Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please provide this question solution general accounting

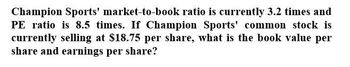

Transcribed Image Text:Champion Sports' market-to-book ratio is currently 3.2 times and

PE ratio is 8.5 times. If Champion Sports' common stock is

currently selling at $18.75 per share, what is the book value per

share and earnings per share?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Roberts and Company’s market-to-book ratio is currently 6.5 times and PE ratio is 12.5 times. If Roberts and Company’s common stock is currently selling at $165 per share, what is the book value per share and earnings per share?arrow_forwardDudley Hill Golf Club's market-to-book ratio is currently 2.4 times and the PE ratio is 6.70 times. If Dudley Hill Golf Club's common stock is currently selling at $21.25 per share, what is the book value per share? (Round your answer to 2 decimal places.) What is the earnings per share? (Round your answer to 2 decimal places.)arrow_forwardDudley Hill Golf Club's market-to-book ratio is currently 3.4 times and the PE ratio is 7.20 times. If Dudley Hill Golf Club's common stock is currently selling at $33.60 per share, what is the book value per share? (Round your answer to 2 decimal places.) Book value per share = _____.__ What is the earnings per share? (Round your answer to 2 decimal places.) earnings per share = ____.__arrow_forward

- ABD common stock is selling for $36.08 a share. The company has earnings per share of S.34 and a book value per share of S12.19. What is the market-to-bok ratio?arrow_forwardPlease I need answer.arrow_forwardThe preference share of Acme International is selling currently at $107.4. If your required rate of return is 8.7 per cent, what is the dividend paid by this share?arrow_forward

- The Evanec Company's next expected dividend, D1, is $2.69; its growth rate is 7%; and its common stock now sells for $35.00. New stock (external equity) can be sold to net $31.50 per share. What is Evanec's cost of retained earnings, rs? Do not round intermediate calculations. Round your answer to two decimal places. rs = % What is Evanec's percentage flotation cost, F? Round your answer to two decimal places. F = % What is Evanec's cost of new common stock, re? Do not round intermediate calculations. Round your answer to two decimal places. re = %arrow_forwardIf a stock's P/E ratio is 13.5 at a time when earnings are $3 per year and the dividend payout ratio is 40%, what is the stock's current price?arrow_forwardThe Evanec Company's next expected dividend, D1, is $3.08; its growth rate is 4%; and its common stock now sells for $39.00. New stock (external equity) can be sold to net $31.20 per share. a. What is Evanec's cost of retained earnings, rs? Do not round intermediate calculations. Round your answer to two decimal places. rs b. What is Evanec's percentage flotation cost, F? Round your answer to two decimal places. F = % c. What is Evanec's cost of new common stock, re? Do not round intermediate calculations. Round your answer to two decimal places. re = %arrow_forward

- A biotechnology company's stock is currently selling for $48.35 per share. The earnings per share are $2.14, and the dividend is $1.90. (a) What is the current yield of the stock (as a %)? (Round your answer to the nearest tenth of a percent.) |% (b) What is the price-earnings ratio? (Round your answer to the nearest whole number.)arrow_forwardYou forecast to have a ROE of 14%, and dividend payout ratio of 12%. Currently the company has a price of $30 and $7 earnings per share. What is the PEG ratio based on market price?arrow_forwardKrell Industries has a share price of $21.55 today. If Krell is expected to pay a dividend of $1.08 this year and its stock price is expected to grow to $24.57 at the end of the year. The dividend yeild is? (Round to one decimal place)The capital rate gain is? (Round to one decimal place)The total return is? (Round to one decimal place)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub