Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

| Returns | |||||||

| Year | X | Y | |||||

| 1 | 16 | % | 20 | % | |||

| 2 | 19 | 31 | |||||

| 3 | 10 | 15 | |||||

| 4 | – | 8 | – | 17 | |||

| 5 | 10 | 21 | |||||

|

Using the returns shown above, calculate the arithmetic average returns, the variances, and the standard deviations for X and Y. (Do not round intermediate calculations. Enter your average return and standard deviation as a percent rounded to 2 decimal places, e.g., 32.16, and round the variance to 5 decimal places, e.g., 32.16161.) |

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

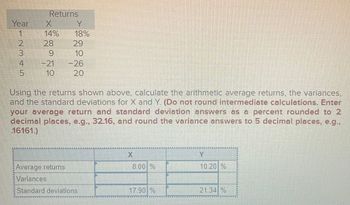

Transcribed Image Text:Year

INM +5

3

4

Returns

14%

28

9

10

Y

18%

29

10

-26

20

Using the returns shown above, calculate the arithmetic average returns, the variances,

and the standard deviations for X and Y. (Do not round intermediate calculations. Enter

your average return and standard deviation answers as a percent rounded to 2

decimal places, e.g., 32.16, and round the variance answers to 5 decimal places, e.g.,

16161.)

Average returns

Variances

Standard deviations

X

8.00 %

17.90 %

Y

10,20 %

21.34 %

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

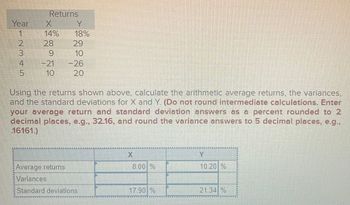

Transcribed Image Text:Year

INM +5

3

4

Returns

14%

28

9

10

Y

18%

29

10

-26

20

Using the returns shown above, calculate the arithmetic average returns, the variances,

and the standard deviations for X and Y. (Do not round intermediate calculations. Enter

your average return and standard deviation answers as a percent rounded to 2

decimal places, e.g., 32.16, and round the variance answers to 5 decimal places, e.g.,

16161.)

Average returns

Variances

Standard deviations

X

8.00 %

17.90 %

Y

10,20 %

21.34 %

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Year INM +5 3 4 Returns 14% 28 9 10 Y 18% 29 10 -26 20 Using the returns shown above, calculate the arithmetic average returns, the variances, and the standard deviations for X and Y. (Do not round intermediate calculations. Enter your average return and standard deviation answers as a percent rounded to 2 decimal places, e.g., 32.16, and round the variance answers to 5 decimal places, e.g., 16161.) Average returns Variances Standard deviations X 8.00 % 17.90 % Y 10,20 % 21.34 %arrow_forwardUse the data shown in the following table: K a. Compute the average return for each of the assets from 1929 to 1940 (the Great Depression). b. Compute the variance and standard deviation for each of the assets from 1929 to 1940. c. Which asset was the riskiest during the Great Depression? How does that fit with your intuition? Note: For all your answers type decimal equivalents. Data table Year 1929 1930 1931 1932 1933 1934 1935 1936 1937 1938 1939 1940 S&P 500 -0.08906 -0.25256 - 0.43861 -0.08854 0.52880 -0.02341 0.47221 0.32796 -0.35258 0.33204 -0.00914 - 0.10078 Small Stocks - 0.43081 -0.44698 -0.54676 -0.00471 2.16138 0.57195 0.69112 0.70023 - 0.56131 0.08928 0.04327 -0.28063 Corp. Bonds 0.04320 0.06343 -0.02380 0.12199 0.05255 0.09728 0.06860 0.06219 0.02546 0.04357 0.04247 0.04512 World Portfolio -0.07692 -0.22574 -0.39305 0.03030 0.66449 0.02552 0.22782 0.19283 -0.16950 0.05614 -0.01441 0.03528 Treasury Bills 0.04471 0.02266 0.01153 0.00882 0.00516 0.00265 0.00171 0.00173…arrow_forwardIsn't the 0.0592 in part 2 the variance? By squaring that you should get 24%?arrow_forward

- Use the following returns for X and Y. Year 1 2 3 4 5 Returns X 22.1% -17.1 10.1 20.2 5.1 Y 27.3% -4.1 29.3 -15.2 33.3 a. Calculate the average returns for X and Y. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. b. Calculate the variances for X and Y. Note: Do not round intermediate calculations and round your answers to 6 decimal places, e.g., .161616. c. Calculate the standard deviations for X and Y. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. X Answer is complete but not entirely correct. X 8.06 a. Average return b. Variance c. Standard deviation 136.454400 % 11.67 X % Y 14.04 377.286400 x % 19.42%arrow_forwardReturns Year X Y 12345 11% 18% 25 26 11 10 -18 10 -23 17 Using the returns shown above, calculate the arithmetic average returns, the variances, and the standard deviations for X and Y. (Do not round intermediate calculations. Enter your average return and standard deviation answers as a percent rounded to 2 decimal places, e.g., 32.16, and round the variance answers to 5 decimal places, e.g., .16161.) X Y Average returns Variances 7.80 % 9.60% 0.01974 0.02947 Standard deviations 14.05 % 17.17%arrow_forwardYear a. b. 12345 C. Returns X 22.0% 17.0 10.0 20.0 5.0 a. Calculate the average returns for X and Y. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. Calculate the variances for X and Y. (Do not round intermediate calculations and round your answers to 6 decimal places, e.g., 32.161616.) c. Calculate the standard deviations for X and Y. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Y 27.0% 4.0 29.0 - 15.0 33.0 X Answer is complete but not entirely correct. Average return Variance Standard deviation X 8.00 2.445000 x 15.64 % % Y 14.72 X % 4.501920 X 21.22 X %arrow_forward

- Returns Year X Y 12345 11% 18% 25 26 11 10 -18 10 -23 17 Using the returns shown above, calculate the arithmetic average returns, the variances, and the standard deviations for X and Y. (Do not round intermediate calculations. Enter your average return and standard deviation answers as a percent rounded to 2 decimal places, e.g., 32.16, and round the variance answers to 5 decimal places, e.g., .16161.) X Y Average returns % % Variances Standard deviations % %arrow_forwardThe variance of stock A is 0.0035 and the return is 0.12, while B has the same return but 0.17 as standard deviation what is the coefficient of variation for stock A what is the coefficlont of varlation for stock b .. Finish attempt Previous page Quiz naV 12 11 10 7. 5 4. 3 ... Finish EN HP Autoarrow_forwardUse the following returns for X and Y. Returns Year x y 1 21.8% 26.4% 2 -16.8 -3.8 3 9.8 28.4 4 19.6 -14.6 5 4.8 32.4 a. Calculate the average returns for X and Y. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. Calculate the variances for X and Y. (Do not round intermediate calculations and round your answers to 6 decimal places, e.g., 32.161616.) c. Calculate the standard deviations for X and Y. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

- Year 123 2 4 5 Returns X 17% 20 -7 11 10 Y 20% 32 Average returns Variances Standard deviations - 18 15 22 Using the returns shown above, calculate the arithmetic average returns, the variances, and the standard deviations for X and Y. (Do not round intermediate calculations. Enter your average return and standard deviation answers as a percent rounded to 2 decimal places, e.g., 32.16. Enter your variance answers rounded to 5 decimal places, e.g., .16161.) X % % Y % %arrow_forwardIn terms of Porfolio Variance calculation/formula of 0.02819 your computation is different than mine of 0.8733428592 based on the formula you provided. Can you explain on how did you get the 0.02819 portfolio variancearrow_forwardConsider a population proportion p = 0.20. a. What are the expected value and the standard error for the sampling distribution of the sample proportion with n = 20 and n = 58? Note: Round the standard error to 4 decimal places. Answer is complete and correct. n Expected value Standard error 20 58 0.20 0.20 0.0894 0.0525 b. Can you conclude that the sampling distribution of the sample proportion is approximately normally distributed for both sample sizes? Yes, the sampling distribution of the sample proportion is normally distributed for both sample sizes. No, the sampling distribution of the sample proportion is not normally distributed for either sample size. No, only the sample proportion with n = 20 will have a normal distribution. No, only the sample proportion with n = 58 will have a normal distribution. c. If the sampling distribution of the sample proportion is normally distributed with n = 20, then calculate the probability that the sample proportion is between 0.18 and 0.20.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education