ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

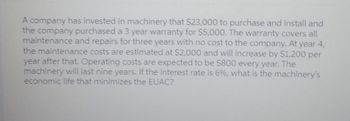

Transcribed Image Text:A company has invested in machinery that $23,000 to purchase and install and

the company purchased a 3 year warranty for $5,000. The warranty covers all

maintenance and repairs for three years with no cost to the company. At year 4,

the maintenance costs are estimated at $2,000 and will increase by $1,200 per

year after that. Operating costs are expected to be $800 every year. The

machinery will last nine years. If the interest rate is 6%, what is the machinery's

economic life that minimizes the EUAC?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The maintenance on a machine is expected to be P155 at the end of the first year and is expected to increase P40 each year for the next 8 years. What sum of money should be set aside now to pay the maintenance. Assume 6% interest Compute the equivalent annual cost.(kindly give the given, complete and detailed solution. Thank you)arrow_forwardDetermine the annual equivalent amount over 4 years for the following cash flow (CF) pattern. The nominal interest rate is 5%, and it is compounded monthly. (EOY = end of year) EOY 0, CF = -$16,500 • EOY 1, CF = -$3,000 • EOY 2, CF = $3,000 • EOY 3, CF = $7,000 • EOY 4, CF = - $7,000 ·arrow_forwardA young professional wishes to have $890000 in her retirement account. Its current value is $13000. She invests $900 monthly in the account which earns 9.7% annually. Find the number of payments needed to reach her goal.arrow_forward

- QUESTION 3 Rajesh would like to buy his first car and the one he has his eye on is $25,000, plus an extra 13% HST for a total price of $28,250. The dealership has a deal for $0 down payment and charges 2.79% interest on the loan. Rajesh plans to make car loan payments weekly and has accepted the maximum loan repayment period of 8 years. How much will his weekly care loan payment be? How much will he have paid to the dealership by the time his loan is paid off? How much interest will be paid?arrow_forwardAn electronic device is available that will reduce this year's labor costs by $8,000. The equipment is expected to last for 10 years. Labor costs increase at a rate of 5% per year and the interest rate is 10% per year. a. What is the maximum amount that we could justify spending for the device? b. What is the uniform annual equivalent value (A) of the labor costs over the eight-year period?arrow_forwardThe repair cost for an equipment starts at $80.00 at the end of the 1st year and increases at a rate of 6% every year. The useful life of the equipment is 5 years and it has no salvage value. If the interest rate is 8%, the present worth of the repair costs of this equipment is:arrow_forward

- Question 1 In planning for your retirement, you would like to withdraw $60,000 per year for 12 years. The first withdrawal will occur 20 years from today. Click here to access the TVM Factor Table Calculator What amount must you invest today if your return is 10% per year? $ Round entry to the nearest dollar. Tolerance is +4.arrow_forwardA firm will install one of two mechanical devices to reduce costs. Both devices have useful lives of 5 years and no salvage value. Device A costs $10,000 and can be expected to result in $3000 savings annually. Device B costs $13,500 and will provide cost savings of $3000 the first year, but savings will increase $500 annually, making the second-year savings $3500, the third-year savings $4000, and so forth. With interest at 7%, which device should the firm purchase?arrow_forwardBook sales of a popular author are expected to start at 500,000 books in the first month. This numbe is expected to decrease by 8,000 books each month over the three-year study period. The author receives $5 per book sold. If the author places all monies received in a bank account eaming 1% interest per month, what is the present (time 0) equivalent value of the three years of book sales? Sales money is received at the end of each month and the first receipt will be one month from today.arrow_forward

- Typed answerarrow_forwardAnnual thermal loss through the pipe lines of a factory is estimated to be $412 in terms of wasted energy. A new anti-heating technology can reduce the energy loss by 93% and costs for $1232. Although this new technology has no salvage value but it helps the factory to save much energy for upcoming 8 Years. Identify the present worth of the entire investment if the market rate is 10%.arrow_forwardTrue Car of Columbia, SC advertised a Ford EcoSport (2019) at $23,178. The EcoSport is a sporty smaller SUV that is perfect for the recent college graduate/young professional. Given that the repayment period is 5 years and the interest on the loan is 3.99%, what are the likely monthly car payments on this loan?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education