FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Don't use

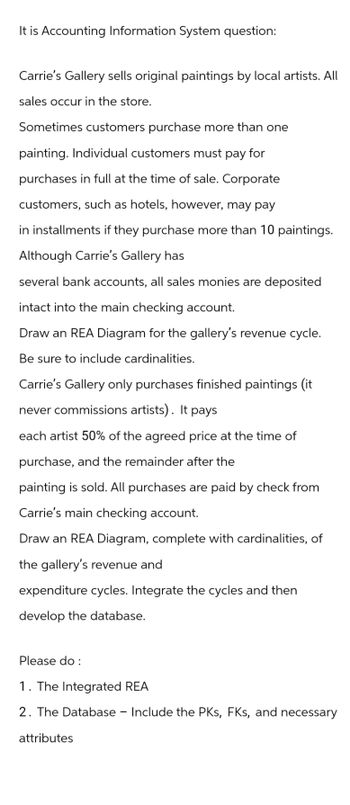

Transcribed Image Text:It is Accounting Information System question:

Carrie's Gallery sells original paintings by local artists. All

sales occur in the store.

Sometimes customers purchase more than one

painting. Individual customers must pay for

purchases in full at the time of sale. Corporate

customers, such as hotels, however, may pay

in installments if they purchase more than 10 paintings.

Although Carrie's Gallery has

several bank accounts, all sales monies are deposited

intact into the main checking account.

Draw an REA Diagram for the gallery's revenue cycle.

Be sure to include cardinalities.

Carrie's Gallery only purchases finished paintings (it

never commissions artists). It pays

each artist 50% of the agreed price at the time of

purchase, and the remainder after the

painting is sold. All purchases are paid by check from

Carrie's main checking account.

Draw an REA Diagram, complete with cardinalities, of

the gallery's revenue and

expenditure cycles. Integrate the cycles and then

develop the database.

Please do :

1. The Integrated REA

2. The Database - Include the PKs, FKs, and necessary

attributes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- I don't quite how to solve this question. Could you please clarify it? Thank you so much!arrow_forwardI need unique and correct answer. Don't try to copy from anywhere. Do not give answer in image formet and hand writingarrow_forwardIf a company accepts credit cards, they must record the expense on their books. Please prepare the journal entries for the following scenario: Company A sells $480,000 on credit card sales. The credit card charges a 4.5% fee for the use of the card. The card company also deposits the cash into the company’s bank account the same night as the credit cards are accepted.arrow_forward

- all have cleared handled on the bank reconcilement? 22. A company sold $15,000 of inventory to a customer. The shipment arrived late and the customer complained. The company grants the customer a $450 allowance. Write the entry to record the company (the seller) post to record this transaction.arrow_forwardThe data below is for Betts Corporation for the year. Accounts receivable-December 31 Customer accounts written off as uncollectible during the year Allowance for doubtful accounts--January 1 Estimated uncollectible accounts based on an aging analysis If the aging approach is used to estimate bad debts, determine the bad debt expense for the year. Select one: O O O A. $48,600 B. $48,000 C. $52,200 D. $59,400 $3,216.000 48,000 52,200 63.600arrow_forwardAccompanying a bank statement for Marsh Land Properties is a credit memo for payment on a $15,000 one-year note receivable and $900 of interest collected by the bank. Marsh Land Properties had been notified by the bank at the time of collection, but had made no entries. Journalize the entry that should be made by Marsh Land to bring the accounting records up to date. If an amount box does not require an entry, leave it blank.arrow_forward

- Han's Supplies's bank statement contained a $260 NSF check that one of its customers had written to pay for supplies purchased. Required: a. & c. Show the effects of the following transactions on the financial statements in the horizontal statements model. (a) Recognize the NSF check, (c) Customer redeems the check by giving Hans $280 cash in exchange for the bad check. The additional $20 was a service fee charged by Hans. Note: Enter any decreases to account balances with a minus sign. For changes on the Statement of Cash Flows, indicate whether the item is an operating activity (OA), investing activity (IA), financing activity (FA), or leave the cell blank if there is no effect. Event (a) (c) HAN'S SUPPLIES Horizontal Statements Model Balance Sheet Income Statement Assets Cash + Accounts Receivable Liabilities + Equity Revenue Expense Net Income Statement of Cash Flowsarrow_forwardAccompanying a bank statement for Marsh Land Properties is a credit memo for payment on a $15,000 1-year note receivable and $900 of interest collected by the bank. Marsh Land Properties had been notified by the bank at the time of collection, but had made no entries. Journalize the entry that should be made by Marsh Land to bring the accounting records up to date. If an amount box does not require an entry, leave it blank.arrow_forwardOn April 3, Snappy Sales decides to establish a $135 petty cash fund to relieve the burden on Accounting. a. Journalize the establishment of the fund. If an amount box does not require an entry, leave it blank. Petty Cash 135 Cash 135 On April 11, the petty cash fund has receipts for mail and postage of $32.75, contributions and donations of $25.25, meals and entertainment of $68.00, and $9.75 in cash. Journalize the replenishment of the fund. Round your answers to two decimal places. Mail and Postage expense 32.75contributions and donations 25.25meals and entertainment 68.00Cash short or over 0.75 Cash 125.25 On April 12, Snappy Sales decides to increase petty cash to $175. Journalize this transaction. If an amount box does not require an entry, leave it blank. Petty cash 40Cash 40 Please let me know if I did it right?arrow_forward

- Archer allows customers to use bank credit cards to charge purchases. The bank used by Archer processes all bank credit cards in exchange for a 3% processing fee. All credit card receipts deposited are credited to the company account on the day of deposit. Assume that on August 10, Archer sold and deposited $5,200 worth of bank credit card receipts. The cost of sales is $2,800. Record this transaction in the general journal.arrow_forwardIn the normal operation of business, you receive a check from a customer and deposit it into your checking account. With your bank statement, you are advised that this check for $775 is "NSF." The bank also informs you that due to the amount of activity on your business account the monthly service charge is $75. During a bank reconciliation, you will Oa. add both values to balance according to bank Ob. add both values to balance according to books Oc. subtract both values from balance according to books Od. subtract both values from balance according to bankarrow_forward10. In Exhibit 3.6, you see a credit sale to G. H. Allen that is recorded in a paper-based accounting system. On July 28, 2021, Aca Pool Co. received check number 6311 from G. H. Allen in payment of his outstanding invoice. Required: a. Record the receipt of Allen's check on the cash receipts prelist, document number CR645. Your instructor will provide you a blank form. b. Use the prelist as your source document to record this cash receipts transaction in the appropriate 14arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education