Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

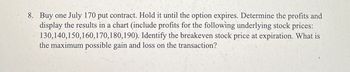

Transcribed Image Text:8. Buy one July 170 put contract. Hold it until the option expires. Determine the profits and

display the results in a chart (include profits for the following underlying stock prices:

130,140,150,160,170,180,190). Identify the breakeven stock price at expiration. What is

the maximum possible gain and loss on the transaction?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A collar is established by buying a share of stock for $46, buying a 6-month put option with exercise price $43, and writing a 6-month call option with exercise price $49. On the basis of the volatility of the stock, you calculate that for a strike price of $43 and expiration of 6 months, N(d₁) = .6974, whereas for the exercise price of $49, N(d₁) = 0.6504. What will be the gain or loss on the collar if the stock price increases by $1? (Round your answer to 2 decimal places. Omit the "$" sign in your response.) Collar gain by b-1. What happens to the delta of the portfolio if the stock price becomes very large? (Omit the "$" sign in your response.) a. Delta of the portfolio approaches .05 b-2. What happens to the delta of the portfolio if the stock price becomes very small? (Omit the "$" sign in your response.) Delta of the portfolio approachesarrow_forwardCall options on a stock are available with strike prices of $15, $17.5 and $20 before expiration date. The call premiums for each are $4, $2 and $0.5 respectively. Explain how the options can be used to create a butterfly spread. A. Construct a table showing how profit varies with stock price for the butterfly spread. B. Plot the profit with stock price for the butterfly spread. List the profit formula for each trend.arrow_forwardRefer to Figure 15.1, which lists the prices of various Microsoft options. Use the data in the figure to calculate the payoff and the profit/loss for investments in each of the following November 2019 expiration options on a single share, assuming that the stock price on the expiration date is $143. (Loss amounts should be indicated by a minus sign. Round "Profit/Loss" to 2 decimal places.)arrow_forward

- Consider the following Put Option: May 50 trading at $3.15/share May is the expiration 50 is the Strike Price$3.15 is the PremiumIf, at expiration, the stock price is $40, the Buyer (to Open) would have a TOTAL gain or loss of.....(not per share) if a loss use the '-' signarrow_forwardAssume that you hold a call option on stock A. The call has a strike price of 50 and expires in 6 months. Stock A pays no dividends. 1. What is the payoff from the call if stock A is trading at 57 in 6 months? 2. What is the payoff from the call if stock A is trading at 45 in 6 months? 3. Draw a payoff diagram that shows the payoff of the call as a function of the underlying stock price.arrow_forwardsolve a,b,c and d pleasearrow_forward

- An investor owns Citibank stock at $75. They want to sell some 3-month out- of-the-money call options against their position. STRIKES 72.50 75 77.50 CALL PRICE 5.60 4.12 2.84 Create a table showing the profit and loss for underlying trading at 70, 72.5, 75, 77.5, 80 and 82.5 for all the positions and the option strategy. Draw an expiry pay-off diagram, using the prices in the table.arrow_forwardGiven the following information, price of a stock: strike price of a six-month call: market price of the call: strike price of a six-month put: market price of the put: The maximum the seller of the put can lose is $ $102 $100 $6 $100 $3arrow_forwardIn the Table below are the Numato Ltd's PUT Option prices (expiring on February 2022, March 2022 and April 2022) for various Strike Prices as on 15th January, 2022. Current Stock Price of Numato Ltd. is Rs 590. Determine the Intrinsic value and time value of PUT options (expiring on February 2022, March 2022 and April 2022) for various given Strike Prices at current price of Rs 590. Strike February Intrinsic Time Put Price Value March Intrinsic Time April Intrinsic Time Value Put Price Price Value Put Value Value Value (Rs.) (Rs) Price (Rs) (Rs) 500 0.50 3 5.5 550 2.50 9.5 14.5 600 17.5 28 34 650 59 62 66 700 109 109 109arrow_forward

- A collar is established by buying a share of stock for $54, buying a 6-month put option with exercise price $47, and writing a 6-month call option with exercise price $61. On the basis of the volatility of the stock, you calculate that for a strike price of $47 and expiration of 6 months, N(d1) = 0.7298, whereas for the exercise price of $61, N(d1) = 0.6374. Required: What will be the gain or loss on the collar if the stock price increases by $1? What happens to the delta of the portfolio if the stock price becomes very large? What happens to the delta of the portfolio if the stock price becomes very small?arrow_forwardA put with a strike price of $50 was sold at $11 when the price of the stock was $48. What was the time value of the put at expiration?arrow_forwardA stock is currently priced at 43.75 when options are about to expire. What is the net profit of a CALL option with a strike price of 45 for the BUYER of the option if the premium paid was 1.75? (per share) Group of answer choices 1.75 0.00 -2.25 -1.75 45.00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education