FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

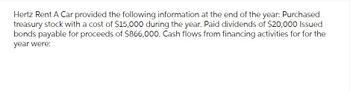

Transcribed Image Text:Hertz Rent A Car provided the following information at the end of the year: Purchased

treasury stock with a cost of $15,000 during the year. Paid dividends of $20,000 Issued

bonds payable for proceeds of $866,000. Cash flows from financing activities for for the

year were:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Selected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forwardSherwood, Inc., the parent company of Frito-Lay snack foods and Sherwood beverages, had the following current assets and current liabilities at the end of two recent years: Line Item Description Current Year(in millions) Previous Year(in millions) Cash and cash equivalents $4,611 $4,986 Short-term investments, at cost 3,275 9,259 Accounts and notes receivable, net 10,411 9,497 Inventories 1,445 963 Prepaid expenses and other current assets 481 356 Short-term obligations 385 4,089 Accounts payable 9,245 9,101 a. Determine the (1) current ratio and (2) quick ratio for both years. Round your answers to one decimal place. Line Item Description Current Year Previous Year 1. Current ratio ? ? 2. Quick ratio ? ? slightly over this time period. Both the current and quick ratios have fill in the blank 2 of 4 . Sherwood is a fill in the blank 3 of 4 company with fill in the blank 4 of 4 resources…arrow_forwardThe income statement for Dodson Corporation reported net income of $22,400 for the year ended December 31 before considering the following: During the year the company purchased available-for-sale securities. At year end, the fair value of the investment portfolio was $2,100 more than cost. The balance of Retained Earnings was $83,000 on January 1. . Dodson Corporation paid $9,000 in cash dividends during the year. Calculate the balance of Retained Earnings on December 31. 51,600arrow_forward

- Green Moose Company has the following end-of-year balance sheet: Green Moose Company Balance Sheet For the Year Ended on December 31 Assets Liabilities Current Assets: Current Liabilities: Cash and equivalents $150,000 Accounts payable $250,000 Accounts receivable 400,000 Accrued liabilities 150,000 Inventories 350,000 Notes payable 100,000 Total Current Assets $900,000 Total Current Liabilities $500,000 Net Fixed Assets: Long-Term Bonds 1,000,000 Net plant and equipment $2,100,000 Total Debt $1,500,000 (cost minus depreciation) Common Equity Common stock 800,000 Retained earnings 700,000 Total Common Equity $1,500,000 Total Assets $3,000,000 Total Liabilities and Equity $3,000,000 The firm is currently in the process of forecasting sales, asset requirements, and required funding for the coming year. In the year that just ended, Green Moose Company generated $350,000 net income on sales of $13,000,000. The firm…arrow_forwardGympa reported on its income statement a net income $647,000 for the year ended December 31 before considering the following: a. During the year, Gympa purchased trading securities b. At year-end , the fair value of the investment portfolio was $50,000 lesshan the cost c. The balance of Retained Earnings was $792,000 on January 1 d. Gympa paid $67,000 in cash dividends during the year. Using the above data, calculate the balance of Retained Earnings on Decemeber 31.arrow_forwardCash dividends of $78,312 were declared during the year. Cash dividends payable were $12,000 and $13,834 at the beginning and end of the year, respectively. Determine the amount of cash for the payment of dividends during the year.arrow_forward

- Working capital: Winston Electronics reported the following information at its annual meetings. The company had cash and marketable securities worth $1,236,761, accounts payables worth $4,159,857, inventory of $7,122,108, accounts receivables of $3,488,872, notes payable worth $1,152,718, and other current assets of $121,748. What is the company’s net working capital?arrow_forwardThe Butler-Huron Company's balance sheet and income statement for last year are as follows: Balance Sheet (in Millions of Dollars) Assets Cash and marketable securities Accounts receivable* Inventories** Other current assets Total current assets Plant and equipment (net) Other assets Total assets $82 820 1,507 22 $2,431 3,967 6,460 $6,460 Liabilities and Equity Accounts payable****** Accrued liabilities (salaries and benefits) Other current liabilities Total current liabilities Long-term debt and other liabilities Earnings before taxes Taxes Earnings after taxes (net income) Common stock Retained earnings Net sales Cost of sales Selling, general, and administrative expenses Other expenses Total expenses Total stockholders' equity Total liabilities and equity **Assume that average inventory over the year was the same as ending inventory. ***Assume that average accounts payable are the same as ending accounts payable. Income Statement (in Millions of Dollars) *Assume that all sales are…arrow_forwardSelected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $51,900; total assets, $169,400; common stock, $85,000; and retained earnings, $45,550.) Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets CABOT CORPORATION Income Statement CABOT CORPORATION Balance Sheet December 31 of current year Liabilities and Equity $ 22,000 Accounts payable 8,800 Accrued wages payable 33,400 Income taxes payable 34,150 Long-term note payable, secured by mortgage on plant assets 2,850 152,300 Common stock Retained earnings $ 253,500 Total liabilities and equity For Current Year Ended December 31 Sales Cost of goods sold Gross profit Operating expenses Interest expense Income before taxes Income tax expense Net income $ 450,600 298,050 152,550 98,900 4,500 49,150 19,800 $ 29,350 $ 15,500 4,000 3,700…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education