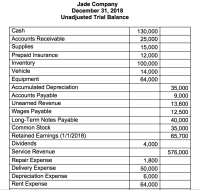

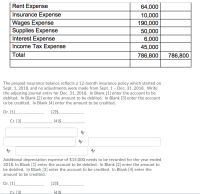

Wages due to employees of $8,000 need to be recorded at year end. These wages will be paid to employees on January 9, 2019 (next month). In Blank [1] enter the account to be debited. In Blank [2] enter the amount to be debited. In Blank [3] enter the account to be credited. In Blank [4] enter the amount to be credited.

Dr. [1]_______________ [2]$_____________

Cr. [3]________________ [4]$____________

The company has completed $12,900 of the amount in unearned revenue as of Dec. 31st. In Blank [2] enter the amount to be debited. In Blank [1] enter the account to be debited. In Blank [3] enter the account to be credited. In Blank [4] enter the amount to be credited.

Dr. [1]_______________ [2]$_____________

Cr. [3]________________ [4]$____________

In December the company provided services worth $8,000 to clients that were not yet billed or recorded by Dec. 31. Record the additional revenue. In Blank [1] enter the account to be debited. In Blank [2] enter the amount to be debited. In Blank [3] enter the account to be credited. In Blank [4] enter the amount to be credited.

Dr. [1]_______________ [2]$_____________

Cr. [3]________________ [4]$____________

On Dec 31st the company completed a physical count of their supplies and determined that only $4,000 of supplies are still on hand. In Blank [1] enter the account to be debited. In Blank [2] enter the amount to be debited. In Blank [3] enter the account to be credited. In Blank [4] enter the amount to be credited.

Dr. [1]_______________ [2]$_____________

Cr. [3]________________ [4]$____________

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- Assume that the payroll records of Bramble Oil Company provided the following information for the weekly payroll ended November 30, 2020. Employee T. King T. Binion N.Cole C. Hennesey Hours Worked Date 44 46 Nov. 30 40 Show Transcribed Text Nov. 30 42 Your answer is partially correct. Hourly Pay Rate $69 Salaries and Wages Expense FICA Taxes Payable Account Titles and Explanation Federal Income Taxes Payable Union Dues Payable Salaries and Wages Payable (To record weekly payroll) Payroll Tax Expense 34 FICA Taxes Payable 39 Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA tax rate is 7.65% for the first $132,900 of each employee's annual earnings and 1.45% on any earnings over $132,900. The employer pays unemployment taxes of 6.0% (5.4% for state and .6% for federal) on the first $7,000 of each employee's annual earnings. 44 State Income Taxes Payable Federal Income Taxes Payable Federal Income Tax Prepare…arrow_forwardAccrued Wages Skiles Company's weekly payroll amounts to $10,000 and payday is every Friday. Employees work five days per week, Monday through Friday. The appropriate journal entry was recorded at the end of the accounting period, Wednesday, August 31, 2022. Required: What journal entry is made on Friday, September 2, 2022? For those boxes in which no entry is required, leave the box blank.arrow_forwardSkip to question [The following information applies to the questions displayed below.]At March 31, 2019, the end of the first year of operations at Lukancic Inc., the firm’s accountant neglected to accrue payroll taxes of $6,370 that were applicable to payrolls for the year then ended. Exercise 7-7 (Algo) Part a - Horizontal Model Required:a-1. Use the horizontal model to show the effect of the accrual that should have been made as of March 31, 2019. Indicate the financial statement effect. (Enter decreases with a minus sign to indicate a negative financial statement effect.)arrow_forward

- Calculation of Taxable Earnings and Employer Payroll Taxes and Preparation of Journal Entry 1. Calculate the amount of taxable earnings for unemployment, Social Security, and Medicare taxes. 2. Prepare the journal entry to record the employer's payroll taxes as of September 14, 20--. Round your answers to the nearest cent. If an amount box does not require an entry, leave it blank. Selected information from the payroll register of Joanie's Boutique for the week ended September 14, 20--, is as follows. Social Security tax is 6.2% on the first $118,500 of earnings for each employee. Medicare tax is 1.45% of gross earnings. FUTA tax is 0.6% and SUTA tax is 5.4% on the first $7,000 of earnings. Taxable Earnings Employee Name Cumulative PayBefore CurrentEarnings CurrentGross Pay UnemploymentCompensation SocialSecurity Jordahl, Stephanie $6,600 $1,190 Keesling, Emily 6,150 1,070 Palmer, Stefan 55,200 2,410 Soltis, Robin…arrow_forwardDecember 31 The final pay period of the year will not be paid to employees until January 4, 2023. The company will accrue the wages for the final pay period only. Because the pay period is complete, there will not be a reversing entry for the accrual. As a result, paychecks will not be issued for this pay period since they will be paid in the following year and reflected on the Employee Earning Record forms for each employee when paid. The remainder of the employer liability will be paid with the final filing for the year. The company pays holiday pay for December 26, 2022. Reminder, holidays and vacations are not included as hours worked for calculation of overtime. • Complete the Employee Gross Pay tab. Complete the Payroll Register for December 31. • Complete the General Journal entries for the December 31 payroll. Update the General Ledger with the ending ledger balances from the December 15 pay period ledger accounts first, and then post the journal entries from the current period…arrow_forwardSection 5-EMPLOYEE DATA: FORM W-4 AND STATE WITHHOLDING 0ALLOWANCE CERTIFICATES How long does a new employee have to submit a completed W-4? How must the employer withhold FIT until the W-4 is received from a new employee? On March 2, 2020, Mischa submits a new W-4. If payday is Friday, what is the date of the first paycheck that must reflect Mischa’s new W-4? On March 23,2020, Paul submits a new W-4. If Paul is paid the last weekday of each month, what is the date of the first paycheck that must reflect Paul’s new W-4? On October 2, 2020, Janet starts a part-time job. She did not owe federal income tax in 2019 and does not expect to earn enough to pay federal income tax for 2020, so she claims exempt from federal income tax withholding on her 2020 Form W-4. Does Janet need to submit a W-4 in 2021? If so, by when—and how does her employer withhold if she does not do this?arrow_forward

- Payroll Accounting 2020 by Landin Question: Ed Myers is verifying the accuracy and amount of information contained in the employee records for his employer, Genible Industries. Which of the following items should be present in the employee information? Social Security number. checkedJob title. checkedEmployee address. checkedBirth date, if greater than 19.arrow_forwardQuestion 1: The third-party designee sections in both Form 941 and Form 940 require that the employer select a Answer: А. O username В. O password C. O five-digit PIN D. secret question B.arrow_forwardComplete Form 941 for the 2nd quarter of 2020 for Smith's Distributing Co. (employer identification #11-3333333). Assume that Smith's Distributing (located at 819 Main Street, Fremont, CA 94538) chooses to complete and mail Form 941 on the due date. Based on the lookback period, Smith's Distributing is a monthly depositor. Assume that all necessary deposits were made on a timely basis and that the employer made deposits equal to the total amount owed for the quarter. All five employees worked during each of the three months, and the company does not choose to allow a third party to discuss the form with the IRS. Note that the form is signed by the company's president, Juan Wilhelm (telephone #510-555-8293). Second quarter earnings, and associated taxes withheld from employee earnings, are as follows. Notes: • For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. April Taxes May Taxes June…arrow_forward

- Prepare the journal entries, with appropriate journal entry descriptions, for 2020, including any required year-end adjusting entries.The company prepares annual adjusting entries.arrow_forwardPlease complete the payrolll register. Note: this payroll register is partially done please complete the missing boxes with the right answers.arrow_forwardCharles Whyte commenced business on May 1 2019, making up his accounts to September 30 annually. The statement of the Profit or Loss Account for the first 17 months ended September 30,2020 is as follows: Gross Profit Less: Repairs and maintenance. Local transport and travelling Salaries and wages Provision for bad debts Preliminary expenses Depreciation Bank interest and charges Legal and professional charges General expenses (Allowable) Clearing expense on motor vehicle Bad debt Amounts written off Loan to absconded employee (ii) (iii) (iv) (1) You are also given the following additional information. Bad debt £ (v) £'000 30/10/2018 1/1/2019 1/5/2019 1,500 2,450 6,500 1,350 960 1,630 1,520 1,380 1,870 685 2,800 Building Motor Vehicle Furniture and fittings Legal and professional charges were: Salaries and wages: The following qualifying capital expenditures were acquired on: Fines for contravention of the law Legal expenses for tax appeal Audit and accountancy charges £'000 19,300…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education