FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

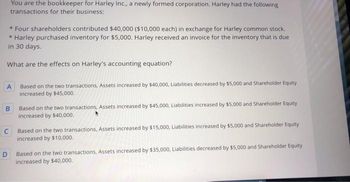

Transcribed Image Text:You are the bookkeeper for Harley Inc., a newly formed corporation. Harley had the following

transactions for their business:

* Four shareholders contributed $40,000 ($10,000 each) in exchange for Harley common stock.

* Harley purchased inventory for $5,000. Harley received an invoice for the inventory that is due

in 30 days.

What are the effects on Harley's accounting equation?

A

B

D

Based on the two transactions, Assets increased by $40,000, Liabilities decreased by $5,000 and Shareholder Equity

increased by $45,000.

Based on the two transactions, Assets increased by $45,000, Liabilities increased by $5,000 and Shareholder Equity

increased by $40,000.

C Based on the two transactions, Assets increased by $15,000, Liabilities increased by $5,000 and Shareholder Equity

increased by $10,000.

Based on the two transactions, Assets increased by $35,000, Liabilities decreased by $5,000 and Shareholder Equity

increased by $40,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hello, I need help with these T-Charts and an explanation of the debits and credits.arrow_forwardFollowing are the transactions and adjustments that occurred during the first year of operations at Kissick Company. Issued 800,000 shares of $5-par-value common stock for $400,000 in cash. Borrowed $200,000 from Oglesby National Bank and signed a 8% note due in three years. Incurred and paid $160,000 in salaries for the year. Purchased $301,000 of merchandise inventory on account during the year. Sold inventory costing $205,000 for a total of $250,000, all on credit. Paid rent of $44,000 on the sales facilities during the first 11 months of the year. Purchased $60,000 of store equipment, paying $18,000 in cash and agreeing to pay the difference within 90 days. Paid the entire $42,000 owed for store equipment and $227,000 of the amount due to suppliers for credit purchases previously recorded. Incurred and paid utilities expense of $15,000 during the year. Collected $221,000 in cash from customers during the year for credit sales previously recorded. At year-end, accrued $16,000 of…arrow_forwardDuring its first year of operations, a company entered into the following transactions: • Borrowed $5,150 from the bank by signing a promissory note. • Issued stock to owners for $11,500. • Purchased $1,150 of supplies on account. Paid $550 to suppliers as payment on account for the supplies purchased. What is the amount of total assets at the end of the year? Multiple Choice O O $17,250 $17,800 $5,750 $16,650arrow_forward

- please help mearrow_forwardABC Company ended Year 1 with the following account balances: Cash 600, Common Stock 400, and Retained Earnings 200. The following transactions occurred during Year 2: • Issued common stock for $19,000 cash. • ABC borrowed an additional $11,000 from Chris Bank. • ABC earned $9,000 of revenue on account. • ABC incurred $4,000 of operating expenses on account. • Cash collections of accounts receivables were $6,000. • ABC provided additional services to customers for $1,000 cash. • ABC purchased land for $14,000. • ABC used $3,000 in cash to make a partial payment on its accounts payable. • ABC declared and paid a $200 dividend to the stockholders • On December 31 ABC had accrued salaries of $4,000. What is the net cash flow from operating activities shown on the statement of cash flows for the year ending December 31, Year 2? Multiple Choice O O $4,000 $3,800 $6,000 None of these answer choices is correct.arrow_forwardQuestion (I got $44,000... correct?): Riley Company began operations on August 1, 2026 and entered into the following transactions during 2026: 1. On August 1, Riley Company sold common stock to owners in the amount of $60,000 and borrowed $48,000 from a local bank on a 10-month, 10% note payable. 2. On August 14, Riley Company purchased inventory for $42,000 cash. 3. On September 1, Riley Company purchased a 3-year insurance policy for $27,000 cash. 4. On September 19, Riley Company purchased land for $30,000 cash. 5. On October 28, Riley Company sold two-thirds of the inventory that was purchased on August 14 to a customer for $62,000 cash. 6. On December 3, Riley Company sold the land that was purchased on September 19 for $19,000 cash. 7. On December 31, Riley recorded all necessary adjusting entries. Calculate the amount of total expenses reported in Riley Company's 2026 income statement after all of the above transactions have been recorded and posted.arrow_forward

- On November 1 of the current year, Rob Elliot invested $30,500.00 of his cash to form a corporation, GGE Enterprises Inc., in exchange for shares of common stock. No other common stock was issued during November or December. After a very successful first month of operations, the retained earnings as of November 30 were reported at $5,000.00. After all transactions have been entered into the accounting equation for the month of December, the ending balances for selected items on December 31 follow. On that date, the financial statements were prepared. The balance sheet reported total assets of $54,400.00 and total stockholders' equity of $38,955.00. 6. What is the amount of profit or loss during December? 7. What were the total expenses for December? 8. How much was paid for rent?arrow_forwardCordell Inc. experienced the following events in Year 1, its first year of operation: 1. Received $44,000 cash from the issue of common stock. 2. Performed services on account for $72,000. 3. Paid a $4,400 cash dividend to the stockholders. 4. Collected $50,000 of the accounts receivable. 5. Paid $44,000 cash for other operating expenses. 6. Performed services for $16,500 cash. 7. Recognized $1,400 of accrued utilities expense at the end of the year. Required a. & c. Identify the events that result in revenue or expense recognition and those which affect the statement of cash flows. In the Statement of Cash Flows column, use OA to designate operating activity, FA for financing activity, or IA for investing activity. IF element is not affected by the event, leave the cell blank. b. Based on your response to Requirement a, determine the amount of net income reported on the Year 1 income statement. d. Based on your response to Requirement c, determine the amount of cash flow from…arrow_forwardHertz Rent A Car provided the following information at the end of the year: Purchased treasury stock with a cost of $15,000 during the year. Paid dividends of $20,000 Issued bonds payable for proceeds of $866,000. Cash flows from financing activities for for the year were:arrow_forward

- Maben Company was started on January 1, Year 1, and experienced the following events during its first year of operation: 1. Acquired $30,000 cash from the issue of common stock. 2. Borrowed $40,000 cash from National Bank. 3. Earned cash revenues of $48,000 for performing services. 4. Paid cash expenses of $45,000. 5. Paid a $1,000 cash dividend to the stockholders. 6. Acquired an additional $20,000 cash from the issue of common stock. 7. Paid $10,000 cash to reduce the principal balance of the bank note. 8. Paid $53,000 cash to purchase land. 9. Determined that the market value of the land is $75,000. e. Determine the net cash flows from operating activities, investing activities, and financing activities that Maben would report on the Year 1 statement of cash flows. Note: Enter cash outflows as negative amounts. Net cash flows from operating activities Net cash flows from investing activities Net cash flows from financing activitiesarrow_forwardLabel each transaction as an Operating Activity, Investing activity, or Financing Activity and if it is an inflow or (outflow). 1. Drake issued 10,000 shares of common stock for $40,000 2. Drake collected $80,000 from customers on Accounts Receivables 3. Drake Paid $5,000 in interest payments on their bonds 4. Drake purchased a new copy machine and paid cash of $35,000 5. Drake sold their old copy machine for $2,000 cash 6. Drake paid a $4,500 dividend to shareholders 7. Drake borrowed $40,000 cash from the bank on December 28,2019 (payments begin 1/28/20) 8. Drake purchased a patent for $15,000 cash 9. Drake paid $65,000 cash in wages during 2019 10. Drake paid 2018 taxes due in the amount of $10,500 on April 15, 2019 Indicate the total net cashflow (Inflow-Outflow) from above for each classification: Operating Investing Financingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education