FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ges

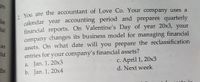

You are the accountant of Love Co. Your company uses a

calendar year accounting period and prepares quarterly

financial reports. On Valentine's Day of year 20x3, your

company changes its business model for managing financial

assets. On what date will you prepare the reclassification

entries for your company's financial assets?

lar

cial

an

cial

C. April 1, 20x3

d. Next week

a. Jan. 1, 20x3

the

b. Jan. 1, 20x4

oto ig

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Select all that apply Vance Co. allows employees to take a two week vacation each year. To account for the two weeks off each year, Dante will record an adjusting entry to which of the following accounts? Multiple select question. Credit to Salaries and Wages Payable. Credit to Cash. Debit to Cash. Credit to Vacation Benefits Payable. Debit to Vacation Benefits Expense. Debit to Salaries and Wages Expense.arrow_forwardOmega Company adjusts its accounts at the end of each month. The following information has been assembled in order to prepare the required adjusting entries at December 31, Year 1: (1) A one-year bank loan of $684,000 at an annual interest rate of 10% had been obtained on December 1, Year 1. (2) The company pays all employees up-to-date each Friday. Since December 31, Year 1, fell on Tuesday, there was a liability to employees at that date for two day's pay amounting to $6,200. (3) On December 1, Year 1, rent on the office building had been paid for four months. The monthly rent is $5,400. (4) Depreciation of office equipment is based on an estimated useful life of six years. The balance in the Office Equipment account is $15,120; no change has occurred in the account during the year. (5) Fees of $9,200 were earned during the month for clients who had paid in advance. By what amount will the book value of the office equipment decline after the appropriate December…arrow_forwardPlese do the exercise: By the end of December 2021, Greta Thunberg, chief accountant of Silence is working to finish his accounting for the year. He realizes that he still needs to prepare the closing entries. This is the trial balance that he has.arrow_forward

- Which accounts remain open at end of year and carried over to the following year?arrow_forwardThe first project for the semester will involve the following items to turn in: 1) Journal entries for financial transactions I will provide you. 2) An adjusted trial balance. 3) An Income statement. 1) On December 1 of 2019 Harold Hammer deposited $ 15,100 in a bank account in the name of Huaning Corporation in exchange for shares of common stock in the corporation. 2) On December 1 of 2019 Huaning Corporation purchased supplies on account for $ 226 . 3) On December 4 of 2019 Huaning Corporation received cash of $ 384 for product sold to the customer. 4) On December 5 of 2019 Huaning Corporation paid the vendor for the December 1st purchase of supplies. 5) On December 6 of 2019 Huaning Corporation purchases supplies on account for $ 469 .6) On December 8 of 2019 Huaning Corporation sells product for $ 445 on account to a customer.7) On December 9 of 2019 Huaning Corporation sells product for $ 462 on account to a customer. 8) On December 10 of 2019 Huaning Corporation paid, in…arrow_forwardWiset Company completes these transactions during April of the current year (the terms of all its credit sales are 2/10, n/30). April 2 April 3 (a) April 3 (b) April 4 April 5 April 6 April 9 April 11 April 12 April 13 (a) April 13 (b) April 14 April 16 (a) April 16 (b) April 17 April 18. April 20 (a) April 20 (b) April 23 (a) April 23 (b) April 25 April 26 April 27 (a) April 27 (b) April 30 (a) April 30 (b) Purchased $14,700 of merchandise on credit from Noth Company, terms 2/10, n/60. Sold merchandise on credit to Page Alistair, Invoice Number 760, for $8,000 (cost is $7,000). Purchased $1,490 of office supplies on credit from Custer, Incorporated, terms n/30. Issued Check Number 587 to World View for advertising expense of $904. Sold merchandise on credit to Paula Kohr, Invoice Number 761, for $15,000 (cost is $13,500). Returned $90 of office supplies purchased on April 3 to Custer, Incorporated. Wiset reduces accounts payable by that amount. Purchased $12,225 of store equipment on…arrow_forward

- Assume the following data for Blossom Care Dry Cleaning for the year ended December 31. • Gross earnings $305,000.00 • All employees’ salaries are greater than $7,000 in the first quarter of employment • Number of employees at the beginning of the year: 10 • One new employee hired during fourth quarter (assume employee earns $7,800 before December 31) • FUTA deposits for the year: $420.00 (a) Determine the amounts entered on Form 940 for the following line items. Line 3: Total payments to all employees $ Line 4: Payments exempt from FUTA tax $ Line 5: Total of payments made to each employee in excess of $7,000 $ Line 7: Total taxable FUTA wages $ Line 8: FUTA tax before adjustments $ Line 13: FUTA tax deposited for the year, including any overpayment applied from a prior year $ Line 14: Balance due $ Line 15: Overpayment $ Line 16a: 1st quarter $ Line 16b: 2nd quarter $ Line 16c: 3rd…arrow_forwardI need help with: · Entering adjustments on the spreadsheet provided. · Using the new and adjusted totals, calculate the totals on the financial statements in the spaces provided.arrow_forwardThe following issues relate to company clients of the firm of accountants you work for. Eachcompany has a year-end of 31 March 2022.You are required to prepare a brief report for your manager explaining the appropriate accountingtreatments at the 31 March 2022 year-end in each case along with supporting calculations asnecessary.You should cite relevant accounting regulations in your answer. (1) On 1 April 2021, Eyemouth Ltd entered into an agreement to lease machinery which has auseful life of 20 years. The agreement met the definition of a lease in accordance with IFRS 16.Under the terms of the agreement, Eyemouth paid a deposit of £10,000 on 1 April 2021 to securethe lease and is required to pay eight annual instalments of £100,000 in arrears, with the firstinstalment due on 31 March 2022. The interest rate implicit in the lease is 6% and the present valueof future lease payments on commencement of the lease is £620,979. Eyemouth paid £5,000 inlegal fees to arrange the lease. The…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education