FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Use the following information to compute each department’s contribution to

| Department A | Department B | Department C | |

|---|---|---|---|

| Sales | $ 61,000 | $ 199,000 | $ 79,000 |

| Cost of goods sold | 38,430 | 103,480 | 41,870 |

| Gross profit | 22,570 | 95,520 | 37,130 |

| Total direct expenses | 4,980 | 42,940 | 8,266 |

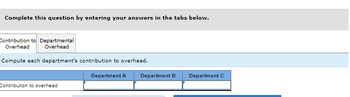

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Contribution to Departmental

Overhead Overhead

Compute each department's contribution to overhead.

Contribution to overhead

Department A

Department B Department C

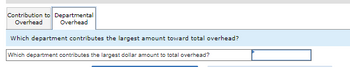

Transcribed Image Text:Contribution to Departmental

Overhead Overhead

Which department contributes the largest amount toward total overhead?

Which department contributes the largest dollar amount to total overhead?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Answer with all workings for all with steps explanation calculation formula answer in textarrow_forward3arrow_forwardMason Company provided the following data for this year: Sales Direct labor cost Raw material purchases Selling expenses Administrative expenses Manufacturing overhead applied to work in process Actual manufacturing overhead costs Inventories Raw materials Work in process Finished goods Beginning $ 8,600 $ 5,800 $ 71,000 Ending $ 10,800 $ 20,000 $ 25,400 $ 653,000 $ 82,000 $ 133,000 $ 106,000 $ 45,000 $ 223,000 $ 201,000 Required: 1. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials. 2. Prepare a schedule of cost of goods sold. Assume the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. 3. Prepare an income statement.arrow_forward

- Complete the following (assume $93,500 of overhead to be distributed): (Round the "Ratio" to 2 decimal places.) Amount of Overhead Square Feet Ratio Allocated Department A Department B 15,040 31,960arrow_forwardThe following is a partially completed departmental expense allocation spreadsheet for Brickland. It reports the total amounts of direct and indirect expenses for its four departments. Purchasing department expenses are allocated to the operating departments on the basis of purchase orders. Maintenance department expenses are allocated based on square footage. Compute the amount of Maintenance department expense to be allocated to Fabrication. Operating costs No. of purchase orders Sq. ft. of space Multiple Choice O $6,400. $9,900. $8,100. $9,000. $25,600. Purchasing Maintenance Fabrication Assembly $32,000 $18,000 $96,000 16 3,300 $62,000 4 2,700arrow_forwardAssume a company provided the following information: Departmental costs Number of employees Square feet of space occupied Multiple Choice If the company (1) uses the direct method to allocate service department costs to operating departments, (2) allocates Cafeteria costs based on the number of employees, and (3) allocates Janitorial costs based on square feet of space of occupied, then the cost allocated from the Cafeteria Department to the Lab Department is closest to: C $58,338. $63,467. $76,800. Service Departments Operating Departments Cafeteria Janitorial Lab Tech $232,000 $950,000 32 68 $240,000 $140,000 20 2,000 11,000 9,000 $116,800. 10 3,000arrow_forward

- Required information SB (Static) The following information is... [The following information applies to the questions displayed below.] The following information is departmental cost allocation with two service departments and two production departments. Percentage Service Provided to Department Service 1 (S1) Service 2 (52) Production 1 (P1) Production 2 (P2) P1 P2 Cost $ 30,000 20,000 100,000 150,000 Total Cost Allocated S1 0% 20 P2 35% 20 60 Brief Exercise 7-14 (Static) If the cost in P1 is changed from... [LO 7-3] What is the amount of service department cost allocated to P1 and P2 using the direct method if the cost in P1 is changed from $100,000 to $120,000? 52 P1 30% 35% 0arrow_forwardThe following is a partially completed lower section of a departmental expense allocation spreadsheet for Brickland. It reports the total amounts of direct and indirect expenses for the four departments. Purchasing department expenses are allocated to the operating departments on the basis of purchase orders. Maintenance department expenses are allocated based on square footage. Department Direct Expenses Number Purchase Orders Square Feet Purchasing $ 51,000 Maintenance 29,400 Fabrication 115,000 15 4,250 Assembly 81,000 1,750 Compute the amount of Purchasing department expense to be allocated to Assembly Multiple Choice $12,750. $20,825. $8,575. $22,950. $38,250.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education