FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

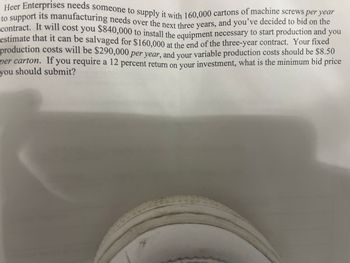

Transcribed Image Text:Heer Enterprises needs someone to supply it with 160,000 cartons of machine screws per year

to support its manufacturing needs over the next three years, and you've decided to bid on the

contract. It will cost you $840,000 to install the equipment necessary to start production and you

estimate that it can be salvaged for $160,000 at the end of the three-year contract. Your fixed

production costs will be $290,000 per year, and your variable production costs should be $8.50

per carton. If you require a 12 percent return on your investment, what is the minimum bid price

you should submit?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Your factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be $5.06 million per year. Your upfront setup costs to be ready to produce the part would be $7.97 million. Your discount rate for this contract is 8.1%. a. What is the IRR? b. The NPV is $5.05 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule?arrow_forwardYour company is deciding whether to purchase a high-quality printer for your office or one of lesser quality. The high-quality printer costs $45 000 and should last five years. The lesser quality printer costs $25 000 and should last two years. If the cost of capital for the company is 12 per cent, then what is the equivalent annual cost for the best choice for the company?arrow_forwardBRAC is considering investing $100000 in a new machine with an expected life of 5 years. The machine will have no scrap value at the end of the 5 years. It is expected that 20000 units will be sold each year at a selling prices of $6.00 per unit. Variable production costs are expected to $2.30 per unit, while incremental fixed costs, mainly the wages of a maintenance engineer, are expected to be $10000 per years. BRAC uses a discount rate of 11% for investment appraisal purposes and expects investment projects to recover their initial investment within two years. Required: (1) Explain why risk and uncertainty should be considered in the investment appraisal process. (2) Calculate and comment on the payback period of the project. (3) Evaluate the sensitivity of the projects net present value to a change in the following project variables: sales volume sales price variable cost and discuss the…arrow_forward

- Consider a project to supply Detroit with 27,000 tons of machine screws annually for automobile production. You will need an initial $6,000,000 investment in threading equipment to get the project started; the project will last for 6 years. The accounting department estimates that annual fixed costs will be $1,450,000 and that variable costs should be $275 per ton; accounting will depreciate the initial fixed asset investment straight-line to zero over the 6-year project life. It also estimates a salvage value of $825,000 after dismantling costs. The marketing department estimates that the automakers will let the contract at a selling price of $392 per ton. The engineering department estimates you will need an initial net working capital investment of $580,000. You require a return of 11 percent and face a tax rate of 22 percent on this project. a-1. What is the estimated OCF for this project? (Do not round intermediate calculations. and round your answer to the nearest whole number,…arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be $5.02 million per year. Your upfront setup costs to be ready to produce the part would be $7.99 million. Your discount rate for this contract is 7.6%. a. What is the IRR? b. The NPV is $5.04 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule? a. What is the IRR? The IRR is %. (Round to two decimal places.)arrow_forwardVikarmbhaiarrow_forward

- HELP MEarrow_forwardThe company would like you to look at a new project. This project involves the purchase of a new $2,000,000 fully auto mated plasma cutter that can be used in our metal works division. The products manufactured using the new technol ogy are expected to sell for an average price of $300 per unit, and the company analyst expects that the firm can sell 20,000 units per year at this price for a period of five years. The cutter will have a residual or savage value of $200,000. at the end of the project's five-year te. The firm also expects to have to invest an additional $300,000 in working capital to support the new business. Other pertinent Information concerning the business venture is as follows: (look at the picture attached) a) Estimate the cash flows for the investment under the listed base-case assumptions. Calculate the project NPV for these cash flows. b) Evaluate the NPV of the investment under the worst-case and best-case assumptions.arrow_forwardEsquire Company needs to acquire a molding machine to be used in its manufacturing process. Two types of machines that would be appropriate are presently on the market. The company has determined the following: Machine A could be purchased for $33,000. It will last 10 years with annual maintenance costs of $1,100 per year. After 10 years the machine can be sold for $3,465. Machine B could be purchased for $27,500. It also will last 10 years and will require maintenance costs of $4,400 in year three, $5,500 in year six, and $6,600 in year eight. After 10 years, the machine will have no salvage value. Required: Assume an interest rate of 8% properly reflects the time value of money in this situation and that maintenance costs are paid at the end of each year. Ignore income tax considerations. Calculate the present value of Machine A & Machine B. Which machine Esquire should purchase?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education