Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

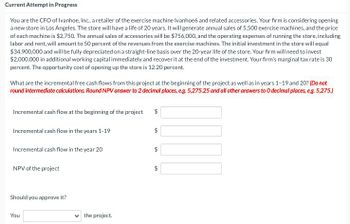

Transcribed Image Text:Current Attempt in Progress

You are the CFO of Ivanhoe, Inc., a retailer of the exercise machine Ivanhoe6 and related accessories. Your firm is considering opening

a new store in Los Angeles. The store will have a life of 20 years. It will generate annual sales of 5,500 exercise machines, and the price

of each machine is $2,750. The annual sales of accessories will be $756,000, and the operating expenses of running the store, including

labor and rent, will amount to 50 percent of the revenues from the exercise machines. The initial investment in the store will equal

$34,900,000 and will be fully depreciated on a straight-line basis over the 20-year life of the store. Your firm will need to invest

$2,000,000 in additional working capital immediately and recover it at the end of the investment. Your firm's marginal tax rate is 30

percent. The opportunity cost of opening up the store is 12.20 percent.

What are the incremental free cash flows from this project at the beginning of the project as well as in years 1-19 and 20? (Do not

round intermediate calculations. Round NPV answer to 2 decimal places, e.g. 5,275.25 and all other answers to O decimal places, e.g. 5,275.)

Incremental cash flow at the beginning of the project

$

Incremental cash flow in the years 1-19

Incremental cash flow in the year 20

NPV of the project

Should you approve it?

You

the project.

$

+A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Business at your design engineering firm has been brisk. To keep up with the increasing workload, you are considering the purchase of a new state-of-the-art CAD/CAM system costing $550,000, which would provide 4,500 hours of productive time per year. Your firm puts a lot of effort into drawing new product designs. At present, this is all done by design engineers on an old CAD/CAM system installed five years ago. If you purchase the system, 40% of the productive time will be devoted to drawing (CAD) and the remainder to CAM. While drawing, the system is expected to out-produce the old CAD/CAM system by a factor of 2.1. You estimate that the additional annual out-of-pocket cost of maintaining the new CAD/CAM system will be $155,000, including any tax effects. The expected useful life of the system is eight years, after which the equipment will have no residual value. As an alternative, you could hire more design engineers. Each normally works 1,800 hours per year, and 50% of this time is…arrow_forwardAfter spending $9,600 on client-development, you have just been offered a big production contract by a new client. The contract will add $196,000 to your revenues for each of the next five years and it will cost you $96,000 per year to make the additional product. You will have to use some existing equipment and buy new equipment as well. The existing equipment is fully depreciated, but could be sold for $45,000 now. If you use it in the project, it will be worthless at the end of the project. You will buy new equipment valued at $29,000 and use the 5-year MACRS schedule to depreciate it. It will be worthless at the end of the project. Your current production manager earns $79,000 per year. Since she is busy with ongoing projects, you are planning to hire an assistant at$38,000 per year to help with the expansion. You will have to immediately increase your inventory from $20,000 to $30,000. It will return to $20,000 at the end of the project is 21% and your discount rate is 14.7%. What…arrow_forwardneed answer in step by steparrow_forward

- You are investigating the cost of project to renovate the kitchens in a large apartment building, the payments for this work will be $32,500 up front and $13500 a month for 8 months, followed by a completion payment of $31500. To start this project you will need to purchase equipment for $70,000 at the beginning of the project and you expect monthly materials and operating costs to be about $7,500. The Rate of Return is 12%. What is the total PV of the 8 monthly payments of $13500 per month. You should assume that the payments are made at the end months 1 through 8. (So this is a ordinary simple annuity). Round your answer to the nearest penny. Your Answer: Answerarrow_forwardNatural Foods Inc. is planning to invest in new manufacturing equipment to make a new garden tool. The new garden tool is expected to generate additional annual sales of 7,600 units at $38 each. The new manufacturing equipment will cost $123,500 and is expected to have a 10-year life and a $9,500 residual value. Selling expenses related to the new product are expected to be 5% of sales revenue. The cost to manufacture the product includes the following on a per-unit basis: Direct labor $6.50 Direct materials 21.00 Fixed factory overhead-depreciation 1.50 Variable factory overhead 3.30 Total $32.30 Determine the net cash flows for the first year of the project, Years 2–9, and for the last year of the project. Use the minus sign to indicate cash outflows. Do not round your intermediate calculations but, if required, round your final answers to the nearest dollar. Natural Foods Inc.Net Cash Flows Year 1 Years 2-9 Last Year Initial investment $fill in the blank 1…arrow_forwardHeer Enterprises needs someone to supply it with 160,000 cartons of machine screws per year to support its manufacturing needs over the next three years, and you've decided to bid on the contract. It will cost you $840,000 to install the equipment necessary to start production and you estimate that it can be salvaged for $160,000 at the end of the three-year contract. Your fixed production costs will be $290,000 per year, and your variable production costs should be $8.50 per carton. If you require a 12 percent return on your investment, what is the minimum bid price you should submit?arrow_forward

- You are considering whether or not to purchase another new air conditioner refrigerant recovery machine that costs RM13600.00 per piece. He knows that his total earnings for the past three years (sales for air conditioning service) have averaged RM33600.00 per year for 5 working days a week and have remained steady. You are sure that you will be able to sell another 200 air conditioning service per year for RM80.00 labor a piece as a result of having this new capability. You decided: i. Calculate and explain what would your shop ROI be over three years by taking this opportunity based on the information. ii. Calculate the ROI percentage (%) for the new machine's sales.arrow_forwarda. Campbell Manufacturing is considering the purchase of a new welding system. The cash benefits will be $480,000 per year. The system costs $2,450,000 and will last 10 years. b. Evee Cardenas is interested in investing in a women's specialty shop. The cost of the investment is $230,000. She estimates that the return from owning her own shop will be $55,000 per year. She estimates that the shop will have a useful life of 6 years. c. Barker Company calculated the NPV of a project and found it to be $63,900. The project's life was estimated to be 8 years. The required rate of return used for the NPV calculation was 10%. The project was expected to produce annual after-tax cash flows of $135,000. Required: 1. Compute the NPV for Campbell Manufacturing, assuming a discount rate of 12%. If required, round all present value calculations to the nearest dollar. Use the minus sign to indicate a negative NPV. Should the company buy the new welding system? Yes 2. Conceptual Connection: Assuming a…arrow_forwardplease show work i need to learn this. Cameron Industries is purchasing a new chemical vapor depositor in order to make silicon chips. It will cost $7,000,000 to buy the machine and $10,000 to have it delivered and installed. Building a clean room in the plant for the machine will cost an additional $3 million. The machine is expected to raise revenues by $3,000,000 per year, starting at the end of the first year, with associated costs (other than depreciation) of $1 million for each of those years. The machine is expected to have a working life of six years and will be depreciated over those six years. The marginal tax rate is 20%. What are the incremental free cash flows associated with the new machine in year 2? O $1,168,333 $831,667 $1,833,667 $1,165,000 O $665,334arrow_forward

- Big Rock Brewery currently rents a bottling machine for $55,000 per year, including all maintenance expenses. The company is considering purchasing a machine instead and is comparing two options: a. Purchase the machine it is currently renting for $165,000. This machine will require $20,000 per year in ongoing maintenance expenses. b. Purchase a new, more advanced machine for $260,000. This machine will require $16,000 per year in ongoing maintenance expenses and will lower bottling costs by $11,000 per year. Also, $39,000 will be spent upfront in training the new operators of the machine. Suppose the appropriate discount rate is 9% per year and the machine is purchased today. Maintenance and bottling costs are paid at the end of each year, as is the rental of the machine. Assume also that the machines are subject to a CCA rate of 45% and there will be a negligible salvage value in ten year's time (the end of each machine's life). The marginal corporate tax rate is 35%. Should Big Rock…arrow_forwardHELP MEarrow_forwardHardevarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education