Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

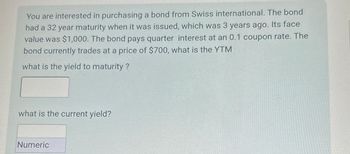

Transcribed Image Text:You are interested in purchasing a bond from Swiss international. The bond

had a 32 year maturity when it was issued, which was 3 years ago. Its face

value was $1,000. The bond pays quarter interest at an 0.1 coupon rate. The

bond currently trades at a price of $700, what is the YTM

what is the yield to maturity ?

what is the current yield?

Numeric

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A bond has a coupon rate of 9.2 percent and 5 years until maturity. If the yield to maturity is 9.3 percent, what is the price of the bond? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardneed help with finding the current yield and capital gains yield for bond p and bond d, thank youarrow_forwardSuppose a ten-year, $1,000 bond with a 8.9% coupon rate and semiannual coupons is trading for$1,035.32. a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? b. If the bond's yield to maturity changes to 9.4% APR, what will be the bond's price? The bond's yield to maturity is ______%. (Round to two decimal places.)arrow_forward

- A bond with face value $1,000 has a current yield of 7.1% and a coupon rate of 9.1%. a. If interest is paid annually, what is the bond’s price? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. Is the bond’s yield to maturity more or less than 9.1%?arrow_forwardWhat is the yield to maturity on a bond that has a price of $1,700 and a coupon rate of 12% annually for 6 years at the end of which it repays the principal of $1000? Is the bond selling at premium, at par, or at discount? How can you tell? (Using financial calculator)arrow_forwardWhat is the market price of a bond if the face value is $1,000 and the yield to maturity is 5.7%? The bond has a 5.15% coupon rate and matures in 14 years. The bond pays interest semiannually. Please express answer as $X.XX or XX.XX and use rounding guideline included in "Course Information" module. Do not round until the final result.arrow_forward

- You have purchased a bond for $973.02. The bond has a coupon rate of 6.4%, pays interest annually, has a face value of $1,000, 4 years to maturity, and a yield to maturity of 7.2%. You expect that interest rates will fall by .3% later today. a) Calculate the bond’s macauly duration b) Use the modified duration to find the approximate percentage change in the bond's price. Find the new price of the bond from this calculation. c) Suggest how the estimate in part (b) can be improved.arrow_forwardPlease see attached. Definitions: Yield to maturity (YTM) is the return the bond holder receives on the bond if held to maturity. Treasury note is a U.S. government bond with a maturity of between two and ten years. Current yield is the annual bond coupon payment divided by the current price.arrow_forwardA bond has the following trading data: Coupon rate = 7 1/4%; Current price = 107.78125% of par; Maturity = 2 years. Bonds such this pay interest semiannually. DURATION. Calculate the duration of this bond. Be sure to store your intermediate data as you calculate your final answer. Question options: 1) 1.934 years 2) 1.907 years 3) 1.852 years 4) None of the abovearrow_forward

- The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of the face value): Maturity (years) Price (per $100 face value) 1 $96.32 a. Compute the yield to maturity for each bond. b. Plot the zero-coupon yield curve (for the first five years). c. Is the yield curve upward sloping, downward sloping, or flat? a. Compute the yield to maturity for each bond. The yield on the 1-year bond is %. (Round to two decimal places.) 2 $91.93 3 $87.36 4 5 $82.57 $77.42arrow_forwardBond prices and maturity dates. Moore Company is about to issue a bond with annual coupon payments, an annual coupon rate of 5%, and a par value of $1,000. The yield to maturity for this bond is 6%. a. What is the price of the bond if it matures in 5, 10, 15, or 20 years? b. What do you notice about the price of the bond in relationship the maturity of the bond? a. What is the price of the bond if it matures in 5 years? $(Round to the nearest cent.) What is the price of the bond if it matures in 10 years? $(Round to the nearest cent.) What is the price of the bond if it matures in 15 years? $(Round to the nearest cent.) What is the price of the bond if it matures in 20 years? $ (Round to the nearest cent.) b. What do you notice about the price of the bond in relationship the maturity of the bond? (Select the best response.) O A. As the time to maturity increases, the price of the bond increases.arrow_forwardyou invested in a corporate bond that has a market price today of R983.87and a yield to maturity of 7%. This bond has a modified duration of 5.3. You believe that interest rates are going to rise by 106 basis points. What price do you expect your bond to trade at if this anticipated change in the yield occurs?Use the duration rule to calculate your answer , in rands (R), correctto Two decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education