Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

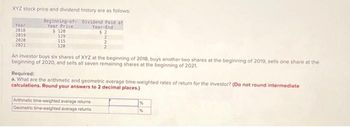

Transcribed Image Text:XYZ stock price and dividend history are as follows:

Dividend Paid at

Year-End

Year

2018

2019

2020

2021

Beginning-of-

Year Price

$ 120

129

115

120

An investor buys six shares of XYZ at the beginning of 2018, buys another two shares at the beginning of 2019, sells one share at the

beginning of 2020, and sells all seven remaining shares at the beginning of 2021.

Required:

a. What are the arithmetic and geometric average time-weighted rates of return for the investor? (Do not round intermediate

calculations. Round your answers to 2 decimal places.)

Arithmetic time-weighted average returns

Geometric time-weighted average returns

%

[%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose XYZ stock pays no dividends and has a current price of $50. The forward price for delivery in 1 year is $55. Suppose the 1-year eective annual interest rate is 10%. (a) Graph the payo and prot diagrams for a forward contract on XYZ stock with a forward price of $55. (b) Is there any advantage to investing in the stock or the forward contract? Why? (c) Suppose XYZ paid a dividend of $2 per year and everything else stayed the same. Now is there any advantage to investing in the stock or the forward contract? Why?arrow_forwardThe cost of equity and dividends are known to the picture.calculate the value of Ve, according to the multi-period dividend discount modelarrow_forwardConsider an example. Assume a share of preferred stock with the following characteristics: Par value $100 Dividend rate 3.0% per year Payment schedule semiannual Maturity date You are analyzing this preferred stock for possible purchase. Your required rate of return on this stock is 5% per year, compounded semiannually. Draw a time line showing the expected dividends for this preferred stock. Calculate the value of this preferred stock based on the required rate of return. Assume that the current market price for this preferred stock is $75 per share. Calculate the expected return based on the market price. Should you invest in the stock? Why or why not? Be sure to use your results from BOTH parts B and C above. You are analyzing a share of XYZ…arrow_forward

- q7- Which of the following statements is true? Select one: a. Trailing P/E is based on the current share price and forward P/E is based on next year's forecast share price. b. Trailing P/E is based on last year's share price and forward P/E is based on the current share price. c. Both trailing and forward P/E are based on the current share price. d. Trailing P/E is based on last year's share price and forward P/E is based on next year's forecast share price. Clear my choicearrow_forwardRefer to Figure 15.1, which lists the prices of various Microsoft options. Use the data in the figure to calculate the payoff and the profit/loss for investments in each of the following November 2019 expiration options on a single share, assuming that the stock price on the expiration date is $143. (Loss amounts should be indicated by a minus sign. Round "Profit/Loss" to 2 decimal places.)arrow_forwardGiven the following price and dividend information, calculate the lower bound to the 95th confidence interval. (Enter percentages as decimals and round to 4 decimals) Stock: MSFT Year Price Dividend 2017 $ 64.65 2018 $ 95.01 $ 1.72 2019 $ 104.43 $ 1.89 2020 $ 107.23 $ 2.09 2021 $231.96 $ 2.30 2022 $310.98 $ 2.54 2023 $247.81 $ 3.00arrow_forward

- Calculating Return Components An investor purchases one share of stock for $50. After one year, they sell the share for $55. During the year, they receive $7 in dividends. a) What was the dividend yield, in percentage terms? b) What was the capital gain from price appreciation on the stock, in percentage terms? c) What was the total return in dollars? What was the total return, in percentage terms?arrow_forwardcks A and B have the following historical returns: Year 2016 2017 2018 2019 2020 Stock A's Returns, ra (17.90%) 30.00 13.25 (3.50) 29.75 Stock B's Returns, ra (14.20%) 22.70 a. Calculate the average rate of return for each stock during the period 2016 through 2020. Round your answers to two decimal places. Stock A 39.50 (7.10) 10.70 Stock B b. Assume that someone held a portfolio consisting of 50% of Stock A and 50% of Stock 8. What would the realized rate of return on the portfolio have been each year? Round your answers to two decimal places. Negative values should be indicated by a minus sign. Year 2016 2017 2018 2019 2020 What would the average return on the portfolio have been during this period? Round your answer to two decimal places. Portfolio CV e. Assuming you are a risk-averse investor, would you prefer to hold Stock A, Stock B, or the portfolio? ele Calculate the standard deviation of returns for each stock and for the portfolio. Hound your answers to two decimal places.…arrow_forwardRequired: Refer to Figure 15.1, which lists the prices of various Microsoft options. Use the data in the figure to calculate the payoff and the profit/loss for investments in each of the following December 2019 expiration options on a single share, assuming that the stock price on the expiration date is $137. (Loss amounts should be indicated by a minus sign. Round "Profit/Loss" to 2 decimal places.) a. Call option, X = 135 b. Put option, X = 135 es c. Call option, X = 145 d. Put option, X = 145 Payoff Profit/Lossarrow_forward

- A stock is selling today for $50 per share. At the end of the year, it pays a dividend of $3 per share and sells for $59. Required: a. What is the total rate of return on the stock? b. What are the dividend yield and percentage capital gain? c. Now suppose the year-end stock price after the dividend is paid is $44. What are the dividend yield and percentage capital gain in this case?arrow_forwardStocks A and B have the following historical returns: Year 2016 2017 2018 2019 2020 Stock A's Returns, ra (15.40%) 29.00 14.25 (5.00) 26.00 Stock B's Returns, ra (15.80%) 21.10 37.30 (6.20) 12.45 a. Calculate the average rate of return for each stock during the period 2016 through 2020. Round your answers to two decimal places. Stock A: Stock B: b. Assume that someone held a portfolio consisting of 50% of Stock A and 50% of Stock B. What would the realized rate of return on the portfolio have been each year Round your answers to two decimal places. Negative values should be indicated by a minus sign. Portfolio CV Year 2016 2017 2018 2019 2020 What would the average return on the portfolio have been during this period? Round your answer to two decimal places. % % % c. Calculate the standard deviation of returns for each stock and for the portfolio. Round your answers to two decimal places. Stock A Stock B Portfolio Standard Deviation d. Calculate the coefficient of variation for each…arrow_forward(a) Compute the expected book value per share at time 1. (b) Compute the expected earnings per share of DTI at time 2. (c) Compute the expected value of the ex-dividend stock price at time 2. (d) Compute the expected value of the ex-dividend stock price at time 0. (e) Compute the expected return (over a single-period) on the stock of DTI at time 0 (in %).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education