FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

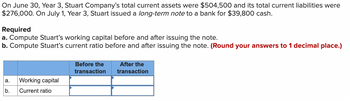

Transcribed Image Text:On June 30, Year 3, Stuart Company’s total current assets were $504,500 and its total current liabilities were $276,000. On July 1, Year 3, Stuart issued a long-term note to a bank for $39,800 cash.

**Required**

a. Compute Stuart’s working capital before and after issuing the note.

b. Compute Stuart’s current ratio before and after issuing the note. **(Round your answers to 1 decimal place.)**

| | Before the transaction | After the transaction |

|------------------------------|------------------------|-----------------------|

| a. Working capital | | |

| b. Current ratio | | |

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Malco Enterprises issued $12,00 of common stock when the company was started. In addition, Malco borrowed $38,000 from a local bank on July 1, Year 1. The note had a 6 percent annual interest rate and a one-year term to maturity. Malco Enterprises recognized $74,700 of revenue on account in Year 1 and $87,200 of revenue on account in Year 2. Cash collections of accounts receivable were $63,300 in Year 1 and $73,500 in Year 2. Malco paid $40,800 of other operating expenses in Year 1 and $47,000 of other operating expenses in Year 2. Malco repaid the loan and interest at the maturity date. Based on this information given above, record the events in the accounting equation then answer the following questions. Enter any decreases to account balances with a minus sign. a. what amount of interest expense would Malco report on the Year 1 income statement? b. what amount of net cash flow from operating activites would Malco report on the Year 1 statement of cash flows? c. what amount of…arrow_forwardE6B. At year end, Paige Company had currency and coins in cash registers of $2,800, money orders from customers of $5,000, deposits in checking accounts of $32,000, U.S. Treasury bills due in 80 days of $90,000, certificates of deposit at the bank that mature in six months of $100,000, and U.S. Treasury bonds due in one year of $50,000. Calculate the amount of cash and cash equivalents that will be shown on the company's year-end balance sheet.arrow_forwardes Specter Company combines cash and cash equivalents on the balance sheet. Using the following information, determine the amount reported on the year-end balance sheet for cash and cash equivalents. ● $7,000 cash deposit in checking account. . $28,000 bond investment due in 20 years. . $7,000 U.S. Treasury bill due in 1 month. . $400, 3-year loan to an employee. • $1,800 of currency and coins. . $700 of accounts receivable. Checking account Bond investment U.S. Treasury bill Loan to an employee. Currency and coins Accounts receivable $ Amount Total Cash and cash equivalents 7,000 28,000 7,000 400 1,800 700 Included in Cash and Cash Equivalents? Cash and Cash Equivalents Amount $ $ 0 0 0 0 0 0 0arrow_forward

- Zirkle Company borrowed $129,000 from Plains Bank on July 31, Year 1. The note carried a 6% interest rate with a one-year term to maturity. Required: a. Show the effects of borrowing the money and the December 31, Year 1 adjustment on the accounting equation. b. What is the amount of interest expense for Year 1? c. Prepare a statement of cash flows for the Zirkle Company for Year 1. Complete this question by entering your answers in the tabs below. Required A Required B Required C Prepare a statement of cash flows for the Zirkle Company for Year 1. Note: Cash outflows should be indicated with a minus sign. ZIRKLE COMPANY Statement of Cash Flows For the Year Ended December 31, Year 1 Cash flows from operating activities Net cash flow from operating activities Cash flows from investing activities Net cash flow from investing activities Cash flows from financing activities Net cash flow from financing activities < Required B Required Carrow_forward! Required information [The following information applies to the questions displayed below.] On January 1, 2024, the general ledger of 3D Family Fireworks includes the following account balances: Accounts Cash Debit Credit $25,300 Accounts Receivable 14,300 Allowance for Uncollectible Accounts $1,600 Supplies 3,200 Notes Receivable (6%, due in 2 years) 27,000 Land 77,700 Accounts Payable 9,800 103,000 33,100 $147,500 $147,500 Common Stock Retained Earnings Totals During January 2024, the following transactions occur: January 2 Provide services to customers for cash, $42,100. Write off accounts receivable as uncollectible, $1,800. (Assume the company uses the allowance method) Pay cash for salaries, $32,100. January 6 Provide services to customers on account, $79,400. January 15 January 20 January 22 Receive cash on accounts receivable, $77,000. January 25 Pay cash on accounts payable, $6,200. January 30 Pay cash for utilities during January, $14,400. 3. Prepare an adjusted trial…arrow_forwardsviarrow_forward

- On January 1, 2024, the general ledger of 3D Family Fireworks includes the following account balances: Accounts Cash Accounts Receivable Allowance for Uncollectible Accounts Supplies Notes Receivable (6%, due in 2 years) Land Accounts Payable Common Stock Retained Earnings Totals Debit $27,300 15,300 4, 200 21,000 80,600 a-1. The receivables turnover ratio is a-2. The company collecting cash from customers b-1. Allowance for Uncollectible Accounts ratio b-2. The company expects an $148,400 Credit $1,600 During January 2024, the following transactions occur: January 2 January 6 Provide services to customers for cash, $52,100. Provide services to customers on account, $89,400. January 15 Write off accounts receivable as uncollectible, $3,900. (Assume the company uses the allowance method) Pay cash for salaries, $33,100. January 20 January 22 Receive cash on accounts receivable, $87,000. January 25 Pay cash on accounts payable, $7,200. January 30 Pay cash for utilities during January,…arrow_forwardThe following transactions apply to Hooper Co. for Year 1, its first year of operations: 1. Issued $130,000 of common stock for cash. 2. Provided $100,000 of services on account. 3. Collected $88,000 cash from accounts receivable. 4. Loaned $11,000 to Mosby Co. on November 30, Year 1. The note had a one-year term to maturity and a 6 percen interest rate. 5. Paid $34,000 of salaries expense for the year. 6. Paid a $2,000 dividend to the stockholders. 7. Recorded the accrued interest on December 31, Year 1 (see item 4). 8. Estimated that 1 percent of service revenue will be uncollectible. Problem 5-26A (Algo) Part b b. Prepare the income statement, balance sheet, and statement of cash flows for Year 1.arrow_forwardOn May 1, Year 1, Benz's Sandwich Shop loaned $12,000 to Mark Henry for one year at 9 percent interest. Required: a. What is Benz's interest income for Year 1? b. What is Benz's total amount of receivables at December 31, Year 1? c. How will the loan and interest be reported on Benz's Year 1 statement of cash flows? d. What is Benz's interest income for Year 2? e. What is the total amount of cash that Benz's will collect in Year 2 from Mark Henry? f. How will the loan and interest be reported on Benz's Year 2 statement of cash flows? g. What is the total amount of interest that Benz's earned on the loan to Mark Henry? Note: For all requirements, round your answers to the nearest dollar amount. a. b. ذان C. e f. f. g. × Answer is not complete. Interest income Receivables Cash used in investing activities Interest income Cash Cash provided by operating activities Cash provided by investing activities Interest earned P ✔ >>arrow_forward

- Rainey Enterprises loaned $50,000 to Small Co. on June 1, Year 1, for one year at 6 percent interest. Required Show the effects of the following transactions in a horizontal statements. In the Cash Flow column, indicate whether the item is an operating activity (OA), an investing activity (IA), or a financing activity (FA). For any element not affected by the event, leave the cell blank. (Not every cell will require entry. Do not round intermediate calculations. Enter any decreases to account balances and cash outflows with a minus sign. Round your answers to the nearest whole dollar.) (1) The loan to Small Co. (2) The adjusting entry at December 31, Year 1. (3) The adjusting entry and collection of the note on June 1, Year 2. RAINEY ENTERPRISES Horizontal Statements Model Assets Equity Income Statement Date Statement of Cash Flow Liabilities Notes Receivable Interest Retained Earnings Cash Receivable Revenue Expense Net Income 1.6/1/Y1 2. 1201/Y1 a. 6/1/Y2 (Adjusting entry) 6/1/Y2…arrow_forwardOrtiz Lumber Yard has a current accounts receivable balance of $400,000 and accounts payable of 700,000. Its sales for the year just ended were $3,350,000. Days sales outstanding is ____ days. Round it to two decimal places.arrow_forwardThe following information is available from the annual reports of Pharoah Company and Novak Corp. Companies. Sales Beginning receivables, net Ending receivables, net 1. 2. 1. (In millions) 2. Pharoah Company $128,000 Based on the preceding information, compute the following for each company: (Round answers to 1 decimal place, e.g. 15.2. Use 365 days for calculation.) 23,300 Accounts receivable turnover 16,300 Average collection period Novak Corp. $43,000 4,000 Accounts receivable turnover. (Assume all sales were credit sales.) Average collection period. 4,800 Pharoah Company times. days Novak Corp. times days.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education