Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN: 9781337902571

Author: Eugene F. Brigham, Joel F. Houston

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Quick answer of this accounting questions

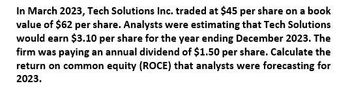

Transcribed Image Text:In March 2023, Tech Solutions Inc. traded at $45 per share on a book

value of $62 per share. Analysts were estimating that Tech Solutions

would earn $3.10 per share for the year ending December 2023. The

firm was paying an annual dividend of $1.50 per share. Calculate the

return on common equity (ROCE) that analysts were forecasting for

2023.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following are earnings and dividend forecasts made at the end of 2020 for the IBM Corporation with a $40 BV per common share at that time. In 2021, EPS will be $7 and DPS $1. In 2022, EPS will be $8 and DPS $1.50. In 2023, EPS will be $9 and DPS $2. The firm has a required equity return of 15% per year. Calculate the book value per share for the company for each year from 2021 to 2023, accordingly.arrow_forwardThe Dell Corporation has reported the BV of common equity of $10 billion at the end of 2020, with 400 million shares outstanding. The required rate of return is 5%. The company trades in the stock market for $30. calculate the price-to-book ratio.arrow_forwardFinancial analysts forecast Limited Brands (LTD) growth rate for the future to be 12.5 percent. LTD’s recent dividend was $0.95. What is the value of Limited Brands stock when the required return is 14.5 percent? (Round your answer to 2 decimal places.)arrow_forward

- Anthony Inc.’s common stock is currently selling for $20.00 per share. Their most recent annual dividend was $0.60, and the dividend is expected to grow at the rate of 10% annually in the future. What is the required return on Anthony’s common equity? Report the percentage to two decimal placesarrow_forwardIn December 31,2017 GE paid an annual dividend of .96. They also announced they will reduce their dividend to .48 per share next year. Today is January 1, 2018. You expect the future dividend payment to be stable for the next 5 years and to increase 2% afterwards in perpetuity. The cost of equity capital for GE is 9% . What should the stock price of GE be based on these forecasts? What is the present value today of the first dividend payments before the new growth rate(that is until year 5)? What is the present value in year 5 of the dividend payments that grow at a rate of 2% per year in perpetuity? What is the present value today in year 0 of the dividend payments that grow at a rate of 2% a year in perpetuity? What is the price of the stock today?arrow_forwardProcter and Gamble (PG) paid an annual dividend of $2.79 in 2018. You expect PG to increase its dividends by 7.9% per year for the next five years (through 2023), and thereafter by 2.7% per year. If the appropriate equity cost of capital for Procter and Gamble is 8.9% per year, use the dividend-discount model to estimate its value per share at the end of 2018.arrow_forward

- Fester Industries’ common stock is currently selling for $30.00 per share. Next year’s dividend (D1) is expected to be $1.26. If the required return on Fester’s common stock is 9.20%, what was the most recent dividend that Fester paid (D0)?arrow_forwardWhat is the current price of the stock on these financial accounting question?arrow_forwardHere is the condensed 2019 balance sheet for Skye Computer Company (in thousands of dollars): Skye's earnings per share last year were $3.20. The common stock sells for $55.00, last year's dividend (Do) was $2.10, and a flotation cost of 10% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 9%. Skye's preferred stock pays a dividend of $3.30 per share, and its preferred stock sells for $30.00 per share. The firm's before-tax cost of debt is 10%, and its marginal tax rate is 25%. The firm's currently outstanding 10% annual coupon rate, long term debt sells at par value. The market risk premium is 5%, the risk-free rate is 6%, and Skye's beta is 1.516. The firm's total debt, which is the sum of the company's short-term debt and long-term debt, equals $1.2 million.a. Calculate the cost of each capital component, that is, the after-tax cost of debt, the cost of preferred stock, the cost of equity from…arrow_forward

- BioScience Inc. will pay a common stock dividend of $3.55 at the end of the year (D1). The required return on common stock (Ke) is 20 percent. The firm has a constant growth rate (g) of 10 percent. Compute the current price of the stock (P0). (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardPlease show detailed steps and correct.arrow_forwardApple Inc. (AAPL) is expected to pay a dividend of $1.59 at the end of the year. AAPL’s dividend payout ratio and return on equity (ROE) are 41.27% and 6.86%, respectively. Other things held constant, what would AAPL’s stock price be if the required rate of return is 6.47%? A. $93.14 B. $84.97 C. $72.26 D. $65.13arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning