FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:---

**Activity-Based Costing and Activity Rates**

In this section, we will compute activity rates for various activity cost pools. Ensuring accurate calculation of these rates is essential for effective cost management and budgeting in businesses.

---

### Activity Cost Pool and Rates

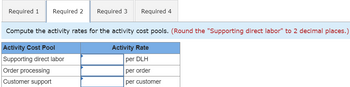

**Compute the activity rates for the activity cost pools.**

*Note: Round the "Supporting direct labor" to 2 decimal places.*

| Activity Cost Pool | Activity Rate |

|----------------------------|------------------------|

| Supporting direct labor | ______ per DLH |

| Order processing | ______ per order |

| Customer support | ______ per customer |

- **DLH** stands for Direct Labor Hours.

- The rates are calculated based on specific cost drivers, such as the number of orders or the number of customers, depending on the activity.

This table provides a framework to determine costs associated with different business processes, enabling more precise cost allocation and aiding in decision-making.

---

Transcribed Image Text:# Activity-Based Costing System of Advanced Products Corporation

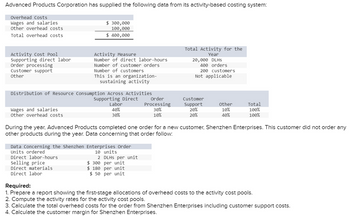

Advanced Products Corporation utilizes an activity-based costing system and has detailed the following data:

### Overhead Costs

- **Wages and salaries:** $300,000

- **Other overhead costs:** $100,000

- **Total overhead costs:** $400,000

### Activity Cost Pool and Measures

- **Supporting Direct Labor:**

- Activity Measure: Number of direct labor-hours

- Total Activity: 20,000 DLHs (Direct Labor Hours)

- **Order Processing:**

- Activity Measure: Number of customer orders

- Total Activity: 400 orders

- **Customer Support:**

- Activity Measure: Number of customers

- Total Activity: 200 customers

- **Other:**

- Activity Type: Organization-sustaining activity

- Total Activity: Not applicable

### Distribution of Resource Consumption Across Activities

#### Wages and Salaries

- Supporting Direct Labor: 40%

- Order Processing: 30%

- Customer Support: 20%

- Other: 10%

#### Other Overhead Costs

- Supporting Direct Labor: 30%

- Order Processing: 10%

- Customer Support: 20%

- Other: 40%

### Shenzhen Enterprises Order

During the year, Advanced Products completed a specific order for Shenzhen Enterprises, which was the only order for this customer.

#### Data Concerning the Order

- **Units Ordered:** 10 units

- **Direct Labor-Hours:** 2 DLHs per unit

- **Selling Price:** $300 per unit

- **Direct Materials:** $100 per unit

- **Direct Labor:** $50 per unit

### Required Tasks

1. Prepare a report showing the first-stage allocations of overhead costs to the activity cost pools.

2. Compute the activity rates for the activity cost pools.

3. Calculate the total overhead costs for the order from Shenzhen Enterprises, including customer support costs.

4. Calculate the customer margin for Shenzhen Enterprises.

This information aims to assist in the analysis and improvement of cost management practices by offering insights into allocations and calculations within an advanced costing framework.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Identifying Cost Drivers. Palisades Company identified the activities listed in the following as being most important (step 1 and step 2 of activity-based costing), and it formed cost pools for each activity: 1. Purchasing raw materials 2. Inspecting raw materials 3. Storing raw materials 4. Maintaining production equipment 5. Setting up machines to produce batches of product 6. Testing finished products Required: Perform step 3 of the activity-based costing process by identifying a possible cost driver for each activity.arrow_forwardA company uses activity-based costing to determine the costs of its three products: A, B, and C. The budgeted cost and activity for each of the company's three activity cost pools are shown in the following table: Budgeted Activity Activity Cost PoolBudgeted Cost Product AProduct BProduct Activity 1 7,500 10,500 21,500 Activity 2 8,500 16,500 9,500 Activity 3 4,000 2,500 3,125 How much overhead will be assigned to Product B using activity-based costing? 85,000 60,000 112,000arrow_forwardimplementing an activity-based costing system that has four activity cost pools: Travel, Pickup and Delivery, Customer Service, and Other. The activity measures are miles for the Travel cost pool, number of pickups and deliveries for the Pickup and Delivery cost pool, and number of customers for the Customer Service cost pool. The Other cost pool has no activity measure because it is an organization-sustaining activity. The following costs will be assigned using the activity-based costing system Driver and guard wages Vehicle operating expense Vehicle depreciation. Customer representative salaries and i expenses office expenses Driver and guard wages Vehicle operating expense Vehicle depreciation Customer representative salaries and expenses office expenses Administrative expenses Administrative expenses Total cost The distribution of resource consumption across the activity cost pools is as follows. Pickup and Delivery 35% 5% $1,000,000 510,000 390,000 Driver and guard wages Vehicle…arrow_forward

- Classic manufacturing costing system uses a three-part classification of direct materials, direct manufacturing labor, and manufacturing overhead costs. The following items (in millions) pertain to Classic Corporation. Requirement Prepare an income statement and a supporting schedule of cost of goods manufactured. Begin by preparing the supporting schedule of cost of goods manufactured (in millions). Start with the direct materials and direct labor costs, then indirect manufacturing costs, and complete the schedule by calculating cost of goods manufactured. For Specific Date Work-in-process inventory, January 1, 2020 $12 Direct materials inventory, December 31, 2020 8 Finished-goods inventory, December 31, 2020 11 Accounts payable, December 31, 2020 20 Accounts receivable, January 1, 2020 59 Work-in-process inventory, December 31, 2020 1 Finished-goods inventory, January 1, 2020 46 Accounts receivable, December 31,…arrow_forwardPlease help me with show all calculation thankuarrow_forwardWhich one of the following is not a step in allocating the support department cost to the production department? Select one: a. Trace all the overhead cost b. Divide the departments in to support and producing departments c. Undertake a breakeven analysis d. Divide the company in departmentsarrow_forward

- TCM Company uses activity-based costing to determine products costs for external financial reports. The company has provided the following data concerning its activity-based costing system: Activity cost pools (and activity measures) Depreciation (allocated based on machine-hours) Batch setup (allocated based on # of set ups) General Factory (allocated based on direct labor hours) Estimated Overhead costs $67,500 273,700 204,000 Expected Activity (Allocation base) Product y Product x Activity Cost pool Depreciation Batch setup General factory The activity rate for the general factory activity cost pool is? Total 5000 m hours 4000 1000 7000 set ups 3000 4000 8000 dl hours 1000 7000arrow_forwardwhat is the labor-related activity cost pool per DLH what is the machine-related activity cost pool per MH what is the machine setups activity cost pool per seteup what is the production orders activity cost per order what is the product testing activity cost per test what is the packaging activity cost per package what is the general factory activity cost per DLHarrow_forwardMirabile Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Processing, Supervising, and Other. The costs in those activity cost pools appear below: Processing Supervising Other Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the other activity cost pool are not assigned to products. Activity data appear below: Product MO Product M5 Total $ 3,800 $ 23,800 $ 10,400 MHs (Processing) 9,700 300 10,000 Sales (total) Direct materials (total) Direct labor (total) Batches (Supervising) 500 500 1,000 Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins. Product Mº $ 74,100 $ 28,500 $ 27,800 Product M5 $ 89,900 $ 31,400 $ 41,700arrow_forward

- Part 1: Allocate the costs of the 3 service departments using the direct method. Part 2: Allocate the costs of the 3 service departments using the step method, with the order determined by the greater percentage usage. Part 3: Allocate the costs of the 3 service departments using the reciprical method. Part 4:What is one strength and one drawback of each of the methods?arrow_forwardNeed some help making a cheet sheet for an up coming test. please provide examples. The exam covers chapters 1 through 13. Here are some suggested study topics: Cost Classifications - variable, fixed and mixed, period and product, direct and indirect, opportunity, sunk, relevant, traceable, common, etc. Calculate the results of changes to cost assumptions (CVP) Calculate net income based on contribution margin values either dollars or % Application of Manufacturing Overhead - calculate predetermined overhead rate or activity rates applied to a product or job - job order using a predetermined overhead rate or rates and activity-based costing calculate over and underapplied overhead calculate adjusted cost of goods sold Job Costing What is the total cost of the job and average cost per unit. Cost of Goods Manufactured and cost of goods sold Calculate break even and target profit Create a contribution format income statement Gross margin calculations absorption or variable costing…arrow_forwardActivity-based costing can be beneficial in allocating selling and administrative expenses to various products for managerial decision making. Which of the following would be the best allocation base for help desk costs? a. number of sales employees Ob. number of products sold c. number of calls Od. square footage of the help desk officearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education