FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

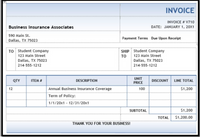

It is the end of January 20x1. At the beginning of January 20x1 your company entered and paid a bill from Business Insurance Associates for the annual insurance premium. A copy of the bill is below along with the asset section of the

Transcribed Image Text:INVOICE

INVOICE # V710

Business Insurance Associates

DATE: JANUARY 1, 20X1

590 Main St.

Payment Terms Due Upon Receipt

Dallas, TX 75023

TO Student Company

123 Main Street

SHIP Student Company

123 Main Street

TO

Dallas, TX 75023

Dallas, TX 75023

214-555-1212

214-555-1212

UNIT

QTY

ITEM #

DESCRIPTION

DISCOUNT

LINE TOTAL

PRICE

12

Annual Business Insurance Coverage

100

$1,200

Term of Policy:

1/1/20x1 - 12/31/20x1

SUBTOTAL

$1,200

ТOTAL

$1,200.00

THANK YOU FOR YOUR BUSINESS!

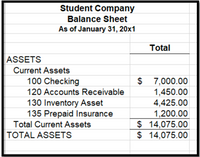

Transcribed Image Text:Student Company

Balance Sheet

As of January 31, 20x1

Total

ASSETS

Current Assets

$ 7,000.00

1,450.00

4,425.00

1,200.00

$ 14,075.00

$ 14,075.00

100 Checking

120 Accounts Receivable

130 Inventory Asset

135 Prepaid Insurance

Total Current Assets

TOTAL ASSETS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What would the journal entries look like for these adjusting entries?arrow_forwardSheffield Corp. received a check for $19080 on July 1, which represents a 6-month advance payment of rent on a building it rents to a client. Unearned Rent Revenue was credited for the full $19080. Financial statements will be prepared on July 31. Sheffield's should make the following adjusting entry on July 31: debit Unearned Rent Revenue, $19080; credit Rent Revenue, $19080. debit Cash, $19080; credit Rent Revenue, $19080. debit Rent Revenue, $3180; credit Unearned Rent Revenue, $3180. debit Unearned Rent Revenue, $3180; credit Rent Revenue, $3180.arrow_forwardOn August 1, 20x1, your company provided lawn service to Duke's Basketball Camp for $35.99. Mr. Duke paid you with a check immediately upon the completion of the service. When you looked at the Accounts Receivable Aging report at the end of the month, you noticed that Duke's Basketball Camp still had an open balance. Per review of the activity in Duke's account, what was wrong with the transaction on August 1? Teacher Feedback: The issue - did the accountant use the proper form? Review the differences between a sales receipt and a sales invoice.arrow_forward

- At the end of April, Hernandez Company had a balance of $35,070 in the vacation benefits payable account. During May, employees earned an additional $2,730 in vacation benefits, but some employees used vacation days that amounted to $1,920 of the vacation benefits. The $1,920 was charged to Wages Expense when it was paid in May. What adjusting entry would Hernandez Company make at the end of May to bring the vacation benefits payable account up to date? If an amount box does not require an entry, leave it blank. Account Debit Credit Vacation Benefits Expense Vacation Benefits Payable Feedback Additional Vacation benefits earned less benefits paid; balance should be debited to Vacation Benefits Expense and credited to Vacation Benefits Payable.arrow_forwardOn August 30, JumpStart incurred the following expenses:Payment to the landlord for August rent, $640Payment to the Gas & Electric Company for August's bill, $200Payment of employee wages for the last half of August, $7,861Payment of shopping center's parking lot cleaning fee, $240 Journalize these payments as one journal entry. If an amount box does not require an entry, leave it blank. Aug. 30 - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select -arrow_forwardOn August 1, 20x1, your company provided lawn service to Duke's Basketball Camp for $35.99. Mr. Duke paid you with a check immediately upon the completion of the service. When you looked at the Accounts Receivable Aging report at the end of the month, you noticed that Duke's Basketball Camp still had an open balance. Per review of the activity in Duke's account, what was wrong with the transaction on August 1?arrow_forward

- On August 30, JumpStart paid the following expenses: August rent, $2,300 August's utility bill, $525 Employee wages, $1,750 Parking lot cleaning fee, $27 Journalize these payments as one journal entry. If an amount box does not require an entry, leave it blank. August 30arrow_forwardCrane Company has the following year-end account balances on November 30, 2024: Service Revenue $37,000; Insurance Expense $2,700; Rent Expense $6,000; Supplies Expense $1,350; L. Johnson, Capital $42,000; and L. Johnson, Drawings $28,000. (a) Prepare the closing entries. (Credit account titles are automatically indented when amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts. List all debit entries before credit entries.) Date Account Titles Nov. 30 Nov. 30 Nov. 30 Nov. 30 To close revenue account) < To close expense accounts) To close income summary) To close drawings account) Debit Credit | |||| |||||arrow_forwardBank 'n' Roll, Inc. pays its employees once a month and records the expense at the time of payment. On May 31, Bank 'n' Roll, Inc. paid its employees $10,000 for work performed in May. The entry to record the payment includes a (Check all that apply.) Check all that apply. debit to Cash for $10,000 credit to Wages Expense for $10,000 credit to Wages Payable for $10,000 debit to Wages Expense for $10,000 credit to Cash for $10,000arrow_forward

- At Bramble Company, employees are entitled to one day’s vacation for each month worked. In January, 70 employees worked the full month. Record the vacation pay liability for January, assuming the average daily pay for each employee is $120. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answer to 0 decimal place, eg. 2500.) Date Account Titles and Explanation Debit Credit Jan. 31arrow_forwardcompany received a deposit for $19600 last month for services to be provided in the current month, October. By the end of October the services have been provided. What does the appropriate journal entry include at the end of October?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education