 2. If the cost is $550,000 this year (year O) and will be $550,000 again in year 1, but then it is estimated to increase by $57,000 each year through year 12, what is the equivalent annual worth in years 1 to 12 of these energy costs at an interest rate of 14% per year? The equivalent annual worth is determined to be $arrow_forwardPlease no written by hand solution Assume that 25 years ago your dad invested $240,000, plus $31,000 in years 2 through 5, and $45,000 per year from year 6 on. Determine the annual retirement amount that he can withdraw forever starting next year (year 26), if the $45,000 annuity stopped at year 25. The interest rate being 12% per year. The annual retirement amount is determined to be $arrow_forward

- Please provide a clear and complete solution. Answer fast for I have 30 minutes left. Thank you very much.arrow_forwardSelf-tightening wedge grips are designed for tensile testing applications up to 1200 pounds.The cash flow associated with the product is shown below. Determine the cumulative cash flow after year 4. Year Revenue, $ Costs, $ 1 7,000 -14,000 The cumulative cash flow after year 4 is $ 2 17,000 -30,000 3 23,000 -22,000 4 19,000 -6,000arrow_forward! Required information Eight years ago, Ohio Valley Trucking purchased a large- capacity dump truck for $102,000 to provide short-haul earth-moving services. The company sold it today for $45,000. Operating and maintenance costs averaged $10,200 per year. A complete overhaul at the end of year 4 costs an extra $3600. Calculate the annual cost of the truck at i = 8% per year. The annual cost of the truck is $- per year.arrow_forward

- Please solve the problem and draw a diagram for the problem, Make sure you post pictures of your work instead of writing it. Please! Thank you for your help.arrow_forwardQuestion Number 5 You will deposit money into a bank account according to the following schedule: Today 4 year from today 6 years from today 8 years from today 12 years from today $182,000 $78,000 $136,000 $115,000 $94,000 After 12 years from today, what will be the purchasing power of the money in your bank account, expressed in today's dollars?. You bank pays interest at 7.000% per year, compounded annually. Inflation is expected to be 4.520% per year.arrow_forwardFind the accumulated amount of P3,967 invested 0.09% compound daily at for a period of 18 years.arrow_forward

- Required information Assume that 25 years ago your dad invested $320,000, plus $32,000 in years 2 through 5, and $49,000 per year from year 6 on. Determine the annual retirement amount that he can withdraw forever starting next year (year 26), if the $49,000 annuity stopped at year 25. The interest rate being 14% per year. The annual retirement amount is determined to be $arrow_forwardA company is considering establishing a new machine to automate a meatpacking process. The machine will save $59,350 in labor annually. The machine can be purchased for $271,296 today and will be used for 8 years. It has a salvage value of $11,071 at the end of its useful life. The new machine will require an annual maintenance cost of $9,594. The corporation has a minimum rate of return of 9.4%. Calculate the NPW.arrow_forwardThe city of Oak Ridge is considering the construction of a three kilometer (km) greenway walking trail. It will cost $1,000 per km to build the trail and $320 per km per year to maintain it over its 23-year life. If the city's MARR is 10% per year, what is the equivalent uniform annual cost of this project? Assume the trail has no residual value at the end of 23 years.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education