Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

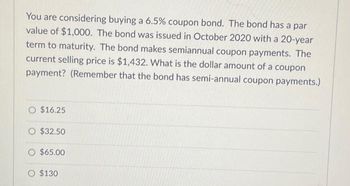

Transcribed Image Text:You are considering buying a 6.5% coupon bond. The bond has a par

value of $1,000. The bond was issued in October 2020 with a 20-year

term to maturity. The bond makes semiannual coupon payments. The

current selling price is $1,432. What is the dollar amount of a coupon

payment? (Remember that the bond has semi-annual coupon payments.)

$16.25

$32.50

O $65.00

O $130

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are interested in purchasing a bond from Swiss international. The bond had a 32 year maturity when it was issued, which was 3 years ago. Its face value was $1,000. The bond pays quarter interest at an 0.1 coupon rate. The bond currently trades at a price of $700, what is the YTM what is the yield to maturity ? what is the current yield? Numericarrow_forwardConsider the following $1,000 face value bond which makes semi- annual coupon payments, Bond Bank of Montreal Coupon rate 3% Price 108.19 Maturity June 1, 2030 Settlement Date January 3, 2019 What is the total price you would pay for this bond? Enter your answer rounded to two decimal places.arrow_forwardA Treasury bond that settles on May 18, 2019, matures on December 31, 2031. The coupon rate is 9.65 percent, and the quoted price is 106 12/32. What is the bond’s yield to maturity? Payments are semi-annually.arrow_forward

- You purchase a bond with an invoice price of $1,170. The bond has a coupon rate of 7.2 percent, and there are 2 months to the next semiannual coupon date. What is the clean price of the bond? Assume a par value of $1,000.arrow_forwardSolve this onearrow_forwardConsider the following $1,000 face value bond which makes semi-annual coupon payments, Bond Coupon rate Price Maturity Settlement Date Bank of Montreal 3.5% 101.71 December 1, 2030 January 23, 2019 What is the total price you would pay for this bond? Enter your answer rounded to two decimal places. Numberarrow_forward

- Bond A is a $1,000, 6% quarterly coupon bond with 5 years to maturity.(a) If you bought Bond A today at a yield (APR) of 8%, what is your purchase price? Is this apremium or discount bond? Why?)(b) One year later, Bond A's YTM (APR) has gone down to 6% and you sell it immediately afterreceiving the coupon.(i) What is the current yield? (ii) What is the capital gains yield? (iii) What is the one-year total rate of return (in APR) if the coupons are reinvested at 2%per quarter during the holding period? (iv) Can Bond A’s one-year total rate of return be determined correctly by simply adding upthe current yield and the capital gains yield? Explain your answer without calculations.(c) Consider two other bonds: Bond B and Bond C.Bond B: A $1,000, 7% quarterly coupon bond with 4 years to maturityBond C: A $1,000 zero coupon bond with 2 years to maturity(i) Without calculation, briefly explain which bond in the following pairs has higherinterest rate risk.1) Bond A vs. Bond B 2) Bond B vs.…arrow_forwardConsider the following bond where the coupons are paid annually, Bond Scotiabank Price $1008.50 YTM 9% Years to maturity 8 years What is the coupon rate of this bond? The face value of the bond is $1,000. Enter your answer as a percentage. Do not include the percentage sign in your answer. Enter your response below. Enter your answer rounded to 2 DECIMAL PLACES.arrow_forwardAssume that a 10-year bond pays interest of $55 every six months and will mature for $1,000. Also assume that the yield to maturity on this bond is currently 12.34 percent. Given this information, determine the expected total dollar price appreciation for this bond if you buy it today, hold it for 2 ½ years, and interest rates go down to 11.47 percent by the time you sell the bond. Answer choices: $39.56 $45.80 $59.51 $36.69 $52.57 Please answer fast I give you upvotearrow_forward

- A bond has $ 94000 face value and the coupon rate of the bond is 3.4 % (APR). The YTM of the bond is 6.8 %. What is the fair price of the bond assuming that the maturity of the bond is 8 years and the bond pays coupon in every 6 months? (Give the answer in round numbers without presenting a $sign.) Answer: Time left 0:06:54 Next pagearrow_forwardYou are offered an 6 year bond issued by Fordson, at a price of $943.22. The bond has a coupon rate of 9% and pays the coupon semiannually. Similar bonds in the market will yield 10% today. Do you buy the bonds at the offered price? Yes the bond is offered at a premium. O No, the bond offered is worth less than $943.22. Yes, the bond offered is being sold at a discount. O There is not enough information to determine.arrow_forwardToday, you just paid $924.22 to buy a semiannual bond with 6 years to maturity. This bond carries 4% coupon rate and $1,000 par value. After exactly one year, the bond’s YTM changes to 3.60%. What is the new price of the bond?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education