Assume that using the Security Market Line (SML) the required

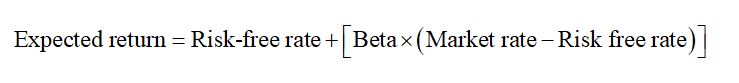

Capital Asset Pricing Model (CAPM):

CAPM is the method of calculating the expected return on investment. The formula to calculate the expected return using the CAPM model is:

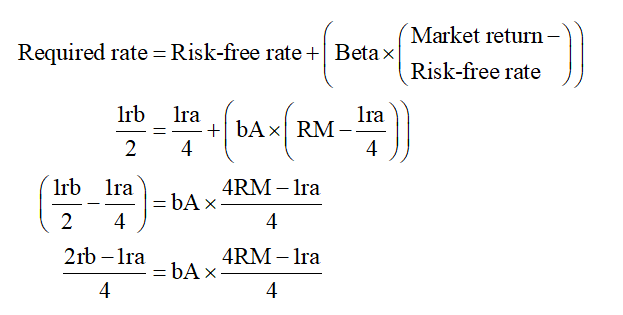

The required rate of return (RA) on stock A 1/2 return on stock B. The risk-free rate is 1/4 return on stock A. The market portfolio is RM.

Compute the beta of A (bA), using the equation as shown below:

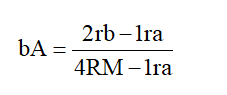

Rearrange the above-mentioned equation to determine the beta of A as follows:

Hence, the beta of A (bA) is computed above.

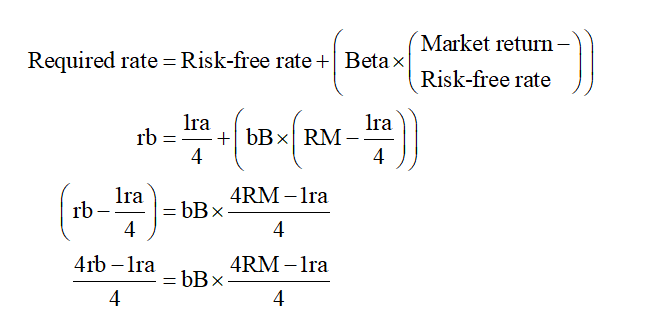

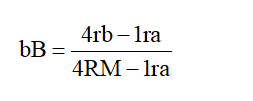

Compute the beta of B (bB), using the equation as shown below:

Rearrange the above-mentioned equation to determine the beta of B as follows:

Hence, the beta of B (bB) is computed above.

Step by stepSolved in 5 steps with 7 images

- The market portfolio (M) has the expected rate of return E(rM) = 0.12. Security A is traded in the market. We know that E(rA) = 0.17 and βA = 1.5. (1) What is the rate of return of the risk-free asset (rf)? (2) Security B is also traded in the market. βB = 0.8. Then what is “fair” expected rate of return of security B according to the CAPM? (3) Security C is a third security traded in the market. βC = 0.6, and from the market price, investors calculate E(rC) = 0.1. Is C overpriced or underpriced? What is αC?arrow_forwardequals the slope of the security market line: one. beta. the market risk premium. the expected return on the market portfolio.arrow_forwardWhat is the Capital Asset Pricing Model (CAPM)? Derive the risk premium when beta is between 0 and 1. Interpret your result.arrow_forward

- The following numbers were randomly generated from a standard normal distribution:0.5 − 0.75 1.1i). Given interest rate r = 0.01 and volatility parameter σ = 0.2, compute the drift parameter µ of asecurity following a risk-neutral geometric Brownian motion.ii). Suppose security ABC follows a geometric Brownian motion with the parameters given above. Ifthe initial closing price of ABC is S0 = s = 10, compute 3 more simulated daily closing prices forABC using the random numbers above.arrow_forwardYou are given the following information concerning three portfolios, the market portfolio, and the risk-free asset: Portfolio X Y Z Market Risk-free Rp 14.0% 13.0 .8.5 12.0 7.2 Ор 39.00% 34.00 24.00 29.00 0 Bp 1.50 1.15 0.90 1.00 0 Assume that the correlation of returns on Portfolio Y to returns on the market is 0.90. What percentage of Portfolio Y's return is driven by the market? Note: Enter your answer as a decimal not a percentage. Round your answer to 4 decimal places. R-squaredarrow_forwardYou are given the following information concerning three portfolios, the market portfolio, and the risk- free asset: Portfolio X Y Z Market Risk-free Rp 14.5% R-squared 13.5 9.1 10.7 5.4 op 36% 31 21 26 0 6p 1.60 1.30 .80 1.00 0 Assume that the correlation of returns on Portfolio Y to returns on the market is 72. What percentage of Portfolio Y's return is driven by the market? (Enter your answer as a decimal not a percentage. Round your answer to 4 decimal places.)arrow_forward

- When we test CAPM using historical data, a classic test is to regress excess returns of stocks onto the stock betas, using the following regression specification across stocks: - Rp Rf =α+By+ε where Rup - Rf is the average excess return of a security or portfolio, ẞ is the estimated beta of the security or portfolio, & is the regression residual, and a (Alpha) and y (Gamma) are regression coefficients. Based on the regression, which of the following statements are true if CAPM is true? Select all two correct statements. The Alpha is zero The Alpha is positive The Gamma is positive The Gamma is zeroarrow_forwardAssume the CAPM holds and consider stock X, which has a return variance of 0.09 and a correlation of 0.75 with the market portfolio. The market portfolio's Sharpe ratio is 0.30 and the the risk-free rate is 5%. (a) What is Stock X's expected return? (b) What proportion of Stock X's return volatility (i.e. standard deviation) is priced by the market? Explain why this number is less than 1.arrow_forwardThe beta of a portfolio is: A. A measure of the correlation of betas of the securities in the portfolio. B. Always greater than one. C. The market value weighted average beta of the securities in the portfolio. D. The geometric average of the beta of the securities in the portfolio.arrow_forward

- If you plot the relationship between portfolio expected return and portfolio beta, what is the slope of the line that results? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) | Slope of the line %arrow_forwardThe Capital Asset Pricing Model (CAPM) says that the risk premium on a stock is equal to its beta times the market risk premium. ..... True Falsearrow_forwardAssume that using the Security Market Line (SML) the required rate of return (RA) on stock A is foundto be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the requiredreturn on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (A) to beta of B(B). d) Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to payreturns of 15% with the standard deviation equal to 20%. Asset A pays on average 5%, has standarddeviation equal to 20% and is NOT correlated with the S&P500. Asset B pays on average 8%, also hasstandard deviation equal to 20% and has correlation of 0.5 with the S&P500. Determine whetherasset A and B are overvalued or undervalued, and explain why. (Hint: Beta of asset i (??) =???????, where ??,?? are standard deviations of asset i and marketportfolio, ??? is the correlation between asset i and the market portfolio)Question 2. Foreign exchange marketsStatoil, the national…arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education